Comex Delivery Results: August 2021 Contract

This analysis focuses on gold and silver data provided by the Comex/CME Group. The Comex (or CME Group) is a global derivatives market that allows for trading in futures contracts. They allow two parties (a long and a short) to speculate or hedge in specific commodity markets and guarantee the transaction in the process. The majority of gold and silver is traded in paper form on the Comex within the futures market rather than in the physical market. See the article What is the Comex for more detail.

Silver: Recent Delivery Month

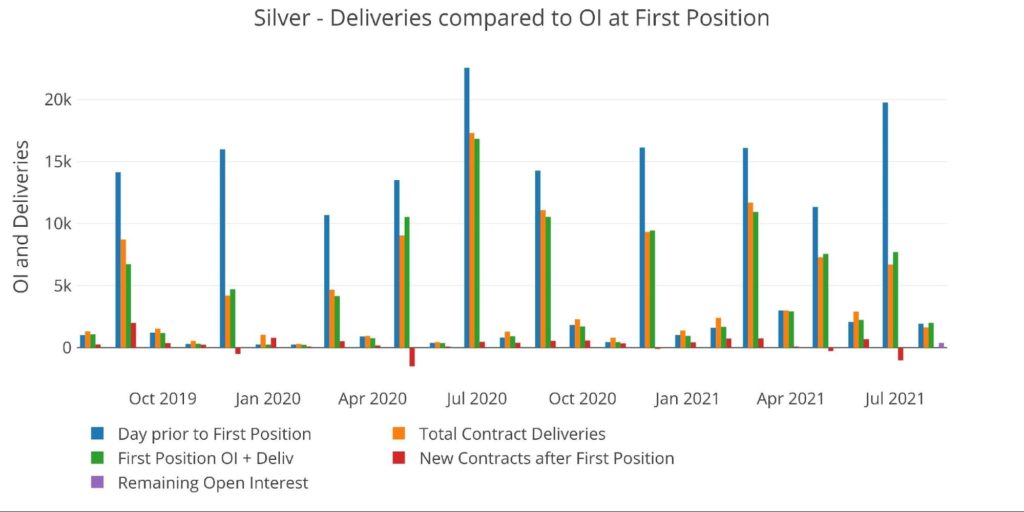

First Position Day is when contracts must post 100% margin to stand for delivery. Once delivery begins, contracts can settle in cash, or more contracts can be opened and stand for immediate delivery (usually a sign of strong physical demand). Figure 1 below shows the last 24 months of silver delivery data when compared to First Position and the day before First Position. As shown, Open Interest falls significantly between the two days. This can be seen more clearly in Figure 4 below, the Open Interest countdown chart.

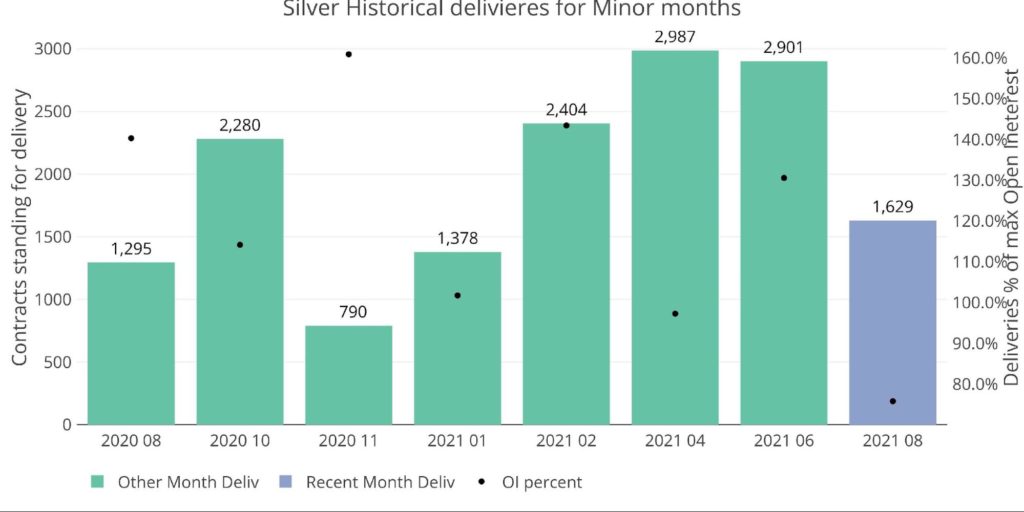

Silver is wrapping up a minor delivery month which usually means a smaller delivery volume. However, it can be a good indicator of physical demand. Contracts in the minor months are much more likely to stand for delivery versus the major months that speculators prefer due to much higher liquidity.

