Americans Spending More, Getting Less and Borrowing More to Pay for It

American consumers are spending more, getting less, and borrowing more to fund this involuntary spending spree.

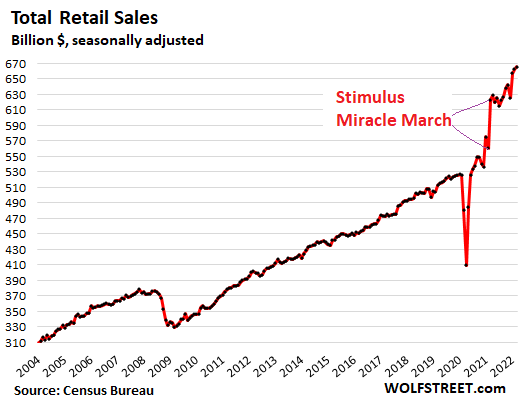

Retail sales in March were 7% higher than they were in the stimulus-fueled March of 2021, but thanks to inflation, they didn’t get as much bang for their buck.

Seasonally adjusted, retail sales were up 0.5% month-on-month in March at $677 billion.

As WolfStreet put it, “Stimulus Miracle March 2021 was a very tough month to beat. But Americans did blow by it. What they didn’t do is blow by the now raging inflation.”

Unsurprisingly, higher gasoline prices accounted for the bulk of that increase in retail sales as consumers pulled back in other areas. Online sales fell for the second straight month. It was the first back-to-back decline in online sales in over a year.

Increasing retail sales is usually viewed as a good sign for the economy. It signals that consumers are confident and able to spend money. Reuters reported that the pickup in consumer spending is “helping to underpin the economy.”

This is just wishful thinking. Paying more and getting less does not “underpin” an economy.

In a high inflation environment, surging retail sales tell a different story. Consumers spend more because they have to. This is an involuntary spending spree. American consumers are spending hand-over-fist in an effort to keep up with surging prices.

Since retail sales are expressed in dollar amounts, they reflect both units sold and rising prices. That means there are two ways retail sales can go up.

- Consumers buy a larger quantity of stuff.

- The price of the stuff they’re buying goes up.

In other words, just because dollar widget sales increase doesn’t mean people bought more widgets. It could be that they bought fewer widgets but paid more for them.

This is exactly what’s happening in many retail sales segments.

You can see clearly see the pain from rising prices when you look at individual categories in the Consumer Price Index Data.

The CPI for durable goods was up 17.4% year-on-year in March, even with a month-on-month drop of 0.9% thanks to a sharp drop in used vehicle prices after a massive spike.

The CPI for nondurable goods was up a blistering 3.8% in March and up 13.1% year-over-year.

When up put a 7% increase in retail sales in the context of these rapidly rising prices, it doesn’t look so good. Americans are spending a lot more money and they’re getting a lot less for it.

And in order to keep up with surging prices, Americans are turning to plastic. Revolving credit, primarily credit card debt, rose by a whopping 20.7% in February. That helped fund a 0.8% increase in February retail sales – revised up in the latest data from 0.3%.

This raises an important question: how much longer can over-indebted consumers keep paying these upward-spiraling prices? Especially given the fact that the Fed is now raising borrowing costs?

They can’t. Savings are running dry and credit cards have limits.

They’re going to have to start cutting back on many buying a lot of stuff just to keep up with the rising cost of necessities.

This does not bode well for the economic future.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]