Comex Inventory Aug: Gold Slowly Drains But Silver Surges

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock data at the Comex. This is different than the delivery countdown that looks to see how many contracts will stand for delivery each month. Instead, it shows the physical movement of metal into and out of Comex vaults.

Registered = Ready for Delivery, Eligible = Warrant assigned but can be made available for delivery

Current Trends

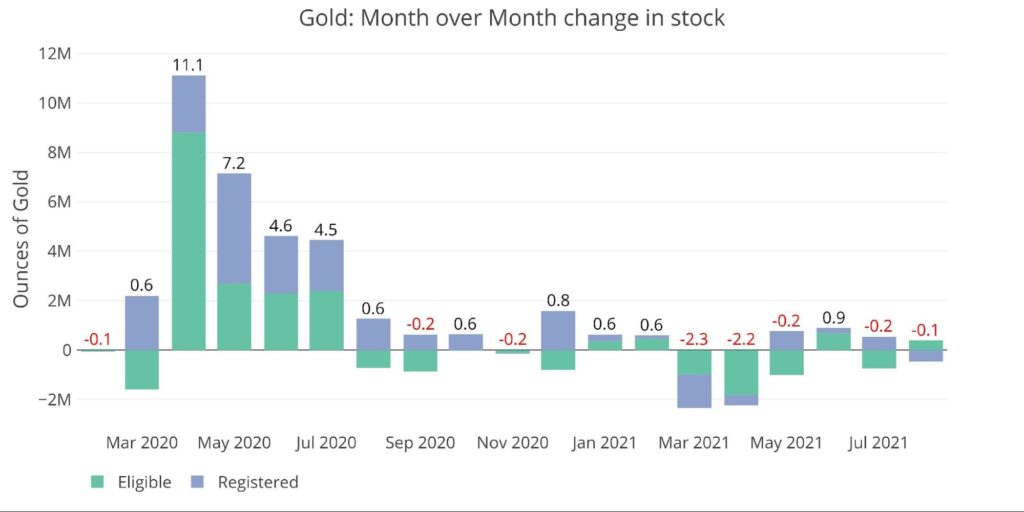

After a massive surge last year, Gold has seen a slow and steady fall in inventory over the last 6 months, with June being the lone exception.

Figure: 1 Recent Monthly Stock Change

Silver inventory drained for five months starting with the February silver squeeze, but Comex vaults have partially restocked the last 6 weeks by almost 10 million ounces, mostly in Eligible.

