US Budget Deficit Analysis: June 2021

The US Budget Analysis shows the deficit or surplus of the US Federal Government. A deficit occurs when spending (outlays) is greater than income (receipts). When the US Budget is in deficit (which it has been for over 2 decades), it accounts for one of the two components of the Twin Deficits. The trade deficit accounts for the other component which was previously analyzed for May 2021. To cover the deficit, the government borrows money from the public (or from the Fed). The latest borrowing report was reviewed in the June debt analysis.

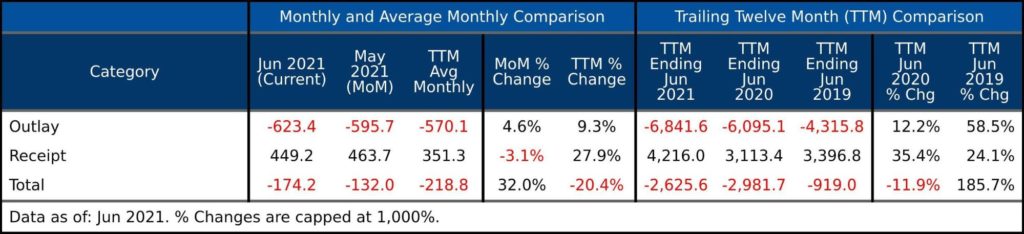

TTM = Trailing Twelve Months

Understanding the Trends

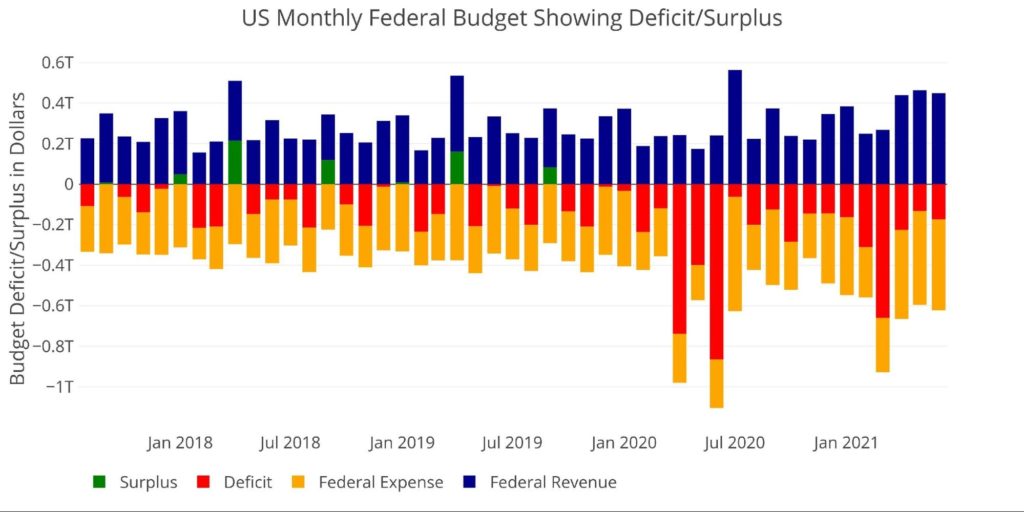

The budget deficit for June 2021 was 174B which was up 32% over May but 20% below the TTM average of 218B. The massive deficits incurred last year and in March of 2021 were for one time COVID-19 stimulus packages. The plot below shows the monthly budget deficit going back 4 years. In normal years, September and April typically see small monthly surpluses due to tax season, but increased spending and falling revenues have kept the government in a continuous deficit since September 2019.