In this latest month, the number of contracts actually increased into the close, rising by 69 contracts from 1,932 to 2,001. On the first day, 1,629 contracts stood for delivery with 372 remaining as open interest. The minor months have seen a steady trend of new contracts opening and standing for delivery during the month. This trend will most likely continue for the August contract.

Figure: 1 24 month delivery and first notice

We can see in Figure 2 below how this most recent month stacks up more directly with other minor months. While August is only just above half the last two minor months, it is important to remember there are 30 days remaining for delivery. Not only can it be assumed that 372 from Open Interest will be added, but looking at April and June saw 74 and 679 contracts open mid-month to stand for immediate delivery.

Figure: 2 Recent like-month delivery volume

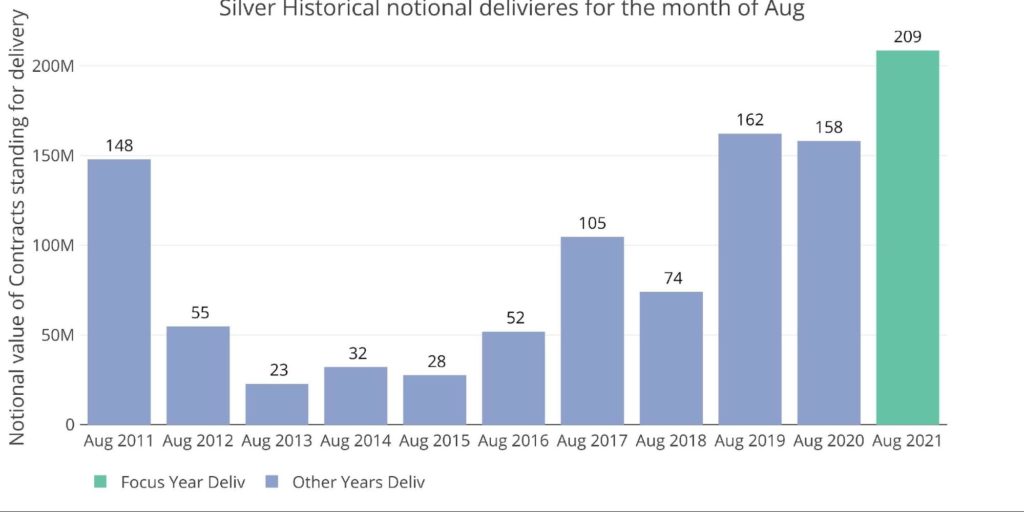

Even with the Open Interest outstanding and a number of contracts opening mid-month for delivery, it is unlikely August will exceed the delivery volume seen in April and June. While this is slightly a negative trend, it is important to put this August into historical perspective. The chart below shows how this August on a notional (dollar) level is even set to exceed last August. Last July was right when silver saw its explosive move higher into the August contract.

Thus, there is more physical demand this August when price action has been sideways compared to last August when prices had doubled since the March lows.

