Day 7: Trump’s ‘Big, Fat, Ugly Bubble’ Becomes Bull Rally

Today SchiffGold begins its newest weekly series, the “Trump 100”, a continuing look at the new President-elect’s first 100 days in office. Our series will provide you Peter Schiff’s unique perspective on Trump’s executive orders, financial stimulus, deregulation policies, and everything else essential to managing your portfolio.

The Markets Hit 20K and Tweeting Trump Changes His Tune

It’s not every day the stock market breaks the 20,000-point. In fact, it’s the first time ever. Trump campaigned on resetting a weakened economy, bringing it back out of its false recovery.

- Back in September, Trump said the stock market was a “big, fat, ugly bubble.”

- He’s held consistent with claims he made all the way back in December when criticizing “low energy” Jeb Bush on the campaign trail.

- “Remember the word bubble? You heard it here first,” Trump said at a late December 2015 rally in Iowa.

He finished his rally statement with a bit of prophetic vision: “I don’t want to sound rude, but I hope if it explodes, it’s going to be now, rather than two months into another administration.”

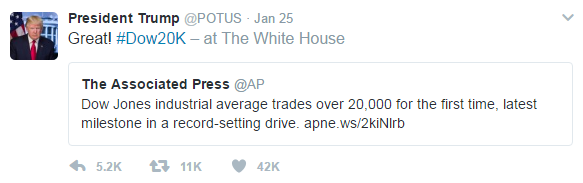

Trump could have used the Dow’s historic numbers illustrate his predictions were correct; however, all we’ve seen so far is a simple tweet:

The tweet seems to go against everything Trump campaigned on. The giant bubble economy created by Barack Obama and those before him didn’t just disappear within his first week of being President. Peter Schiff weighed in during his podcast with a perfectly seasoned statement to sum up the whole hypocritical situation.

“If it was a big, fat ugly bubble when it was Barack Obama’s bubble, now that it is Donald Trump’s bubble, it is still a bubble. I guess a bubble is in the eye of the beholder, right? When it’s your bubble, it’s a bull market. When it’s someone else’s bubble, it’s really a bubble.”

Trump’s Mighty Pen Strikes down Obamacare

Within hours of taking the oath of office, Trump held his shining pen high before striking his signature on a document to start the process of dismantling the Affordable Care Act. As Peter Schiff has said time and time again, Obamacare is borderline unconstitutional, and never had a chance of being the solution America needed for healthcare.

Not long after it was launched, Peter couldn’t hide his biting criticisms of the plan: “The real shock of Obamacare is not the unbelievable ineptitude in which it was launched, but the naiveté in which it was designed,” he said in a 2013 commentary.

- The Republicans may not have anything better to replace it. Hopefully, their solution is a free market one.

- Trump’s offered no official plan to replace Obamacare; however a few suggestions are in the works: The Cassidy-Collins plan, the Patient Freedom Act, and others are being submitted by Republicans in Congress.

- Trump’s made lofty promises about what comes after Obamacare. However, Peter seems skeptical:

“Who knows what he has in mind for a replacement for Obamacare. He’s talking about everybody being covered, nobody losing coverage, insurance companies not being able to discriminate based on pre-existing conditions. I don’t know, it still sounds a lot like of Obamacare.”

Trump Plans for a Wall, While Mexico Goes AWOL

Having big tax cuts alongside big government spending makes it hard to make a net profit. When national debt moves past the $20 trillion mark, it’s easy to spiral out of control. President Trump this week made major advances toward building his wall on the US and Mexico border.

The Mexican president scrapped his meeting with Trump because of the President’s tweets about the country’s obligation to pay for the wall. Trump unveiled his plan to have Mexico “pay” for the construction through other means than direct payment: a direct 20% import tax on Mexican-made products.

- Trump has promised big league spending on top of his planned corporate and individual tax cuts, which is supposed to reduce government income while increasing government expense.

- If the legislation passes on Trump’s import tax plan, American consumers will front the cost of the southern border wall through higher-costing imported products.

- This is another example of how mounting new fiscal projects won’t bolster the United States’ already weak economy, but create even more of a deficit.

- Peter Schiff took a deep look at the looming issues concerning Trump’s deficits in his latest article and highlights how those deficits affect gold prices.

“What they’re going to do is more of the same: more cheap money, more Keynesian stimulus, and Trump’s going to hope that he can make it for another four years before the whole thing blows up.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]