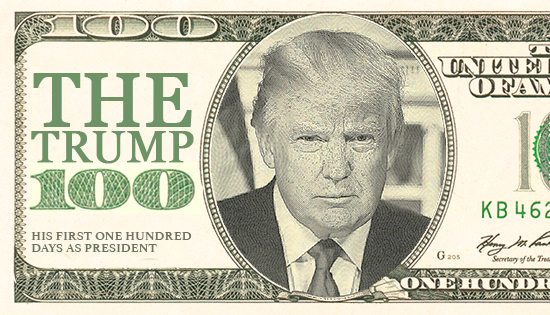

Day 63: TrumpCare May Never Pass; More Russia Connections Uncovered

This week, Trump’s taking to social media to transform his Twitter followers into a grassroots movement to get the TrumpCare bill passed. FBI Director James Comey sets his sights on the Trump campaign as well, dropping the bombshell on Monday that the Bureau would be investigating possible Russian collusion.

TrumpCare Support Slow Going for Leadership

- Vote for TrumpCare delayed.

- Lack of support could push vote as late as Monday, according to Reuters.

- Investors are showing concern since a failed vote may be negative for pro-business agenda.

Early Thursday Trump asked his supporters via Twitter to contact their state reps to vote for his healthcare replacement. The plan still faces strong push back from Democrats and opposition from some Republicans.

The confusion and uncertainty about the bill has caused financial markets to slow down. Infrastructure spending and tax cuts are on the mind of Wall Street, and a failed healthcare bill could impact support for Trump’s future initiatives. Markets seem to be preparing for potential failure given last Tuesday’s sharp decline in stocks.

FBI: More collusion between Trump’s associates and Russian ops

- Monday, FBI Director James Comey announced his agency would be investigating Trump’s campaign for involvement with Russia.

- Intelligence may indicate contacts would approve timed releases of information to belittle Clinton campaign, according to CNN.

- Next steps may involve FBI gathering conclusive info surrounding possible collusion.

The FBI noted that communication they uncovered between Trump’s associates and the Russians has halted over the past few months. Their challenge will be to discover if the methods of communication have changed or ceased altogether.

This new investigation attempts to tie together previous revelations that the Russians were involved in the DNC email hack that appeared via Wikileaks. These types of investigations commonly use many highly classified programs, and the FBI is remaining tight-lipped about who they’re focusing on.

Trump-Era dollar will continue to fall

- The dollar seems to be slowing along with Trump’s fiscal projects and de-regulation, according to CNBC.

- Healthcare distractions have been muddying the waters on Trump’s financial plans.

- Trump has a history of preferring a devalued greenback.

Boris Schlossberg of BK Asset Management admitted this week that the “dollar bulls are stuck in a quagmire.” It’s a foreboding statement given the majority of the greenback’s biggest drop this year has happened since the FOMC’s recent rate increase. Supporting the dollar demise is Trump himself, whom Peter suspects of having an informal weak dollar policy:

“Donald Trump always talked about the overvalued dollar when he was a candidate. He didn’t always say, ‘the dollar is overvalued.’ He would say, ‘foreign currencies are undervalued,’ which is basically like saying the same thing only using different words … If he wants foreign currencies to appreciate, then by definition, he wants the dollar to depreciate.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]