Figure: 3 Notional Deliveries

Silver: Next Delivery Month

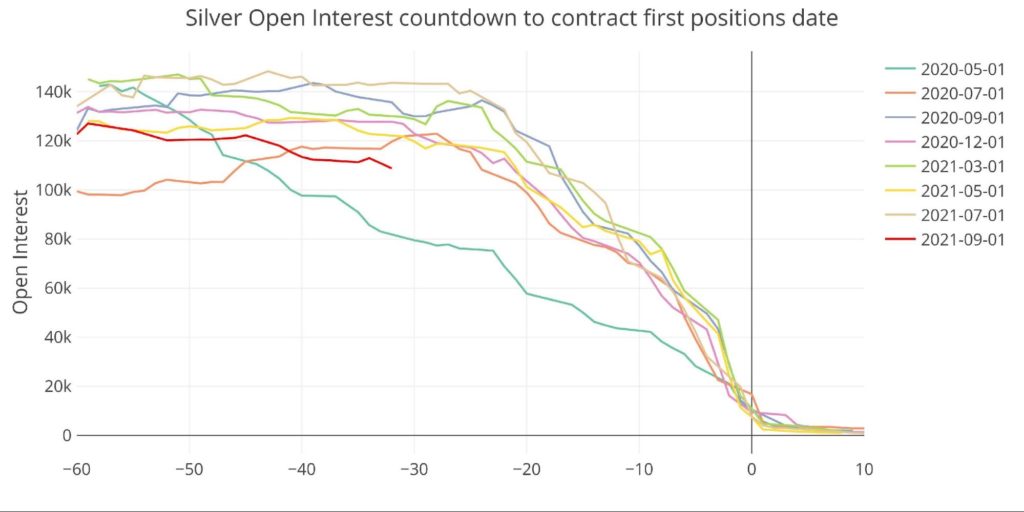

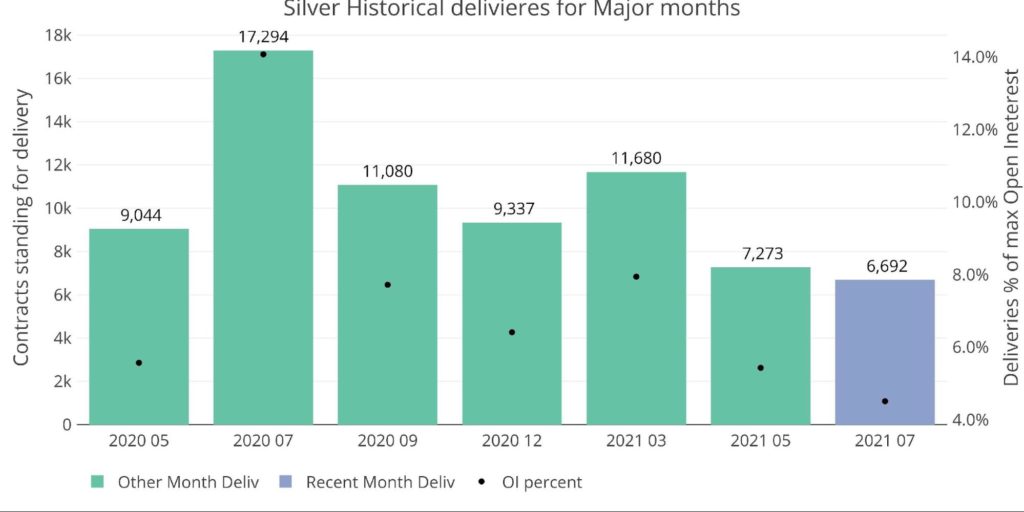

Jumping ahead to July shows that silver is slightly below the trend line compared to recent major months. It is still way too early to gauge what delivery will be like for September based on the chart below.

Figure: 4 Open Interest Countdown

Instead, this next chart can give a good idea of the current trend for major monthly deliveries. Last year was seeing record deliveries and the volume has certainly fallen off since then. The mid-month countdown highlighted very strange behavior in July.

July 2021 was set to possibly exceed the record set last July; however, open interest collapsed into the final day at a rate greater than any prior contract over the last two years (Figure 1 above). Furthermore, more contracts were cash settled last month than any other month since May 2020.

