Trump’s First 100 Days: A Gold Price Retrospective

With Trump’s first 100 days in office coming tomorrow, the mainstream media is abuzz with proclamations of failure. In terms of real numbers, the first 100 days of any president represents around 7% of their overall term. Some are questioning whether it’s fair to judge a new president from such a small sample. Trump himself has called the 100-day standard “an artificial barrier,” adding it was “not very meaningful” in a Twitter post.

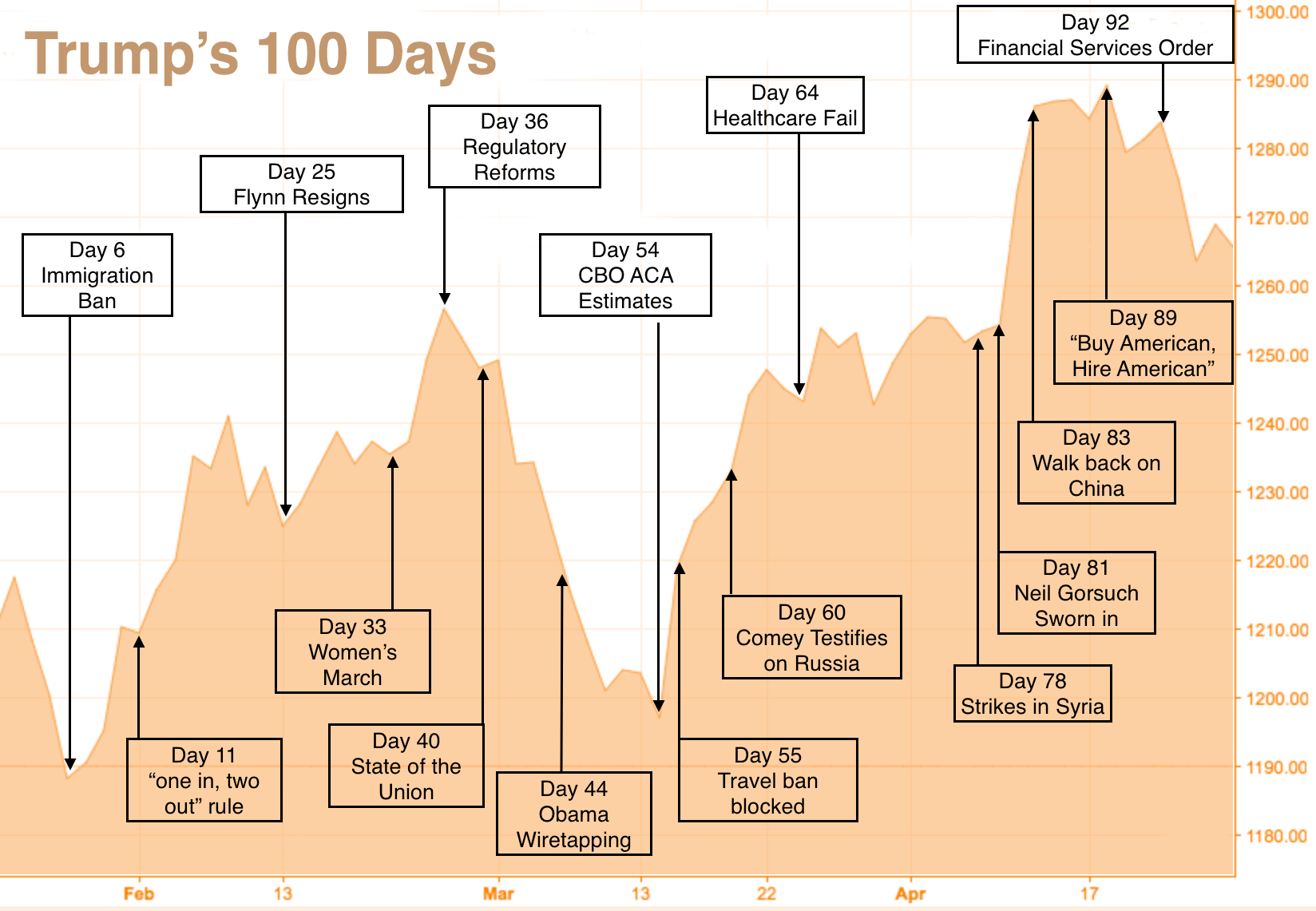

Despite its meaning or arbitrariness, 100 days is a standard nevertheless. Mainstream media will, no doubt, comb over Trump’s executive orders, the healthcare fail, and administrative missteps. However, other perspectives exist to help precious metals investors learn from the past 100 days and plan for future market volatility that can affect the price of gold.

These are broad generalizations, but may be helpful in gold investment and planning for the next 100 days of Trump. Here is a 100-day look back at what 7% of a Trump term looks like.

