2019 Federal Budget Deficit Already Above 2018 Number

The federal government continues to spend America into a black hole and has already topped last year’s budget deficit with two months left in the fiscal year.

The US budget deficit in July came in at $120 billion thanks to a surge in spending, according to data released by the Treasury Department.

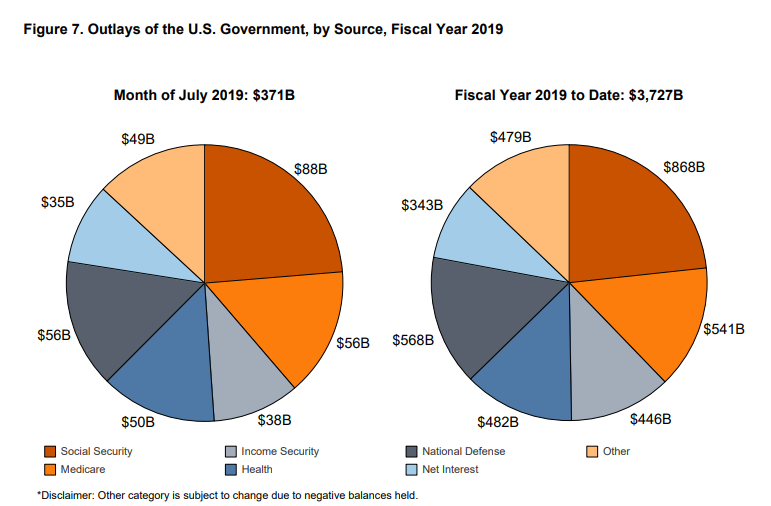

Uncle Sam spent $371 billion in July. That was 23% more than the government spent in July 2018. The Treasury brought in $251 billion. That number was up 12% compared to July 2018.

The total budget deficit for fiscal 2019 now stands at $867 billion. That compares to a $684 billion deficit through the same period in fiscal 2018. With two months remaining in the fiscal year, the federal government has already topped the 2018 deficit, which was the largest in six years.

And there is no end in sight to the spending. Earlier this month, Pres. Trump signed a bipartisan budget deal that will increase discretionary spending from $1.32 trillion in the current fiscal year to $1.37 trillion in fiscal 2020 and then raises it again to $1.375 trillion the year after that. The deal will allow for an increase in both domestic and military spending.

Outlays for the military and healthcare were both up significantly in July. The federal government forked out $56 billion on the military last month. That was up $7 billion from the July 2018 figure. Medicare spending rose to $56 billion from $24 billion in July 2018. Uncle Sam spent $35 billion just paying interest on the current national debt last month.

To date, the federal government has spent over $3.7 trillion.

As Peter Schiff put it in a tweet, we’re seeing the most incredible growth in peacetime government spending ever.

All of this government spending, combined with consumer spending financed by credit cards, is helping prop up the US economy. Government spending was up 5% according to the Q2 GDP figures and added 0.85% to the overall GDP. Non-defense spending was up a whopping 15.9% in Q2. In a recent podcast, Peter Schiff said the last time government spending grew that much in a single quarter was 21 years ago. As Peter pointed out, we had two recessions in that timespan – including the Great Recession.

Non-defense spending – domestic spending – rose last quarter by more than it did in any quarter during either of those recessions. Think about that. Trump keeps complaining that we’re not getting as much monetary stimulus as Obama got. But look at all the fiscal stimulus we’re getting that Obama didn’t get.”

Generally, you see this kind of spending when the economy is weak.

Yet the fiscal stimulus that we’re getting now is larger than what we’ve gotten in the prior two recessions. Yet we’re getting this stimulus when the economy isn’t even in recession. I mean, if the economy is so good, why does it need so much fiscal stimulus? And if it’s getting so much fiscal stimulus, and if you believe fiscal stimulus works, why isn’t GDP even stronger?”

And what is going to happen when the country goes into a recession? If we’re seeing these massive budget deficits now, what will it look like when the economy tanks?

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]