Figure: 5 Historical Deliveries

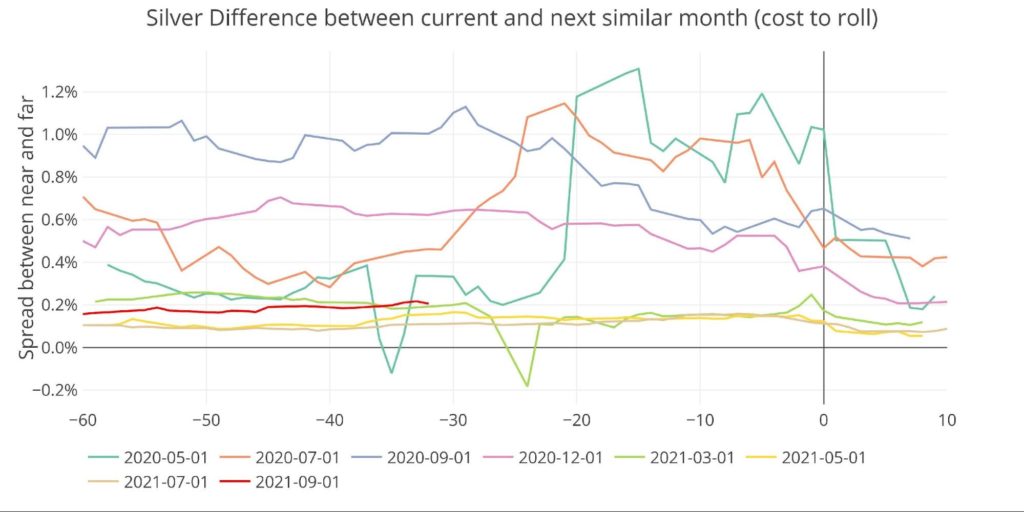

Major Month: Cost to Roll

The cost to roll is the difference between the current month and the next major month. It has started increasing compared to recent months. If this continues to rise, it may prompt contracts looking to take delivery to act sooner since the cost to roll becomes more expensive. When the cost turns negative known as backwardation, it’s also a major signal of strong physical demand.

Only when it’s steady and low similar to May and July 2021 does it indicate an environment of complacency that makes it inexpensive to roll contracts forward. September is still relatively low, but higher than the last two months (potentially due to a longer time horizon stretching to the December contract).

Figure: 6 Roll Cost

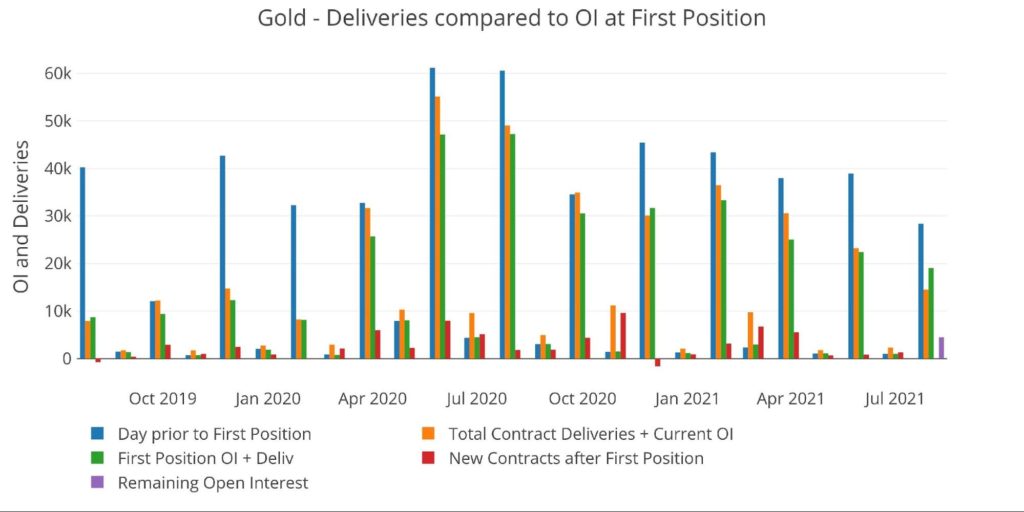

Gold: Recent Delivery Month

The charts below follow the same order as the silver charts above.

August gold is a major delivery month. While 19,031 contracts at first position is still high relative to all history, it is far below the more recent major months. Gold has not seen contracts cash settling mid-month which means total deliveries for August should slightly exceed 19k.

Figure: 7 24 month delivery and first notice

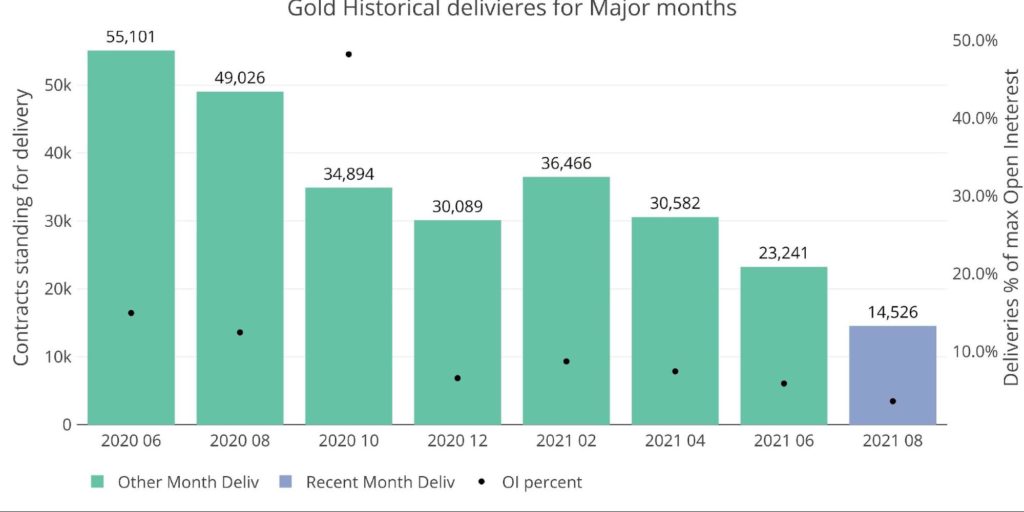

Even with mid-month activity increasing delivery above 19k, it will be very hard for gold to break out of its current downtrend. As the chart below shows, physical demand has been steadily falling month after month since last June.

