A Major Red Flag in the Jobs Market Few People Are Talking About

The shockingly bad May jobs report dumped a bucket of cold water on central bankers and mainstream pundits. A June interest rate hike that was a foregone conclusion just a week ago disappeared like a teenager when it’s time to do the dishes. Suddenly, a lot of people are starting to realize the great Obama economy isn’t quite as advertised.

Peter Schiff has said several times we are in a “phony recovery,” and the US economy is likely already in recession. A few other “contrarian” voices like Mike Maloney have echoed Peter’s warning. If we dig a little deeper, we find buried in the jobs data a major red flag that indicates that they are probably right.

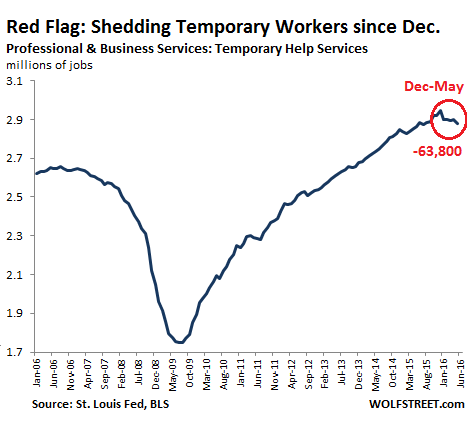

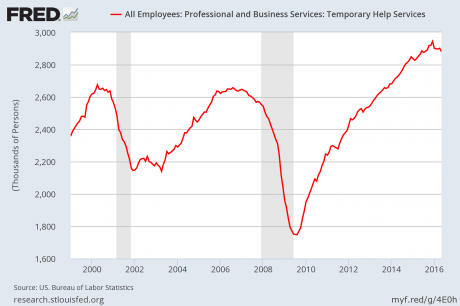

The number of temporary jobs has been on the decline since peaking last December. In May, the economy shed 21,000 temp jobs, bringing the total to nearly 64,000 lost since December of last year.

Why is this so significant?

If you look at the numbers, the exact same thing happened prior to both the 2001 recession and the 2008 Great Recession. Temporary jobs began to fall rapidly just prior to both economic downturns. In 2007, the number of temporary worker began to fall even as the economy was still adding jobs. The five-month decline in temporary workers since December of this year would be exactly what you would expect if the US economy was entering into recession.

Historically gold has served to protect wealth during times of economic uncertainty. Download SchiffGold’s Free White Paper: Why Buy Gold Now?

Temporary employment is known as a leading indicator. Because they are easier to hire and fire, temporary workers are generally the first to feel the impact of changing economic circumstances. If you look at the recovery after the great recession, companies began hiring temporary workers first. It was an early sign they wanted to hire, but weren’t willing to commit to permanent hires. Now were seeing the opposite. Wolf Richter explains why:

Staffing agencies are cutting back because companies no longer need that many workers. Total business sales in the US have been declining since mid-2014. Productivity has been crummy and getting worse. Earnings are down for the fourth quarter in a row. Companies see that demand for their products is faltering, so the expense-cutting has started. The first to go are the hapless temporary workers.”

Janet Yellen and government officials can keep telling us the May jobs report was just a blip on the radar and everything is great, but signs of trouble are flashing brightly for all to see.

This post is part of our ongoing series Data Dependent: Reading Between the Lines, where we examine the real economic data not reported in the financial media. Click here to read all our articles in this series.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Great Job Peter.

Love to read your articles

Even if you believe Obama,that he has helped the economy,no way could any sane person think the $trillions spent to do it,was a good deal.

Obama says you’re just peddling fiction. So I don’t care what the facts are or what the truth is, I want my chocolate unicorns and my rainbow lollipops, m’kay? I want my free health care and my free cell phone and my free lunch, and if I don’t get it immediately I will throw a tantrum!!!