Even the Government Knows the Stock Market Is a Huge Bubble

Last month, we reported on a Bank of America survey that indicated the mainstream has started to acknowledge that the stock market is a big, fat, ugly bubble.

The latest fund-manager survey by Bank of America Merrill Lynch found that a record 48% of investors say the US stock market is overvalued. Meanwhile, 16% of investors say they are taking on above-normal risk. BoA chief investment strategist Michael Hartnett called this “an indicator of irrational exuberance.”

Now, even the government has taken notice, acknowledging asset prices are floating in dangerous bubble territory.

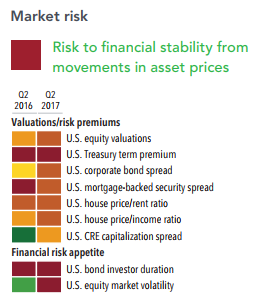

The Office of Financial Research (OFR) recently released its 2017 Annual Report. According to its analysis, market risk is flashing red, with stock market valuations at historic highs based on several metrics.

Market risks from a sharp change in the prices of assets in financial markets are high and rising. Rising prices and falling risk premiums may leave some markets vulnerable to big changes. Risk premiums are returns in excess of returns on risk-free investments.”

In other words, asset prices are overvalued and the bubble could easily pop. This poses a serious risk to the entire financial system – especially given high levels of debt.

Such market corrections can trigger financial instability when the assets are held by entities that have excessive leverage and rely on short-term debt and other liabilities.”

The reference to debt dovetails with Mint Capital strategist Bill Blain’s warning last month that “the truth is in bond markets. And that’s where I’m looking for the dam to break. The great crash of 2018 is going to start in the deeper, darker depths of the credit market.”

Indeed, the OFR report also put non-financial corporate debt in the red zone.

Credit risk from debt by nonfinancial corporations remains elevated. Nonfinancial corporate debt continues to grow, although at a slower pace than in 2016. Measures of firms’ debt-to-assets and debt-to-earnings ratios are red on the monitor heat map.”

Interestingly, the OFR report lays the blame for the asset bubbles right where it belongs – at the feet of the central bankers at the Federal Reserve.

Each of our annual reports has highlighted the risk that low volatility in market prices and persistently low interest rates may promote excessive risk-taking by investors and create future vulnerabilities. In 2017, strong earnings growth, steady economic growth, and increased expectations for a U.S. fiscal policy that stimulates economic growth have fueled the rise in asset prices.” [Emphasis added]

Some members of the Fed even expressed some concern about the monster it’s created according to the November FOMC minutes.

In light of elevated asset valuations and low financial market volatility, several participants expressed concerns about a potential buildup of financial imbalances,” the minutes said. “They worried that a sharp reversal in asset prices could have damaging effects on the economy.”

We’ve been talking about asset bubbles for years. In an interview on The Street last month, Peter Schiff talked about the US stock market, saying, “Well, the bubble keeps getting bigger.” We recently dubbed 2017 “the year of the bubbles.” Of course, it’s easy to blow us off as pessimistic contrarians who just don’t get it. But when the government starts to acknowledge a problem, maybe its time to sit up and take notice.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]