Are Consumers Nearing the End of Their Road of Debt?

Are consumers getting close to the end of their road of debt?

There are some indications that they might be and that’s not good news for an economy built on consumers spending money they don’t have.

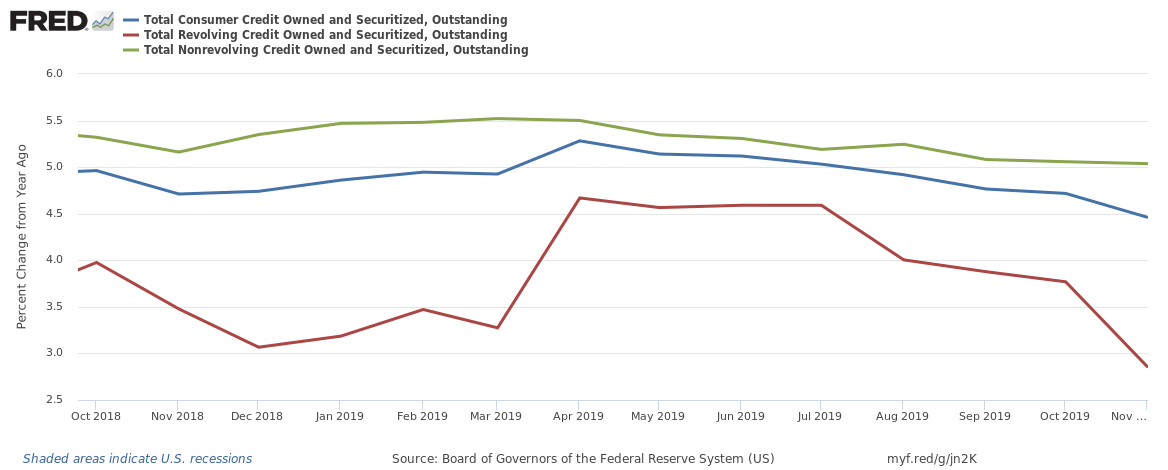

Total consumer debt grew and set yet another new record in November, according to the most recent data released by the Federal Reserve. But the rate of growth slowed and credit card debt contracted slightly for the third month out of the last four.

Total consumer debt grew by $12.5 billion to $4.176 trillion. (Seasonally adjusted). That represents an annual growth rate of 3.6%, down from 5.5% in October.

The Fed consumer debt figures include credit card debt, student loans and auto loans, but do not factor in mortgage debt.

Revolving credit outstanding, primarily credit card debt, fell by $2.4 billion, a 2.7% decline. That was offset by a healthy increase of $14.9 billion (5.8%) in non-revolving credit, including student loans, automobile loans and financing for other big-ticket purchases.

Even with the decline in revolving credit card debt, Americans still owe nearly $1.1 trillion on their plastic.

But the overall trend in borrowing has fallen over the last six months and credit card borrowing has taken a noticeably steep downturn.

Some are taking the sagging level of borrowing as a warning sign. As one analyst put it in an article on Seeking Alpha:

It could be that the consumer end of the economy has reached the point at which it cannot add any more debt. Unlike the federal government which has sovereign dollars to print, the consumer has a fixed amount they can spend including paying back any loans.”

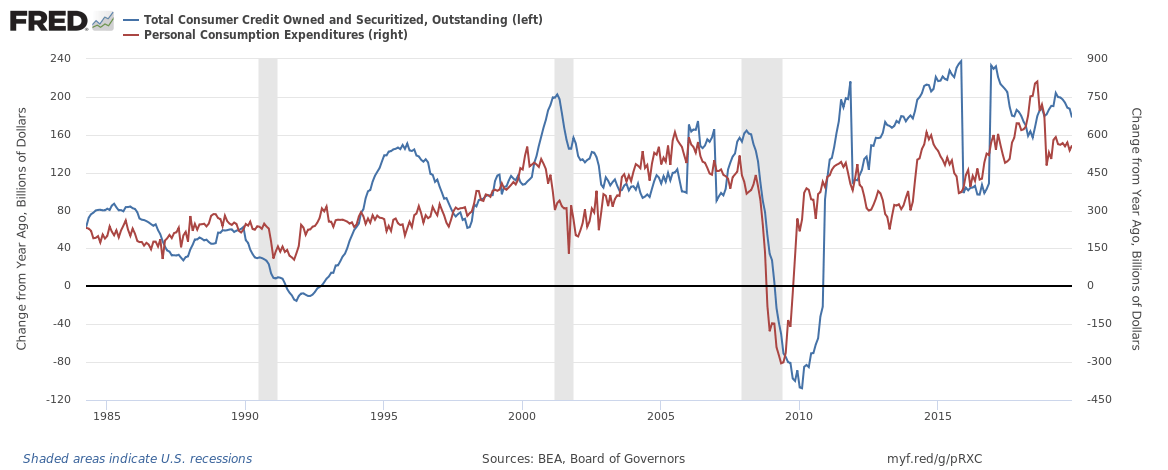

Generally, consumer spending and consumer debt tend to move in the same direction. In other words, the drop in borrowing could indicate consumers are shutting their wallets.

The drop in credit card spending in November could have been due to consumers paying off balances in preparation for the holiday shopping season. Retail sales showed a healthy increase in December and holiday spending was up a little over 4% year-on-year. We may well see another increase in credit card debt when the December report comes out. But the longer-term downward trend in borrowing should cause concern if your focus is on economic growth.

There is also anecdotal evidence that Americans are getting in over their heads when it comes to debt. A Northwestern Mutual study in 2019 found that many millennials are drowning in credit card debt. The study found that “it’s from going out to dinner and travel.”

The truth is American consumers have been driving the US economy with money they don’t have. If they are getting close to maxing out the credit cards, that doesn’t bode well for future economic growth. If that moment isn’t upon us yet, it will be at some point in the not-to-distant future.

A large percentage of US GDP growth comes from consumer spending. Headlines have lauded the American consumer for “rescuing the US economy.” But as Peter Schiff has said, if that’s the case, who is going to rescue the consumer?

If you look at where the consumer is getting that money, it’s from credit. Year-over-year, consumer debt has increased by 5%. So, what is driving consumer spending is debt.”

Peter has also said the huge levels of debt could indicate that the economy isn’t as great as the pundits keep telling us.

If an economy really is strong, you would think consumers would be taking on less credit card debt because they wouldn’t need it. They would be able to buy more stuff that they could actually afford. They wouldn’t have to go into debt. Because credit card debt is the worst possible debt because the interest rate is so high on credit card debt. If you can afford to pay off your credit card, you’re going to pay it off.”

The question is how much money can American consumers borrow before the bubble pops? In effect, consumers are taking from the future to spend in the present. Whether driven by confidence or desperation, debt-fueled spending can’t go on forever. Credit cards have this inconvenient thing called a limit. What happens when the future arrives? Every dime borrowed eventually has to be paid off.

During an appearance on RT Boom Bust, Peter took on this notion that the US consumer has never been in better shape.

The consumer is completely levered up. He has record amounts of debt. And the only reason he can spend is because the Fed is keeping rates low enough so that credit continues to flow despite the lack of legitimate savings to finance it. So, this whole house of cards is going to come tumbling down and the consumer is going to be right in the center of that.”

In a word, the situation is unsustainable and American consumers could be getting close to the end of their road of debt.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]