Figure: 1 Monthly Federal Budget

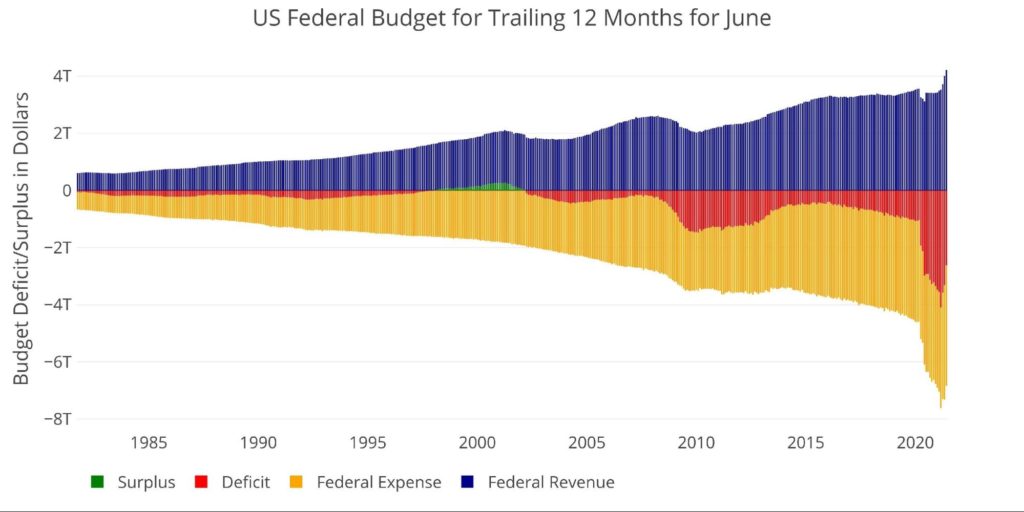

Zooming out and looking over the history of the budget back to 1980 shows a complete picture. The chart below shows the data on a TTM basis to smooth out the lines. TTM sums the previous 12 months so that each month has one month added, one month dropped, and the other 11 unchanged. Not only does this effectively annualize each monthly period, but it shows how rarely the fiscal budget has been in surplus.

While the current extreme period will pass, new spending has been planned, not to mention bills finally coming due (e.g. baby boomer social security payments). This makes it unlikely the federal budget deficit will ever get back below $1T despite CBO projections for sub $1T for 2023-2025.

Figure: 2 Trailing 12 Months (TTM)

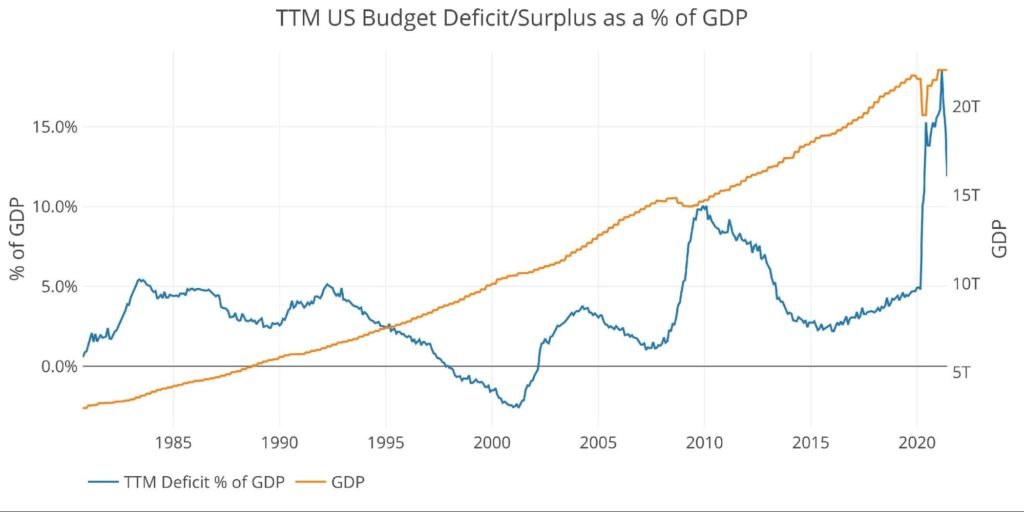

While the chart above does not paint a pretty picture, it is important to put the entire economy in perspective. Below compares the TTM federal deficit to GDP. The peaks below are not solely driven by increases in debt. Usually, recessions (which by definition are 2 quarters of falling GDP) are accompanied by increased spending in the form of stimulus.

With this context, it makes the lead up to 2020 more concerning. The ratio had started rising in 2015 even though GDP was rising. This indicates deficits were growing at a faster clip than GDP. Even without Covid or the new spending, this trend was set to continue. It is unlikely the US TTM deficit will get back below 5% of GDP without major reductions in government spending.

