Day 56: Trump Quiet on Rate Hike, Loud on Budget Cuts

This week, Trump laid out his big budget adjustments and issued a loud silence about the Fed’s decision to hike rates for the second time since Election Day. In the same week, he’s also changed opinions on unemployment numbers, which he once lambasted and is now using to prove his effectiveness as a leader on economic matters.

Rate Hike Aftermath: Trump Proves His Bite is Weaker than His Bark

- “We’re not going to comment on the Fed’s decisions,” a White House spokesperson said.

- Trump’s silence goes against his campaign rhetoric blasting the Fed for being too “political”.

- Trump may be biding his time until new members are appointed to the Fed.

Many investors are looking for an opinion on the rate hike from the President along with a coherent picture of how he wants to change the financial institution.

Trump seems to have two different opinions of the Fed’s role. In May of 2016, he actually complimented Yellen’s decision to keep rates at historic lows for the long term. However, he’s also explored the notion of returning to the gold standard and true commodity-backed currency.

Trump Praises Job Statistics He Blasted During Campaign

- Non-Farm Payroll data came out for February with little change from previous months.

- Trump, now fully in charge of the nation, decided that the numbers weren’t as bad as he saw on the campaign trail.

- Peter Schiff shined a light on Trump’s hypocrisy in an episode of his podcast.

Initial reports have the February job statistics showing a slight decline in added jobs when compared to January. The striking statistic of the report, however, is that hourly earnings are rising at only one-third the rate of inflation. That means nationally, the rate of wage increases is much slower than the falling rate of a devaluing dollar. Workers are starting to make more money, but every dollar he or she earns is worth less.

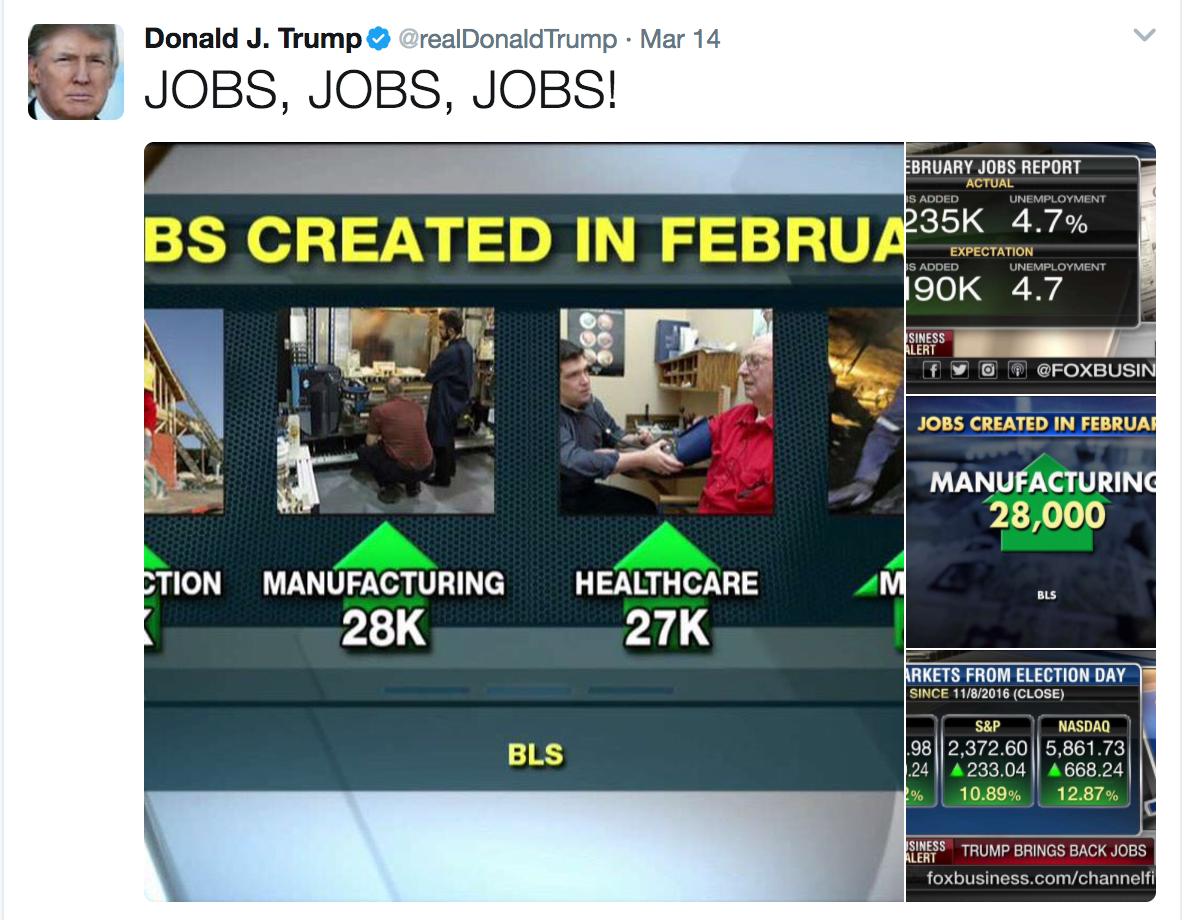

Following the release of the job’s numbers, Trump tweeted:

The only problem is that aside from a slight uptick in manufacturing jobs, the numbers were almost identical to what Trump referred to as “fake” during the campaign. The manufacturing uptick is even less of a trend than an anomaly, which Peter describes as “Trump-related window dressing.”

Trump’s Budget Cuts Gov’t Agencies, but Increases Military Spending

- Trump revealed his national budget to cut funding for many bloated federal agencies, according to The Washington Post.

- Unfortunately, instead of paying off debts with those savings, he is making a down payment on his wall and bolstering the military.

- New budget is a positive move to downsize government, but savings is simply being rerouted to other departments.

Under Trump’s new budget, fifteen government departments would have cuts ranging from 1% to 31%. Additionally 19 departments would be completely shut down. Many of these proposals are worthwhile cuts, as our government is far too large and expensive. Rather than paying down the national debt, the President is instead reallocating that money into the military and Department of Homeland Security.

Trump wants to keep as much money as he can to spend where he wants, rather than sacrifice the total budget’s size just to save a little money.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]