America’s Trade Surplus in Services Shrinks as Trade Deficit in Goods Balloons

Americans consume goods other people produce. As America offshored its manufacturing, it promised to supply the world with high-priced services and technology in exchange. But as it turns out, that promise never materialized.

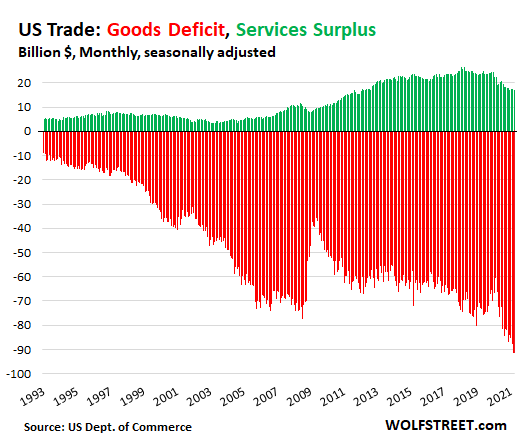

The ballooning overall trade deficit bears this out. It leaped to another record high in March, surging 5.6% month-on-month to a new worst-ever $74.5 billion. That was 52% worse than in March 2019.

The economic woes stemming from government response to the pandemic have exacerbated the trade deficits, but they are nothing new. At one time, we were told offshoring production wasn’t a problem because the US would make up the difference by exporting services -things like software, technology, movies, engineering services, and Wall Street financing. The rationale was that America could buy cheap manufactured products from overseas and foreigners would buy expensive American services.

As WolfStreet put it, “Few economic rationales have failed more spectacularly.”

The boom in service exports never materialized.

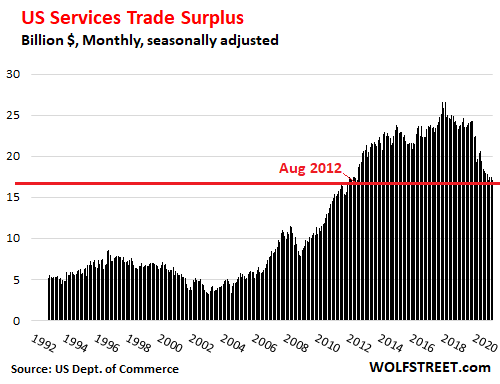

The US does run a trade surplus in services, but it is minuscule compared to the trade deficit in goods. According to the latest Commerce Department data, the trade surplus in services fell to $17.1 billion in March. That was the lowest since August 2012. Contrast that with the record $90.6 billion trade deficit in goods.

You might think this is all due to the pandemic, but the decline in the services trade surplus predates the pandemic by almost a year. It is down 20% from March 2019.

In a nutshell, the promised services surplus that was supposed to drive the US economy is small and has been shrinking since 2018.

During the 2008 financial crisis, the trade deficit narrowed as Americans cut back on spending. But during the pandemic, American consumers have kept right on spending as the government dumped money into their checking accounts.

WolfStreet summed it up.

The government’s and the Fed’s response to the pandemic was a combination of stimulus payments and money-printing on a scale never seen before. And these stimulus payments and the wealth effect triggered by money printing – the ballooning asset prices – caused consumers to buy more goods, and fancy goods too, and so they bought more durable goods than ever before, triggering this WTF spike in consumer spending on durable goods, a big portion of which are imported, or their components are imported, the drivers of the worst ever trade deficit.”

As Peter Schiff put it in a tweet after the March trade numbers came out, foreign countries are supplying the US with billions in goods “the US economy is too weak to produce.”

Last month, Peter appeared on NTD News to talk about the ever-growing trade deficits.

The government, or the Federal Reserve, is printing money and just giving it to unemployed people who aren’t making stuff, but they’re spending money. And so what they’re doing is they’re buying the stuff that people in other countries are employed making. So, it’s the productivity of the rest of the world that Americans are living off of, and the trade deficit evidences that and shows you that our whole economy, our whole recovery, is a fraud.”

In a nutshell, the rest of the world gives the US valuable consumer goods that its own economy lacks the capacity to produce. They were supposed to get valuable services that Americans can produce back in return, but that promise never materialized. All the rest of the world gets in exchange for their efforts and resources are dollars, which the US creates for free.

The question is how long with the rest of the world continue to exchange ever-depreciating dollars for tangible products? At some point, the gravy train will stop rolling.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]