Figure: 3 TTM vs GDP

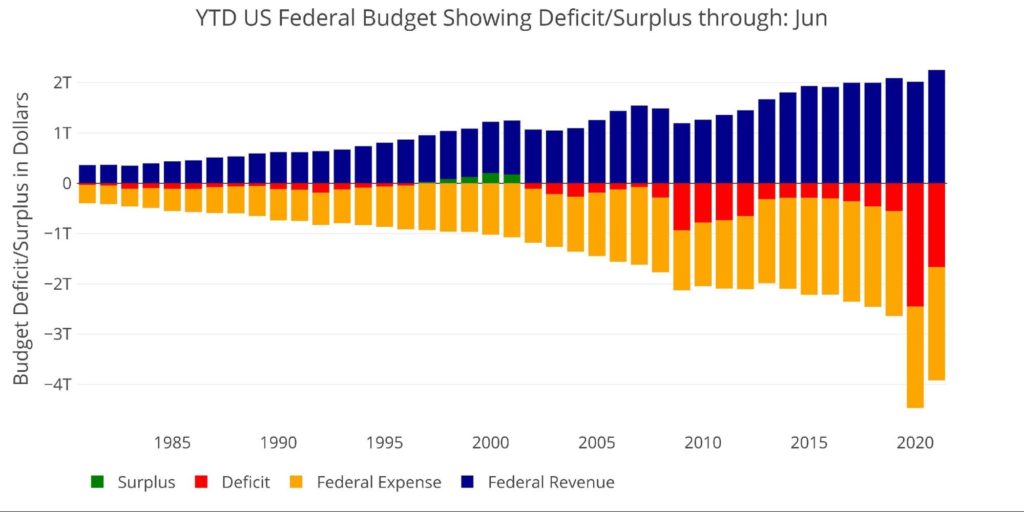

Finally, to compare the calendar year with previous calendar years, the plot below shows the Year to Date (YTD) figures for each year through the current month. The government fiscal year technically ends in September, but that is harder to contextualize (e.g. when did Covid start in relation to October vs January). Now that all stimulus packages have been enacted, it will be interesting to see if the current year falls further behind 2020 in the coming months. 2021 is on track to also be a record year in terms of revenue.

Figure: 4 Year to Date

Digging into the numbers

Summary

Figure: 5 US Budget Summary

This table shows the period over period comparison and also compares TTM data. The main takeaways are listed below:

- June 2021 deficit is below the TTM average 218B but above May 132B.

-

- Receipts are the main driver with June showing 623B vs 570B for TTM avg

- Spending is actually up in June by almost 10% compared to TTM avg

- This was more than offset by Receipts which were up 28% to 450B

- The most recent TTM period is almost 3 times larger than the TTM period ending June 2019

-

- June 2020 was a massive spending month (figure 1 above) which is why TTM ending June 2020 is 10% larger than the most recent TTM period (which starts in July 2020)