Figure: 2 Recent Monthly Stock Change

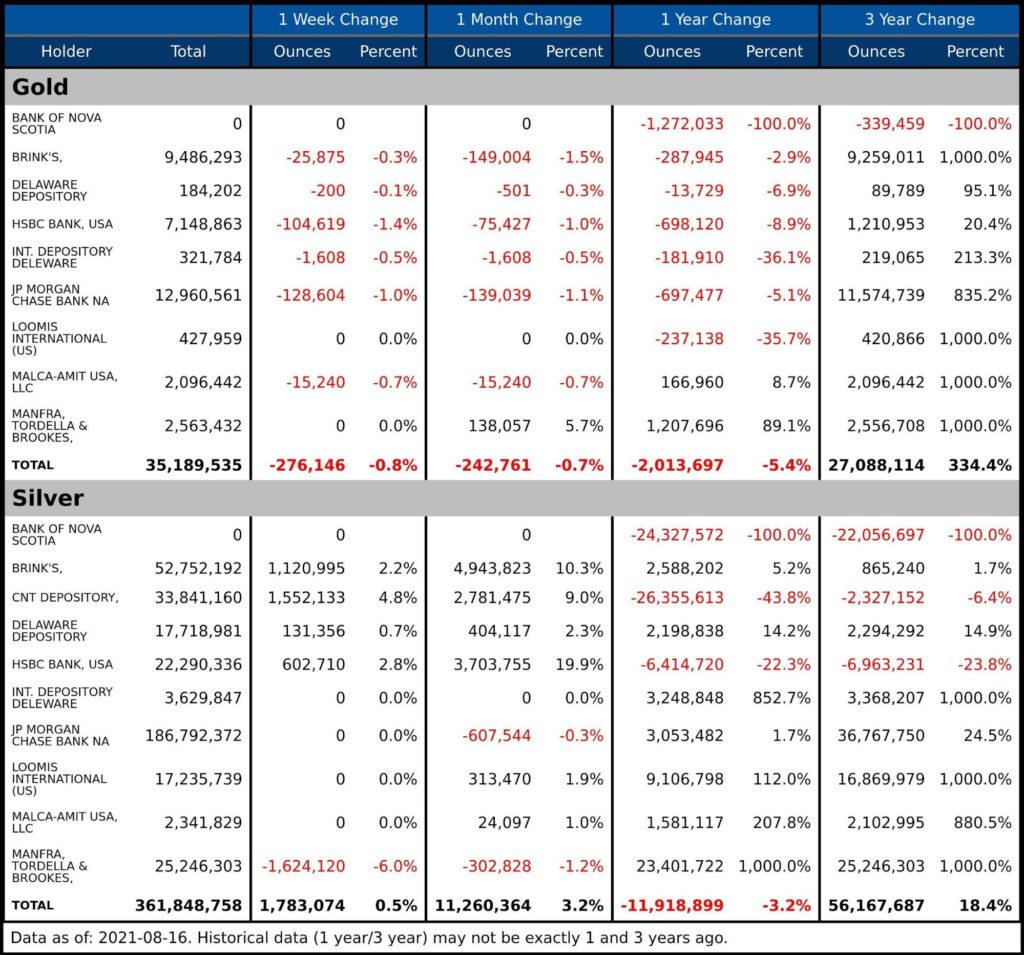

Looking at the summary table below shows the activity over three different periods. Over the past year, gold has lost Eligible where silver has lost inventory in Registered.

Gold

- In the most recent week, Registered saw a big outflow, almost 60% went straight out of the vault with the remaining flowing into Eligible

- This is the opposite of the monthly trend, which has seen Eligible lose 384k and Registered gain 140k

- Over the past year, 2M ounces have been removed

- This is still a fraction of the 27M added during the 2020 market stress

Silver

- The recent month has seen a major inflow into Eligible of 16.6M ounces

- This accounts for 71% of the 1-year increase seen in Eligible

- Registered continues to bleed inventory. Losing 4.7% in the past month and nearly 25% over the last year

- The three-year change is still positive in both Eligible and Registered after the inventory increase in early 2020

Figure: 3 Stock Change Summary

The next table shows the activity by bank/Holder. It shows where the large supply came from in 2020 (see charts below) and also where the drainage has been coming from over the last 1 and 12 months.

- In 2020, JP Morgan was the bank that provided the surge in supply of both gold (11M ounces) and silver (36M ounces) which can be seen in the 3-year change

- Manfra took over the Bank of Nova Scotia

Gold

- Over the last month, every vault except one (Manfra) has seen gold supply drain. Much of this has come in the last week.

- The same trend pretty much holds true over the last year. It appears Manfra is adding inventory to Registered while all other vaults are losing Eligible.

Silver

- The 11m Ounces added this month occurred in 6 of the 10 vaults

- The 11m added undid half of the 23m ounces removed in the preceding 11 months

- HSBC, CNT, and Brinks restocked by 20%, 9%, and 10% of their inventory from a month ago

- JP Morgan saw a modest decline of 607k which barely impacts their massive hoard of 186M ounces

