After a Decade of Monetary Stimulus, Germany on Cusp of Recession

Germany appears to be on the cusp of a technical recession.

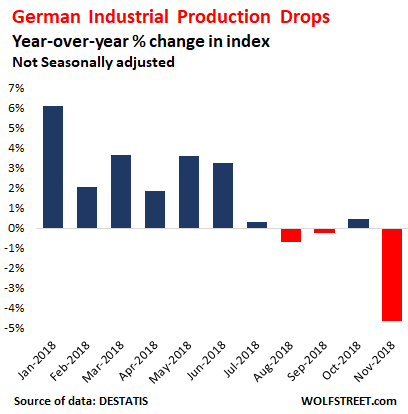

Production in Germany fell by 1.9% in November. Analysts had expected a 0.3% gain. The German statistical agency Destatis also revised October to a 0.8% decline. It was the third straight month of declines.

As WolfStreet put it, “This is embarrassing in the land of super-stimulus via the ECB’s negative-interest-rate policy and years of QE that were supposed to perform miracles.”

The German production index dropped an ugly 4.7% year-on-year in November when adjusted for inflation and calendar differences.

Germans also saw negative GDP growth in the third quarter of 2018. The precipitous drop in production in November signals Germany could be heading toward a second straight quarter of negative economic growth – the technical definition of a recession.

And it doesn’t look like things are going to get better anytime soon. Destatis also reported that new orders in manufacturing – a harbinger for future production – dropped 4.3% in November year-on-year.

So, what’s going on in the German economy? Well, basically the same thing that’s going on in the United States, but on hyperdrive. America is likely heading in the same direction. Just last week, Peter Schiff said the stock market bubble has popped and the US economy is next.

I think this bear market has a long way to go. We’re still much closer to the top than the bottom. And the worst part is not really the bear market, but the economy, which is headed for a worse recession than the one that we now call the Great Recession that we had in ’08 and ’09.”

What popped the bubble?

The Federal Reserve took away the easy money punch bowl. And the European Central Bank is in the process of doing the same thing in the eurozone.

When it comes to stimulative monetary policy, the Federal Reserve has nothing on the European Central Bank. The ECB recently announced the end of its QE program. The central bank’s QE purchases totaled somewhere in the neighborhood of 2.6 trillion euros. The bank also pushed interest rates below zero. So, what did the EU get for all this stimulus? Not a whole lot. We recently highlighted the “successes” of ECB QE. And now that the European Central Bank is winding down the stimulus, it already looks like Germany – and a lot of other EU countries – is slipping toward an economic downturn.

WolfStreet summed it up nicely.

And this economic slowdown is occurring despite, or perhaps because of, the mother of all stimuli engineered by a major central bank – negative interest rates and massive QE – that has benefited a few hedge funds who were able to front run the ECB’s bond buys and make a quick buck, and bond traders for a while, as bond prices were rising due to falling yields. And it has allowed even junk-rated companies to borrow money for a song from beaten-down investors, savers, and pension funds. But this stopped a year ago. Since then corporate bond prices have fallen as yields have risen, particularly at the riskiest end of it. Stocks are down sharply across the EU too, with the German Dax down 20.5% from its 52-week high a year ago … It’s just a bitch when the massive central-bank stimulus that messed up so much produced so few if any lasting economic benefits. And all these economic activities described above were taking place even when the ECB was still pursuing its QE, including buying corporate bonds, to repress returns for investors and the cost of borrowing for even the riskiest companies. “

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]