CPI Shows Higher Consumer Prices Despite Skewed Data

The FOMC raised interest rates on Wednesday, with the decision coming on the heels of the Consumer Price Index data released Wednesday morning by the Bureau of Labor. The report shows an uptick in the price of consumer goods for February, a net gain of 0.1%. Although down from January’s 0.6% increase, a year-over-year look shows consumer prices have risen 2.7%, which is 0.7% above the Fed’s target rate of 2%.

The rising cost of most goods and services is in large part due to the failed monetary policies of the Fed. Money printing and quantitative easing have created runaway inflation, which is driving up prices for consumers.

The biggest jumps YOY were in the energy sectors for gasoline (30.7%) and utility gas service (10.9%). Shelter, transportation services, and medical care all jumped over 3%. While the basket of food items for home consumption fell 1.7%, the cost of eating out rose 2.4%.

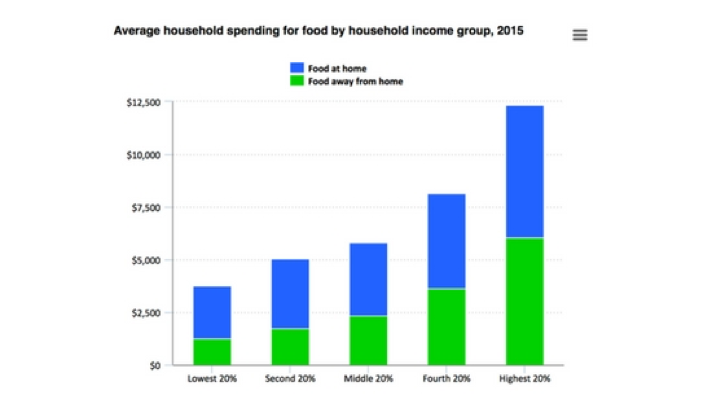

The rise in food consumption outside of the home will likely affect lower income households the most, given BLS household expenditure data from 2015, which shows the bottom 20% spending 34% ($1,281) of total yearly food expenditures on food outside the home. The 2.4% increase since last year alone has added another $30 per-family per-year to lower income budgets.

The methodology to compute the CPI is a flawed metric that provides false data. Peter Schiff has proven this with his own research into the actual increase in price of common household goods, which shows a significant difference between what’s reported in the CPI and what consumers are actually paying. Watch a video from Peter where he explains how this works:

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]