The Economy Is Great (But It’s Not)

CNBC spoke with Chicago Fed President Charles Evans this morning about the Federal Reserve’s schedule for raising interest rates above zero percent. While Evans confirmed the official narrative that the United States economy is getting better and better, he still doesn’t think the Fed will raise rates until 2016. Even the CNBC anchors seem to be waking up to the obvious doublespeak of these government officials, asking the same question Peter Schiff has posed for months: “If the economy is so strong, why can’t it support rate hikes?”

Here’s what Evans had to say about the seemingly improving job markets:

Employment growth has been very good for quite a long time now, and that has been a very important criteria for us to judge success… We’ve seen [substantial improvement in the labor market outlook]… Good, good progress… That’s good. Economic activity seems to be strong, so I’m pretty confident about the outlook…”

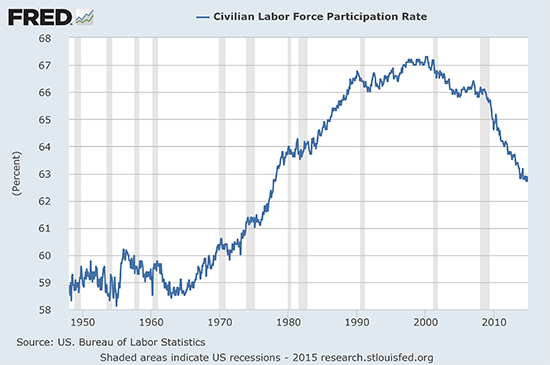

Evans and CNBC paint a nice picture of the labor market, but the truth is that the headline employment numbers don’t accurately reflect the real state of the job market in America. The mainstream news doesn’t report on it, but economists are well aware that the labor force participation rate hasn’t been this low since the 1970s. In December, labor force participation stood at 62.7%, which we last saw in December of 1977.

Even politically “progressive” research shows that the labor market recovery from the Great Recession has been dismal. The Center for American Progress has a long report showing why the unemployment numbers don’t accurately reflect the state of American jobs, and why this can’t be blamed on aging baby boomers leaving the labor market.

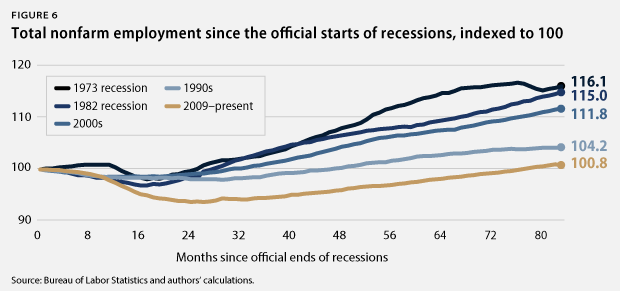

Check out this chart, comparing employment growth following the beginning of recessions going back to 1973. The current “recovery” is the worst we’ve seen in decades, even by the standards of the official numbers lauded by the media. In fact, one study estimates that the US will not achieve its “former level of employment, when factoring in new labor-force entrants, until mid-2019.”

With these grim prospects for job hunters, we shouldn’t be surprised by the recent news that most Americans are living paycheck to paycheck. A story published by MarketWatch this week reports that nearly two-thirds of Americans have no emergency savings:

The findings are strikingly similar to a U.S. Federal Reserve survey of more than 4,000 adults released last year. ‘Savings are depleted for many households after the recession,’ it found. Among those who had savings prior to 2008, 57% said they’d used up some or all of their savings in the Great Recession and its aftermath. What’s more, only 39% of respondents reported having a ‘rainy day’ fund adequate to cover three months of expenses and only 48% of respondents said that they would completely cover a hypothetical emergency expense costing $400 without selling something or borrowing money.”

If Charles Evans and other Fed officials wanted to be honest, they could point to all this data as the real reason why they’re not going to raise interest rates. But if they did that, they’d be admitting that the recovery is a failure, the US economy is heading back into a recession, and that all the Fed’s monetary manipulation was incapable of helping average Americans. Instead, Evans turns to the same “low inflation” bogeyman that Janet Yellen has been using as an excuse for months.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Notice how he touched his ear! that’s a clear sign of body language for someone that it lying!

[…] CLICK HERE TO WATCH VIDEO […]

So very true. I wish Steve Leisman would have pressed Evans a bit more and asked Evans why a quarter-point increase would be so damaging to their inflation target, why the economy is so fragile that prices would be damaged by that quarter-point, but then Leisman is equally tied in with the Fed on making sure the Fed’s narrative works, as he blasts anyone who dares question the alleged genius of these PhD wizards.

The most significant comment Peter has ever made, in my view, was when someone asked him whether why he insists we will get inflation when everyone is warning about deflation. He said “Oh, we WILL get deflation – WHEN PRICED IN GOLD.” That’s the point. Gold is the unmovable marker in the long term. We have already gotten tremendous inflation from the expansion of money AND credit (Mises specifies both create inflation). If prices go down from deflation from the end of credit expansion, even if gold goes down, it will not go down nearly as fast as consumer prices. Rising interest rates could be the result of the collapse of the bond market from interest rates not reflecting a real return, and, like the late 1970’s, gold prices could go up as interest rates go up.

We can gain some insight over what Mr. Evan really thinks by his body language: the moment he is questioned about why interest rates are at zero if we are doing so well and he tries to answer, he grabs his ear lobe, which is a sign of lying and insincerity as you can read here…

http://psychologia.co/signs-of-lying-in-body-language/ and I quote

“Grabbing One’s Ear

When a little child hears something that she doesn’t like, she covers both her ears as if to prevent herself from hearing the sound. Adults are more conscious about what they do with their body, so instead of obvious ear covering gestures, they could quickly touch the earlobe, or rub the back of the ear, or even screw back and forth the inside of the ear.

If you were speaking and the person verbally agrees with what you say, but at the same time does the ear touching gesture, it probably means that he is not sincere with you. From another point of view, it could also mean that you spoke a lot and he wants to speak now.”

Like so many others, my 2 graduate degrees in business (economics and finance), tell me far less about the current economic environment than do my 40 years in big business. Businesses react to facts not to theory or supposition. Facts are that price competition is fierce, there is no room for wage increases in the production processes. The only competitive approaches are to innovate (not easy) or cut expenses (quality). Cutting quality reduces product life expectancy, which in some ways is good for sales, as long as it’s not obvious. Cutting product life expectancy is simply hiding inflation. A product which will will last 20% less for the same price reflects long term inflation (accelerated replacement) which won’t show up in any index. The economy is weak because spendable income is scarce. Far too simple for a PhD to grasp unless they have some real life production experience to lean on. It’s not an academic exercise, it’s business survival in the trenches. Ignoring the obvious can be pretty self serving, think of the (compensable) source when you consider the so called “expertise.”