3 Reasons Gold is Rising and the Dollar is Falling

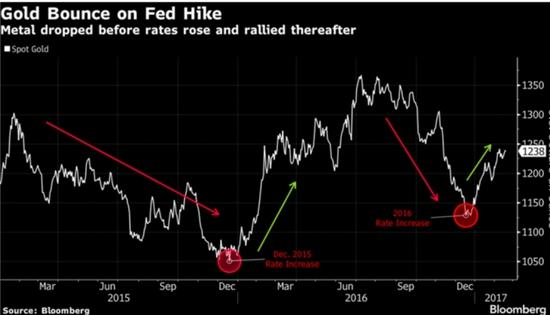

The price of gold is moving in contradiction to its economic purpose, which is to serve as an investor safe haven against inflation. Shortly after the election, the dollar index spiked as gold prices began a quick decline; however, recently the trend has reversed. Gold is now up around 7% since the Fed’s December rate hike, according to Bloomberg.

Last week we saw the Consumer Price Index report showing inflation above 2% and Janet Yellen’s congressional testimony sending firms like Goldman Sachs increasing the odds of a March hike to 30%. With stronger assurance and signals of higher interest rates and rising inflation, why is gold rising and the dollar falling? Here are 3 critical factors:

Donald Trump

Uncertainties surrounding the stability of his administration, the priority of his policies, and responses by other world leaders are keeping investors skeptical of what Trump-o-nomics will look like. The rallies in the dollar and the stock market began quickly after the election results. Investors were looking to campaign promises of fiscal spending and deregulation that would free up more capital investment into construction projects like the border wall. Since then Trump’s focus has been diverted to national security matters, and investors haven’t yet seen the earnestness, political will or Republican support to push through spending increases.

Interest Hikes Don’t Matter

Peter Schiff explained in a recent podcast why the likelihood of rising interest rate hikes isn’t driving interest in the dollar: investors are beginning to understand the insignificance of the Fed’s moves. Raising the Federal Funds target rate to .05% – .75% won’t curb inflation, which is already moved past the Fed’s own target of 2% and accelerating. Anyone going to the grocery store lately doesn’t need a CPI report to know prices are skyrocketing. It’s too little too late.

The Fed can’t risk raising rates too quickly because it will tank the economy, and they’ll be forced to officially declare that we’re still in a recession (another fact most people outside of Washington already know). Janet Yellen and her monetary cabal will raise them just enough to say they’ve done something, but not enough to effectively fight inflation.

Eureka! Inflation is Bad for the Dollar

As obvious as the basic economic law seems, many are finally beginning to realize inflation weakens the purchasing power of their cash. It’s not really a lack of understanding economic fundamentals that’s the problem here; it’s the belief in the Fed’s argument that inflation is good for the economy. The Keynesian theorists running the Fed continue to think the US can spend its way to economic health and prosperity. From that perspective, inflation is good. But for everyday citizens trying to make ends meet, having a devalued fiat currency doesn’t add to an increase in their standard of living. As Ludwig Von Mises said, “Capital goods come into existence by saving.”

These three factors for gold’s upward movement suggest more people are beginning to feel less optimistic about the future, given the current political climate and rightful mistrust of institutions like the Federal Reserve.

Peter believes we’ve been living in a phony recovery, that inflation will increase along with unemployment at a substantial rate. Layoffs are coming and interest rates will rise. As a result, political battles will increase. US citizens will have a White House looking to place blame for the new recession on the Fed, and a Fed pointing to the chaotic policies of the Trump administration.

Today’s political uncertainties make it a great time to consider diversifying your portfolio with precious metals. Buying gold and silver can help guard against destructive inflation and protect your hard-earned wealth.

Get Peter Schiffís latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]