Figure: 8 Recent like-month delivery volume

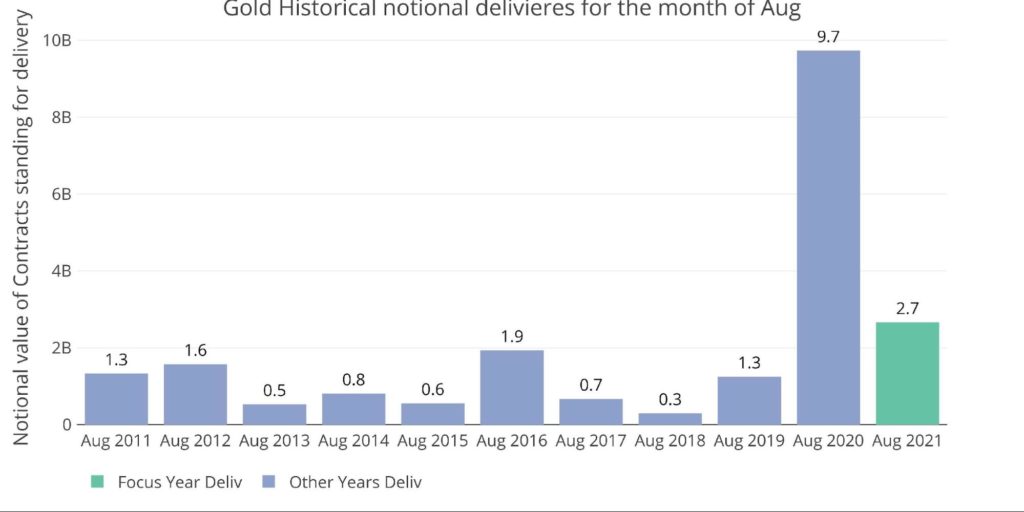

Looking historically at August, the most recent August is still well above average, but far below the nearly $10B in delivery volume that took place last August when gold was approaching all-time highs.

Figure: 9 Notional Deliveries

Gold: Next Delivery Month

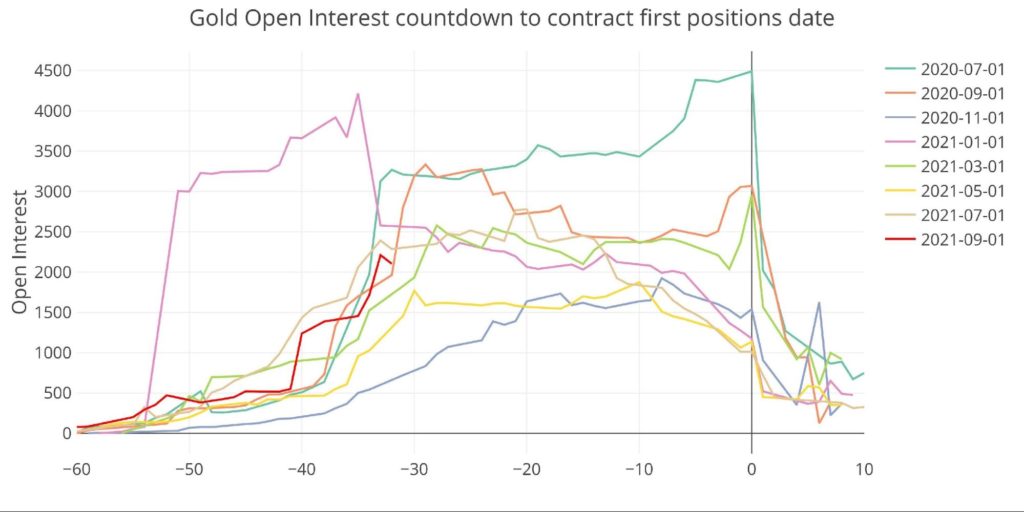

September Gold is a minor delivery month. The initial trend is promising as open interest has increased. The question going forward will be whether it maintains positive momentum and closes the month strong (similar to silver above), or turns back down as first position approaches. The Comex countdown update will be released around Aug. 23 to analyze the trend, about a week prior to September First Position.

