Ron Paul: Fed’s “Dollar Destruction” and Moral Crisis

Ron Paul’s recent op-ed from the Ron Paul Institute for Peace and Prosperity, reprinted in the Orange County Register, breaks down the profound damage caused by central bank money printing: it pits savers against speculators, encouraging consumers to use debt to fund basic needs since their savings are constantly evaporating due to monetary debasement.

The result? Ballooning consumer debt and over-dependence on credit cards, while saving for the future becomes a zero-sum game:

“…even though Americans’ nominal wages have increased, their real wages have declined as their dollars buy less.”

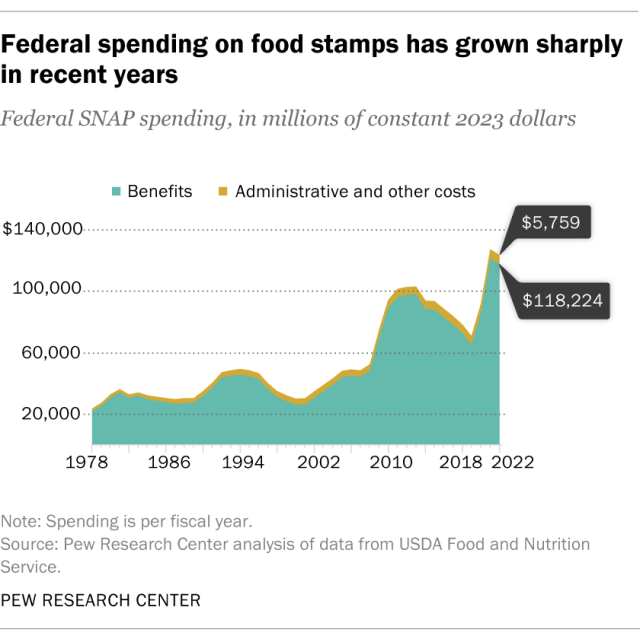

The Fed’s “dollar destruction,” as Paul calls it, is something that Americans are so accustomed to, that we’re addicted to it even as it hurts us. Without endless money printing, the welfare state and forever wars would no longer have financing — but with so many Americans addicted to cheap loans and widespread welfare programs, sound money would initially be rejected by many savers. Like a baby who is accustomed to eating a bag of candy every day, destroying its health, many would be enraged to discover their social “support” being taken away, even if it means securing some chance at prosperity for future generations in the form of gold-backed money.

This is how, as Gerald Celente puts it, “the fish rots from the head down.” Easy money fosters increasing dependence on handouts, and once this becomes the culturally accepted norm, it seems like a profound injustice when these handouts are taken away. Without proper education about sound money and the damaging effects of morally repugnant infinite central bank money printing, most people (welfare recipients or not) are blissfully unaware of the fact that their welfare programs were never affordable to begin with. Immoral leadership and monetary policy lead to an immoral mindset on the ground level, filtering down from the top and infecting every level of society like a virus.

This only guarantees even more struggle for future generations who get saddled with unsustainable debt, thereby further increasing their dependence on cheap credit and government welfare. But the inevitable end game for these experiments is total dollar collapse. When that happens, not only will the punch be taken away all at once, but the resulting economic implosion creates conditions for a tremendously violent and authoritarian society as plebeians fight for scraps and beg for a strong central government to save them from the problem that central banks created:

“…too many Americans at all levels of society (believe) that they have a right to government-provided economic security at the expense of their fellow citizens. This will result in violence and the growth of authoritarian political movements.”

However, there is hope. While an eventual implosion is inevitable, even for a country like the US which spreads its newly printed dollars around the world and exports inflation to other countries, a dollar collapse also provides the best opportunity yet for freedom lovers to hijack the cultural conversation and political capital from Keynesians.

From the ashes of fiat money, we will have a unique chance to create a new society where sound money policies have a better chance than ever to take political hold — and, slowly but surely, repair the moral fiber of a society destroyed by endless war and overstretched welfare that are only possible with infinite debt to fund them.

With all-time highs for gold, incoming interest rate cuts, and more war on the horizon, 2024-2025 could be the time when the fiat chickens finally come home to roost for good. But Paul ends the piece with this sliver of hope, imploring freedom lovers not to become too complacent or demoralized to continue the fight:

“We must continue our efforts to reach a critical mass of people with the message of liberty while making plans to ensure our families can take care of themselves when the next crash occurs.”

Get Peter Schiff’s most important gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!