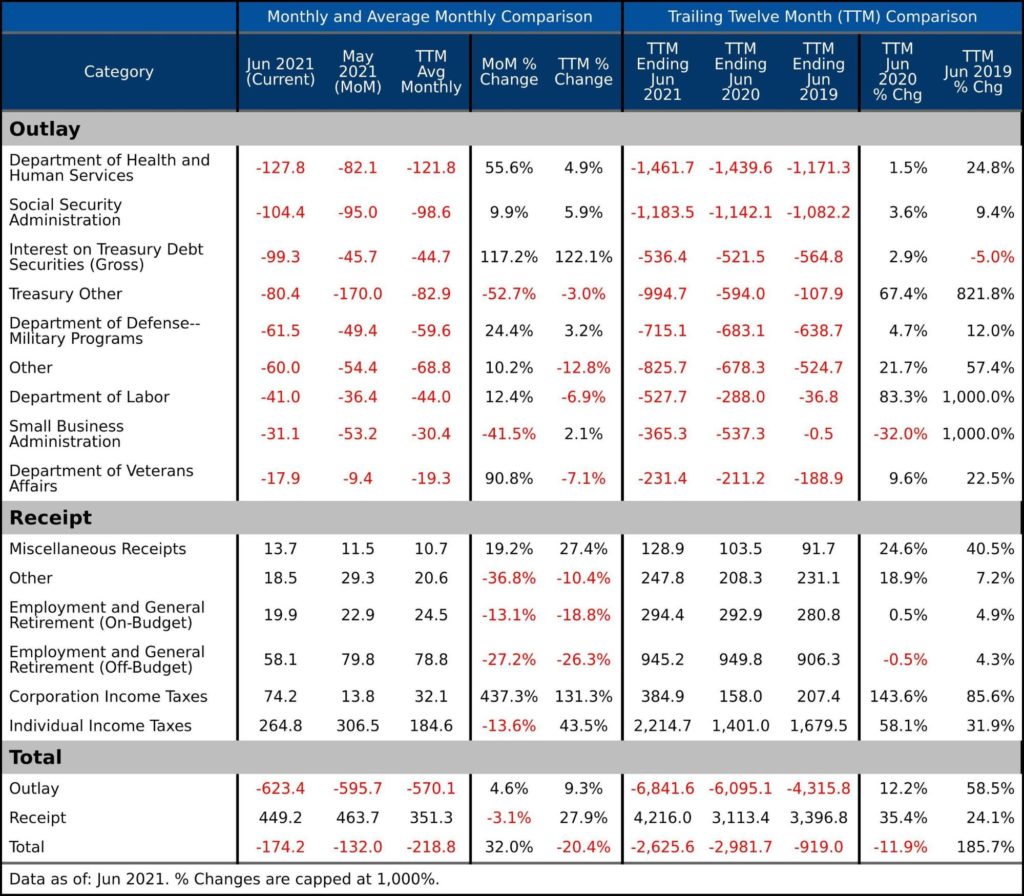

Detail

Figure: 6 US Budget Detail

The detailed budget deficit filters for the 8 biggest expenses and 5 biggest revenue sources, bucketing the rest of the items into “Other.” This table shows which categories are driving the changes in deficit spending month over month and also the TTM periods. The main takeaways are below.

Comparing current TTM to TTM ending June 2019.

- The Small Business Administration has seen spending increase from 500M to 365B due to PPP loans

-

- Value was even larger in TTM ending June 2020 at 537B

- Treasury “Other” is a nondescript spending item that has surged almost 10 fold from 107B to 995B

-

- This appears to be stimulus payments being issued by the IRS

- Department of Labor has seen spending increase from 37B to 528B

-

- This is a result of enhanced unemployment benefits

- Corporate and Individual Income taxes have surged

-

- Corporate taxes are up 85% from two years ago increasing from 207B to 385B

- After a slight dip last year, Income taxes have increased 32% from 1.7B in 2019 to 2.2B

The current surge in tax revenue could be attributed to increased stimulus. As the stimulus slows, spending will fall but so will tax receipts. The question going forward is how this dynamic plays out and whether deficits can fall back into a range closer to $1T (still extremely large by historic standards). With new spending planned and a potentially weaker than expected economy, it is hard to see a scenario where the budget deficit comes into a sustainable range.

What it means for Gold and Silver

The Budget Deficit matters for gold and silver because it shows how much the US government needs to borrow to make up for the revenue shortfall. More borrowing usually means higher interest rates. As the debt analysis shows, higher interest rates would prove devastating for the federal budget in the medium to long term. Interest rates have been kept under control with considerable help by the Fed (see “Interest on Debt” in the table above). Higher interest rates would also prove devastating on the rest of the economy (corporate debt, mortgage rates, etc.).

International government demand for bonds is at a standstill. This combined with bigger deficits put more pressure on the Fed to increase monetary stimulus through both Quantitative Easing and maintaining low interest rates. This will push inflation higher, devaluing the dollar. Gold and silver offer protection in this environment.

Data Source: Monthly Treasury Statement

Data Updated: Monthly on eighth business day

Last Updated: July 13, 2021, for period ending Jun 2021

US Debt interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […] The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more details on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).

The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more details on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).