Feds Set Monthly Spending Record: The Swamp Is Now Bigger and More Expensive than Ever

As Peter Schiff put it in a Facebook post, Trump promised to drain the swamp, but today, “The swamp is now bigger and more expensive than ever!”

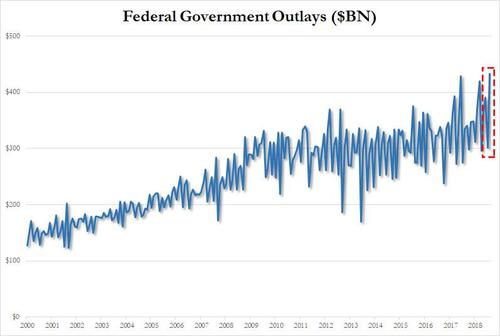

The US government spent a record $433.3 billion last month, running up a monthly deficit of $214 billion, according to data released by the US Treasury Department.

That’s $433 BILLION spent in a single month.

Federal government spending came in 30% higher than August 2017 and ranked as the highest monthly outlay on record.

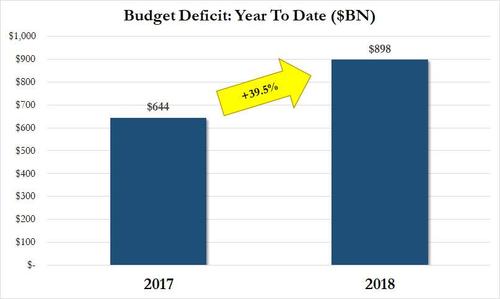

The deficit for the fiscal year hit $898 billion. That compares to a $674 billion deficit in the same period of fiscal 2017. This represents a 39.5% year-on-year increase. The US fiscal year begins in October.

Not only is Uncle Sam spending more, he’s taking in less money thanks to the tax cuts. The Treasury collected $219.1 billion in revenue last month, about $7 billion less than August 2017.

It’s not that tax cuts in and of themselves are bad. But without any accompanying cuts in spending, they are exacerbating the debt problem. As Peter Schiff has put it, we got tax relief without any government relief.

The government spent $32 billion just servicing the current debt. It plunked down $108 billion for Social Security, $65 billion on defense spending, $83 billion on Medicare, and $146 billion on all other government agencies and programs.

As ZeroHedge pointed out, until recently, Most Wall Street firms forecast the deficit for fiscal 2018 to come in at around $850 billion. We’re nearly $50 billion above that projection with another month to go. And things are only predicted to get worse. According to CBO estimates, the federal deficit will climb above $1 trillion per year next year – a year earlier than originally projected.

It’s easy to read all of these numbers and think, ‘ho-hum who cares.’ After all, we’ve been talking about runaway spending, budget deficits and federal debt for years. Nothing has happened. But remember, we’ve also been in an artificially low interest rate environment for years. The federal government continues to pile up debt and interest rates are climbing. The interest payment on the debt hit an all-time high of $538 billion in Q2 2018.

So, how in the world can the Federal Reserve continue pushing interest rates up? It seems highly unlikely the central bank will be able to move anywhere close to “normal” without bursting the debt bubble. Analysts have calculated that if the interest rate on Treasury debt stood at 6.2% – its level in 2000 – the annual interest payment on the current debt would nearly triple to $1.3 trillion annually.

ZeroHedge flashed a big warning sign about ever-increasing debt payments.

Interest costs are increasing due to three factors: an increase in the amount of outstanding debt, higher interest rates and higher inflation. Needless to say, all three are increasing; furthermore, a rise in the inflation rate boosts the upward adjustment to the principal of TIPS, increasing the amount of debt on which the Treasury pays interest, turbocharging the amount of interest expense. The bigger question is with short-term rates still just around 2%, what happens when they reach the mid-3% as the Fed’s dot plot suggests it will?”

Politicians in Washington have created a vicious cycle of skyrocketing debt and borrowing that is only likely to accelerate, and seem completely unwilling to do anything about it.

Many GOP pundits claim economic growth thanks to the tax cuts will solve the problem. But this traditional GOP talking point falls flat. Again – we got tax relief with no government relief.

As we’ve reported previously, high levels of debt are a cancer on economic growth. Several studies have estimated that economic growth slows by about 30% when the debt to GDP ratio rises about 90%. Most analysts say the US economy is already in the 105% range. Most economists believe the tax cuts have boosted the economy, but the boost will likely be short-lived unless Uncle Sam gets his spending problem under control.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]