Figure: 10 Open Interest Countdown

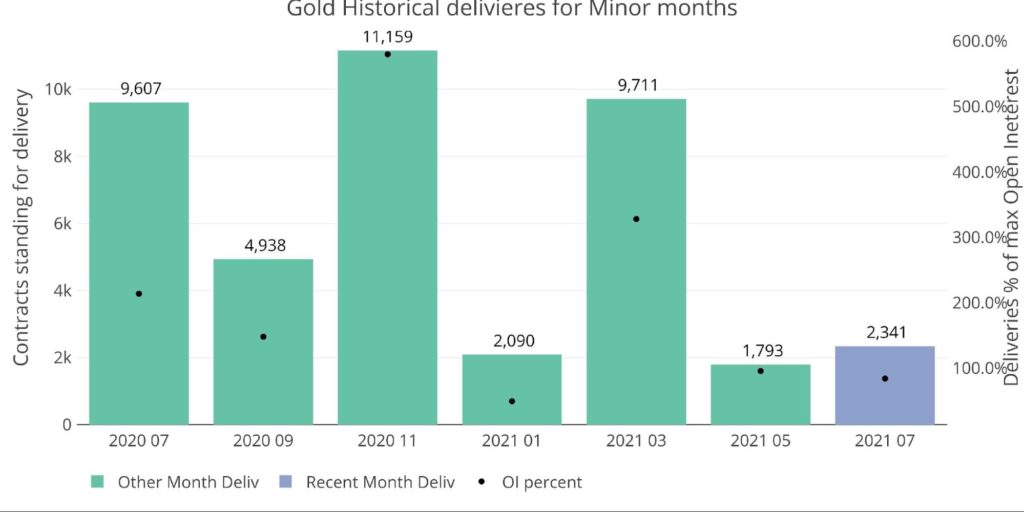

The last several minor months show a very choppy pattern. There have been a few massive months but also low delivery months. It was good to see July trending above May and January, but it’s still a far cry from the bigger months.

Figure: 11 Historical Deliveries

Wrapping up

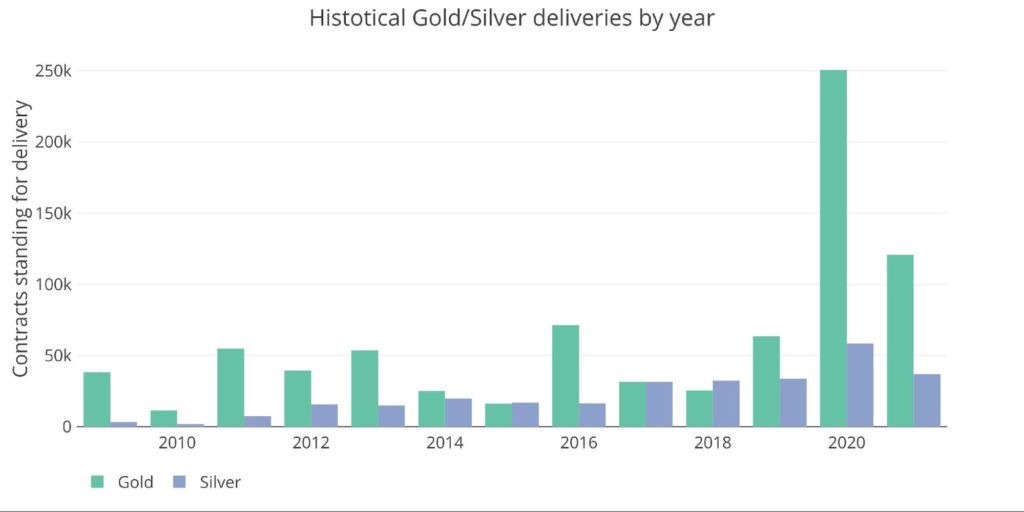

Silver is still showing some strength despite a disappointing delivery amount for July. Gold needs to reverse course soon in order to recapture some of the near-record deliveries from 2020.

Figure: 13 Annual Deliveries

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11PM Eastern

Last Updated: Jul 29, 2021

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]