Figure: 4 Stock Change Detail

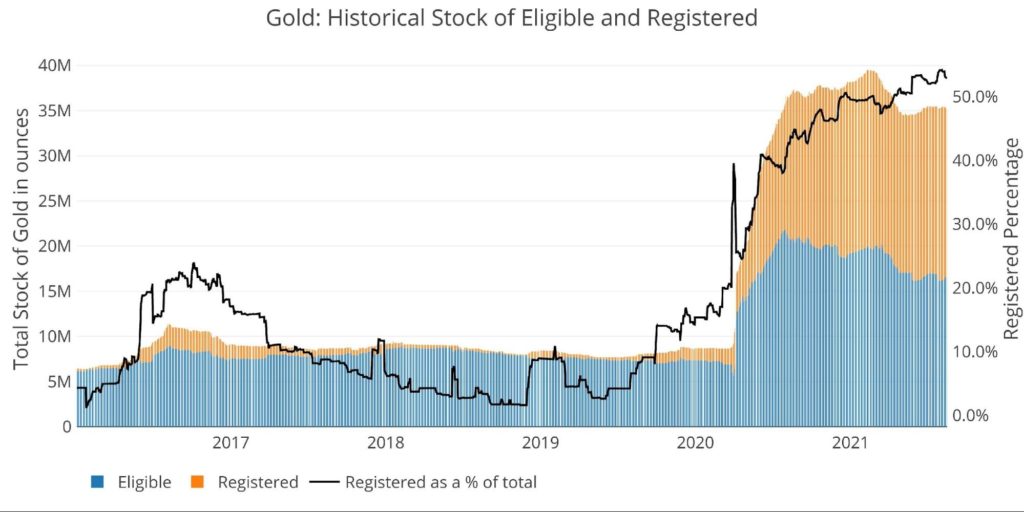

Historical Perspective

Zooming out and looking at the inventory for gold and silver since 2016 shows the impact that COVID had on the Comex vaults. Gold had almost nothing in the Registered category before JP Morgan and Brinks added their London inventory with nearly 20m ounces. Before COVID, this meant that almost no gold was available to move from Registered into Eligible. That changed quickly but since the start of 2021 available inventory has been declining. It remains well above pre-COVID levels though.

Figure: 5 Historical Eligible and Registered

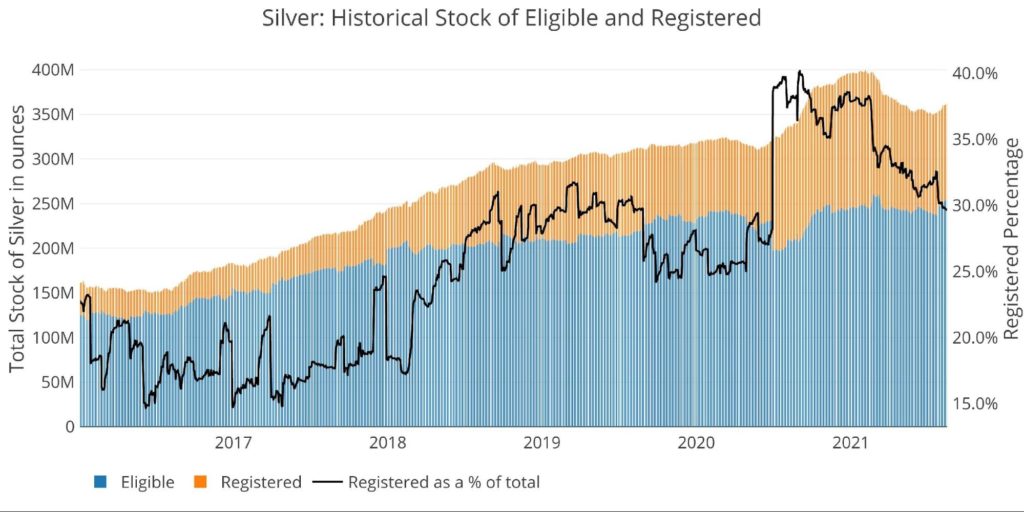

Silver also saw an increase in Registered around March 2020, but this has been draining much more steadily back to pre-COVID levels before a recent uptick. It will be interesting to see if this increase in inventory continues in the weeks ahead.

