Demand for Gold in Technology Sector Expected to Rise

We think of platinum and palladium as the “industrial metals,” but in 2016, there was more gold used in industrial applications than either of these two metals.

According to a report released by the World Gold Council, demand for gold in electronics has been growing since the fourth quarter of 2016. On top of that, other emerging technologies in the health and energy sectors are also driving up the industrial demand for gold. All of this could have a positive impact on overall gold demand in the future.

Historically, gold’s primary industrial use has been in electronics. Its physical properties make it an ideal material for electronic applications. It’s highly conductive, it doesn’t corrode or tarnish like other conductive metals, and gold is soft and pliable. The two primary uses for gold in electronics are as an electroplated coating on connectors and contacts, and bonding wire in semiconductor packages.

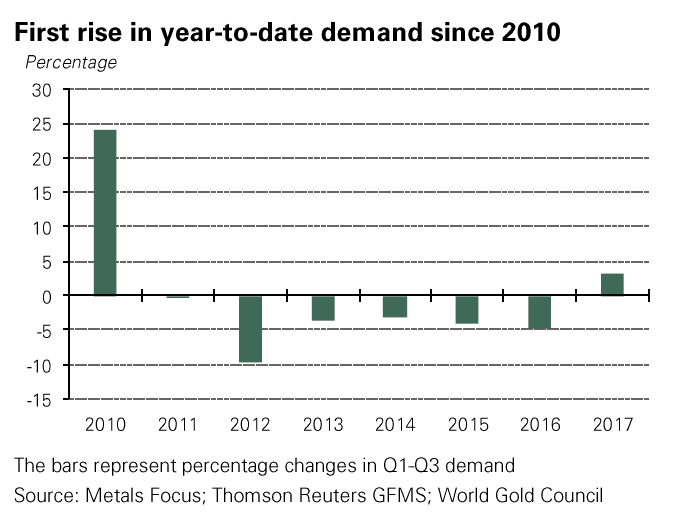

The use of gold in electronics peaked in 2010 at 327 tons and then began to fall off to just 256 tons in 2016. But analysts at the World Gold Council see a sustainable resurgence in industrial demand developing.

We believe the major fall in demand for gold in the electronics sector may be behind us. At the end of Q3 2017, we saw year-to-date demand growth for the first time since 2010, and there are some promising areas of recovery ahead.”

The overall amount of gold used in the technology sector grew for the fourth consecutive quarter in Q3 2017. Tech industries consumed 67.3 tons of gold in the quarter, a 3% increase year-on-year. Demand for memory chips served as a primary driver for increased industrial gold consumption. There are a number of reasons to believe the increasing demand trend will continue.

The steep drop in demand for gold bonding wire has begun to level off. More significantly, there is currently a major digital memory shortage. Samsung Electronics recently announced surging demand for memory drove record-breaking earnings for the company. Coupled with a new generation of smartphones now coming into the market, and the increasing role of hybrid and electric technology in automobiles, this bodes well for a continued increase in gold demand by the electronics sector.

There is also an increasing demand for gold in other technology sectors. Nanoparticle technology is rapidly evolving. Scientists are developing ways to use gold to kill cancer cells, improve the efficiency of solar cells and catalyze chemical reactions. The following video provides a fascinating overview of this developing field.

We generally think of gold as an investment as well as money, but its increasing industrial role will likely impact demand. The amount of gold used in technology was roughly equal to the amount purchased by central banks between 2010 and 2016. This fundamental driver of demand will only increase the overall value of the yellow metal.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]