Average Global Yield Curve Inverts, Could Signal Looming Recession

The economy is strong!

Or so the mainstream financial talking heads tell use every day.

Meanwhile, one of the best predictors of a looming inflation is flashing red.

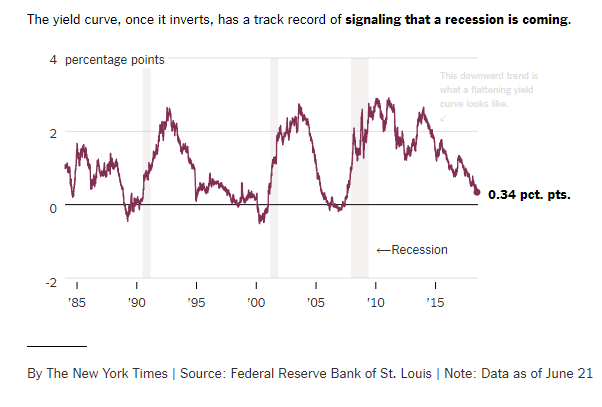

The yield curve between the two and 10-year Treasuries narrowed to around 34 basis points this week. That’s the lowest level since 2007 – right before the financial crisis. Even more troubling, the global yield curve has inverted for the first time since 2007.

GLOBAL #YIELD CURVE HAS INVERTED FOR 1ST TIME SINCE 2007

Why does 2007 sound familiar? pic.twitter.com/MZsV4A16du

— Sapientia (@OccupyWisdom) June 27, 2018

The Financial Times called yield curves, “Coco Chanel’s proverbial ‘little black dress’ of economic indicators.

The slope made up of bond yields of various maturities has a record of predicting recessions that would make even the savviest econometrician turn pea-green with envy. It is not perfect, but the curve has become flat and inverted — when short-term bond yields are actually higher than long-term ones — ahead of most economic downturns in most major countries since the second world war.”

And the New York Times pointed out, “Curve inversions have correctly signaled all nine recessions since 1955 and had only one false positive, in the mid-1960s when an inversion was followed by an economic slowdown but not an official recession.”

In general, investors demand a higher rate of return for locking their money up in long-term bonds and yield curves normally slope upward. The rate of return on a 2-year bond will typically be less than the return on a 10-year bond.

During economic expansions, inflation expectations tend to rise. As a result, investors demand even higher yields for long-term bonds to offset this effect. A sharply upward-sloping yield curve generally means investors have optimistic expectations for the future.

But during recessions, inflation tends to fall. That puts downward pressure on long-term yields. The difference between long-term and short-term yields flattens and eventually inverts.

On the global front, the average yield of seven to 10-year bonds in JPMorgan’s broadest government bond index recently fell below the average yield of bonds maturing in one to three-years.

Although the average yield curve has inverted, individual yield curves in all major countries including the US, Japan, Germany and France remain positive. As the FT points out, there are some technical reasons that help explain the global inversion. Nevertheless, the financial publication insists the average global yield curve inverting should not be immediately dismissed as a technical fluke of no importance.

The shape of the curve matters so much because it is the overall judgment of thousands and thousands of well-informed investors round the world, and the collective signal they are sending is that the outlook is far from rosy.”

The flattening yield curve in the US is not easily explained away by technical factors. And what happens in America has a major impact on the global economy. The FT speculates that a couple of more Federal Reserve interest rate hikes could lead to an inverted US yield curve, deepening the global inversion.

Remember, every recession in the last 50 years have been preceded by an inverted yield curve. Earlier this year, New York Fed president John Williams said that a truly inverted yield curve “is a powerful signal of recessions” that historically has occurred “when the Fed is in a tightening cycle, and markets lose confidence in the economic outlook.”

It probably won’t shock you to know that the Fed has a hand in all of this. It is intentionally pushing up short-term rates as part of its tightening policy. That naturally flattens the spread. But there is a bigger picture. Markets don’t like having their easy-money punch bowls taken away. When you have a boom driven by loose monetary policy, and the policy begins to tighten, bubbles can start to burst. As a result, things can quickly go bust. So, the Fed’s quest to “normalize” rates not only naturally flattens the yield curve, it could crash the bubble economy. This could explain the correlation between Fed monetary tightening, flattening yield curves and the onset of recessions.

The mainstream keeps telling us everything is great, but as we’ve said before, optimism can’t trump economic reality. Tightening yield curves are yet another sign everything isn’t as rosy as the pundits want you to think.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]