Figure: 6 Historical Eligible and Registered

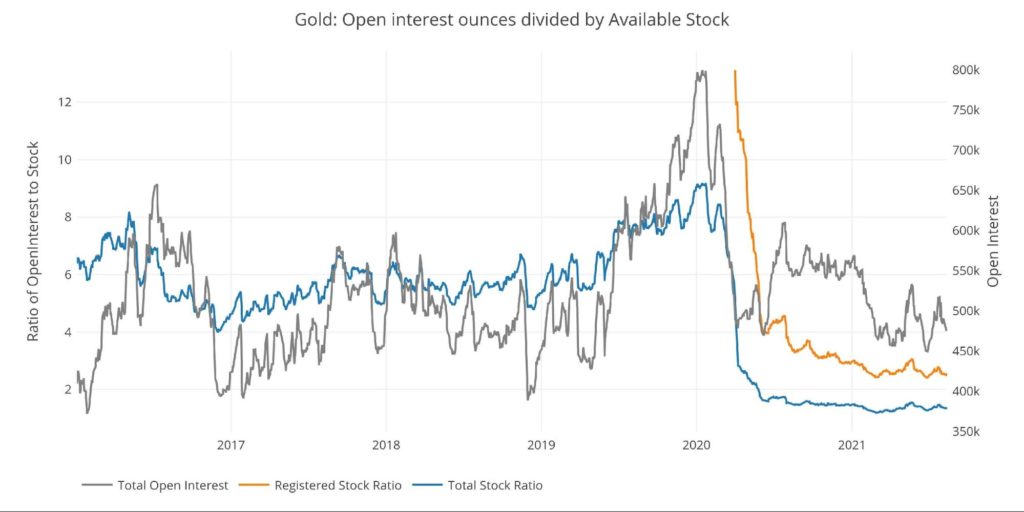

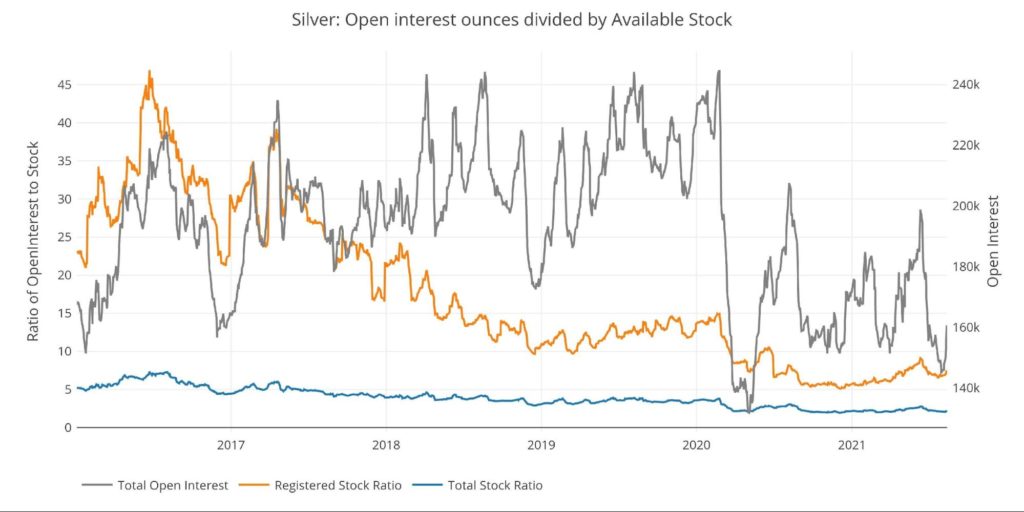

Another data point often referenced is the amount of volume that occurs relative to available inventory. On high-volume days, people may notice that more paper ounces exchanged hands than are physically produced in an entire year by mining companies. While this may be true, that is also the nature of the Comex paper futures market, which is designed to offer liquidity to individuals. These final charts compare both total stock and Registered with the amount of Open Interest over time. A high ratio indicates there is less metal in the Comex system relative to the amount of Open Interest.

As can be seen, this ratio has fallen in both gold and silver over the last year as Open Interest collapsed in March 2020.

After reaching a high above 800k contracts, gold has fallen back below 550k contracts, despite record delivery volume. In parallel, the massive increase in Registered as noted above has driven down the ratio of open interest to available gold. Currently, there are about 2.5 outstanding paper ounces per Registered ounce, and 1.35 per total ounce. This is down from well over 12 and around an 8.7 pre-inventory increase.

Figure: 7 Open Interest/Stock Ratio

After reaching a high above 240k contracts, silver has not held above 180k contracts since, despite record delivery volume. In parallel, the increase in stock noted above also worked to drive down the ratio of open interest to available silver. That being said, there are still 7.4 paper ounces for each ounce of registered metal. At the total level, the ratio is 2.2. pre-COVID, these levels stood at 15 and 3.5.

Figure: 8 Open Interest/Stock Ratio

What It Means for Gold and Silver

While the monthly delivery of contracts certainly represents physical demand. Tracking the activity in the Comex vaults shows the actual movement of metal. In a true crisis, it’s very possible the vaults at the Comex could be drained rather quickly.

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11 PM Eastern

Last Updated: Aug 16, 2021

Gold and silver interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]