Day 6: Immigration Ban

Day 6: Immigration Ban

Trump wasted little time enacting his extremely controversial and ripple-causing ban on immigration from seven key hotbeds of terrorist activity. This action sparked nation-wide protests, and the unrest and volatility in the political climate started an upward trend for gold prices right from the start.

Day 11: “One in, Two out” Rule

Shortly after Trump looked externally to terrorism prevention, he set his sights toward deregulating governmental agencies, signing an executive order requiring every one new regulation be accompanied by the abolition of two others.

Day 25: Flynn’s Foreign Fumbles

Before the first third of Trump’s 100 days, his national security advisor Michael Flynn had already been forced to resign after potential government ties to Russia and Turkey. The bombshell set off weeks of investigation, which continues to ramp up. However, in the short term it solidified volatility and unrest in the markets.

Day 36: Red Tape Reduction

Red tape and government inefficiency was a big platform item for Trump during his campaign, and his executive order on day 36 addressed that in all government agencies. Task forces were set up in each agency to find, identify and eliminate red tape and make government run more efficiently. This started alongside a general downward trend for gold.

Day 40: State of the Union

Trump’s State of the Union address is regarded as a major win from his first 100 days and evoked a period of confidence in his ability. His message of restarting the engine of the American economy was well-received.

Day 44: Obama Wiretapping

In the dark of night, a tweet rang out. The real Donald Trump tweeted: “Just found out that Obama had my ‘wires tapped’ in Trump Tower just before the victory. Nothing found. This is McCarthyism!” This tweet came amidst the calmest portion of Trump’s presidency, and has been controversial to-date as officials continue to examine the level at which surveillance took place.

Day 54: Congressional Budget Office ACA Estimates

The Congressional Budget Office came out with an estimate on the ACA, stating that it would reduce the number of individuals with health care. Over 24 million people would lose coverage over the next nine years due to the elimination of the individual mandate. This was generally unsettling to the majority of the public, and along with other events caused the start of what would be gold’s massive gains.

Day 55: Travel Ban Blocked

Trump’s travel ban from muslim countries was blocked in federal court by a Hawaiian judge. The judge blocked key sections of the executive order, which attempted to impose a 3-month ban on new visas from six nations. Government infighting began in earnest and judicial systems highlighted the divide in the United States, contributing further to the unsettled markets.

Day 60: FBI’s Comey Testifies on Russia

Russia’s role in the US election became clearer as FBI Director James Comey brought new information to light regarding an investigation into tampering in the Republican party. The investigation sent a ripple of concern, fear, and shock throughout the country. It marked the beginning of a far more turbulent tide following Trump’s inauguration.

Day 64: Lack of Support Dooms Trumpcare

Trump’s silver bullet to Obamacare couldn’t make it past the rift in the Republican party, and was withdrawn before it could fall flat on the voting floor. This has been the biggest failure to-date for the new president. It solidified gold’s new value, as markets were struck with doubts about Trump’s other big plans, especially around taxes and infrastructure.

Day 81: Supreme Justice Neil Gorsuch Finally Sworn in

After extensive examination, Neil Gorsuch was finally able to take his seat on the Supreme Court. This came following the airstrikes against Syria, as retribution for their self-inflicted chemical gas attacks. Trump’s hand began shaking up world matters, and along with the investigation into Russia’s election pilfering, tensions began to grow, as did the price of gold.

Day 83: Trump Walks Back on China as ‘Currency Manipulator’

Another promise Trump made during the campaign was washed away after some reflection. Upon meeting with China’s president Xi Jinping at Mar-a-Lago resort, Trump backpedaled on his previous claims that China had been manipulating currency. This came as North Korea rattled their sword, causing more ripples in the markets, and improving gold’s place.

Day 89: ‘Buy American, Hire American’ Executive Order

Labeled by the White House website as “a signature foundation of his Administration,” the executive order aims to give American companies an edge in competing with companies overseas, as well as providing better benefits to hiring American citizens as employees of your business. This moment brought markets a bit of stability and helped slow gold’s recent gains.

Day 92: Tax Reform Investigation

After his promise to dismantle Dodd-Frank during his campaign, Trump made his first steps toward reformation of financial law. The executive orders prompted the Treasury Secretary to review tax regulations and determine how their expense and complexity can be reduced.

Ultimately, Trump’s first part of his presidential term was filled with volatility, along with other events such as the North Korean dilemma, Syria and France’s election. There are many more potential market-swinging events to look forward to in 2017. Trump’s wildcard persona will help make sure of that. If you want to hedge your bets and diversify your financial portfolio in advance, precious metals are a reliable way to preserve your wealth. Gold or silver could be the safe haven you’ve been looking for during the next 93% of Trump’s presidency and beyond.

Get Peter Schiff’s latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Day 6: Immigration Ban

Day 6: Immigration Ban

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.