10 Reasons to Buy Gold Now

As we pointed out a few weeks ago, we’ve now entered the prime time to buy Christmas cards, decorations, and wrapping paper. Why? Because with Christmas in the rearview mirror, Christmas stuff is all on sale.

There are a lot of reasons to believe gold is also on sale right now.

The investment world has focused most of its attention on stock markets and cryptocurrencies over the last few months. But as an article recently published in Forbes points out, there are at least 10 good reasons to believe now is the time to buy gold.

1. Gold has outperformed the S&P 500 this century. Stock market mania is in the air, but investors seem to have forgotten that the S&P 500 has undergone two 40% corrections this century. If we index both gold and the S&P 500 to 100 as of Dec. 31, 1999, gold has returned better than 80% more than the market.

2. Supply is shrinking and miners are slashing exploration budgets. A number of analysts have predicted a significant drop in gold production is on the horizon. Mining companies have slashed exploration budgets and they are uncovering fewer and fewer large deposits.

3. Gold is a bargain compared to stocks. The gold to S&P 500 ratio stands at its lowest point in 10 years. In other words, the stock market is overvalued compared to gold.

4. Stock markets are in a massive bubble. Even the mainstream has started to acknowledge this. In a fund-manager survey by Bank of America Merrill Lynch last month, 48% said the stock market is overvalued. Bank of American chief investment strategist Michael Hartnett said the record number of investors calling equities overvalued combined with simultaneously falling cash positions “an indicator of irrational exuberance.”

5. Government debt keeps growing. As we’ve said, the US federal government is spending money like a drunken sailor. But it’s not just the United States. China is also running up a massive debt. Gold has historically tracked global debt.

6. The Fed is tightening. In October, the Fed launched efforts to shrink its $4.5 trillion balance sheet. As David Stockman pointed out, over the next three to four years, the Fed will sell more bonds than all of the central banks of the world had accumulated in all of recorded history as of 1995. The Fed has shrunk its balance sheet six times between 1921 and 2000. Five of those efforts ended in recession.

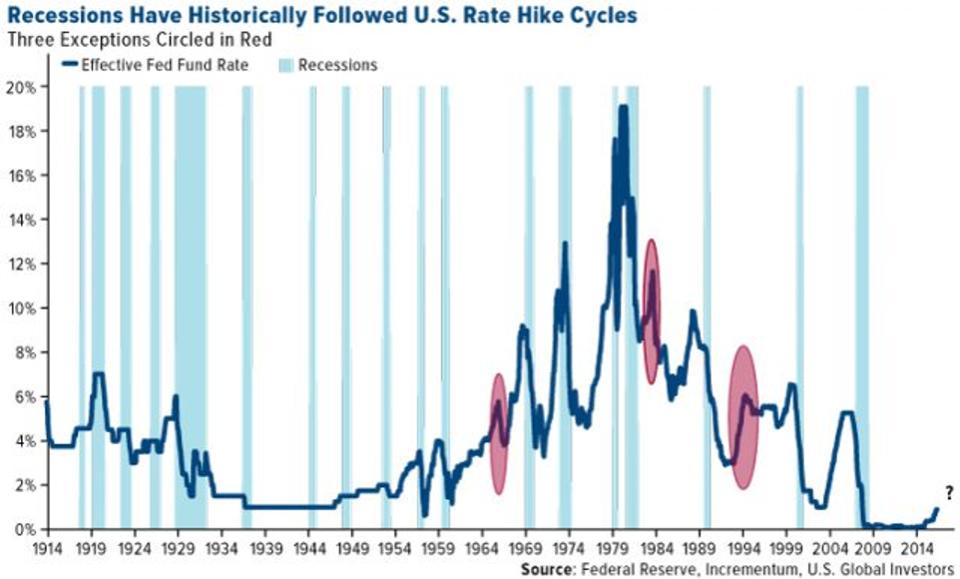

7. Rate hike cycles are correlated to recessions. The Fed started pushing interest rates slowly upward in December 2015. Historically, 15 of the last 18 recessions happened right after a period of central bank tightening.

8. Gold stocks have plenty of upside. Analysts at Incrementum Capital Partners say gold stocks are just getting warmed up. When charted against past gold bull markets, the present one seems to have a lot of room to run.

9. Negative bond yields. Interest rates in some European countries and Japan continue to hover in negative territory. The ECB has no plans to end its quantitative easing program. That means nearly $10 trillion in bonds around the world are guaranteed to lose money. Negative interest rates are one of the reasons for Germany’s budding love affair with gold.

10. Historically, gold has gone up in the early part of the year. This is sometimes referred to the “love trade.” According to the data collected by Moore Research, the gold price rallies early in the year as we approach the Chinese New Year, then dips in the summer.

These reasons taken toegeher build a pretty good case thay gold is undervalued and now is the time to buy.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]