Record Highs Turn Volatile… Stay Focused

The following article was written by Mary Anne and Pamela Aden for the June 2011 edition of Peter Schiff’s Gold Letter.

Volatility infected silver in particular. As it approached its old record high, investors got nervous and it dropped some 27% in just one week. But considering silver has soared over 1,000% over the past eight years, and 450% over the past 2½ years, it wasn’t that extreme.

Volatility infected silver in particular. As it approached its old record high, investors got nervous and it dropped some 27% in just one week. But considering silver has soared over 1,000% over the past eight years, and 450% over the past 2½ years, it wasn’t that extreme.

And as we’ve often noted, during bull markets, silver tends to overshoot on the upside and downside. It’s far more volatile than gold – and it always has been. Gold fell along with silver this month, but its decline was mild at less than 5%.

Big Picture: Most Important

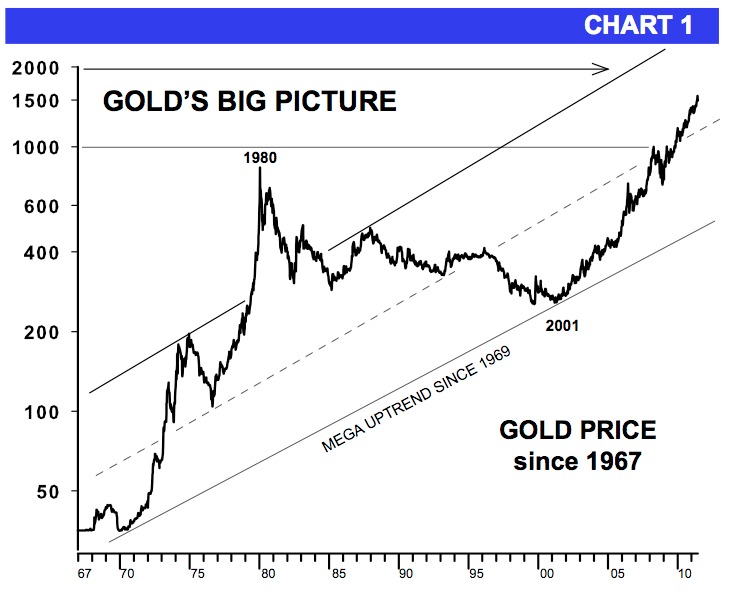

It’s always good to stay focused on the big picture. Chart 1 shows gold’s mega uptrend since 1967. You’ll remember that gold completed its 10-year anniversary rise last February -that’s 10 years of consecutive gains!

This picture reinforces the reason why you should always keep a core position, regardless of the short-term correction. Note the middle broken line on the gold chart. It met up with gold when gold broke-out into the stronger phase of the bull market. This suggests that once upcoming weakness is over and a new record high is reached, our next upside target area will be the $2000 area.

Strategy Is Key

Silver and gold are still very strong. The major trends remain up and we recommend keeping your positions and riding through weakness, which could last for a few months. This has been our primary strategy ever since we first recommended buying gold and silver in 2002, and it has served us well.

We are entering a seasonally slow time for gold; lows tend to occur during the summer months.

Remember, the major trends are the most profitable, simply because they’re far more powerful and long-lasting. The trick is to stay with them unless the fundamentals change. If you have, then your precious metals investments have been extremely profitable.

Central Banks Buying Gold

Central banks have been busy on a balancing act. As they measure inflation and interest rates, they’re on their biggest gold-buying spree in 40 years.

You’ll remember, they became net gold-buyers last year for the first time in decades. India continues buying gold by leaps and bounds. China has been on a massive gold accumulation program for several years now, as they strive to diversify their cash reserves. The other emerging markets are following suit.

In recent months, Mexico, Russia and Thailand added gold to their reserves as the price jumped to a record. Combined, they bought $6 billion of gold, according to the IMF.

Most importantly, gold is now being purchased by powerful mainstream sectors and individuals. As Peter discussed at length last month, the University of Texas at Austin bought nearly one billion dollars worth of physical gold in April and they took delivery of the bullion. That is a momentously bullish sign.

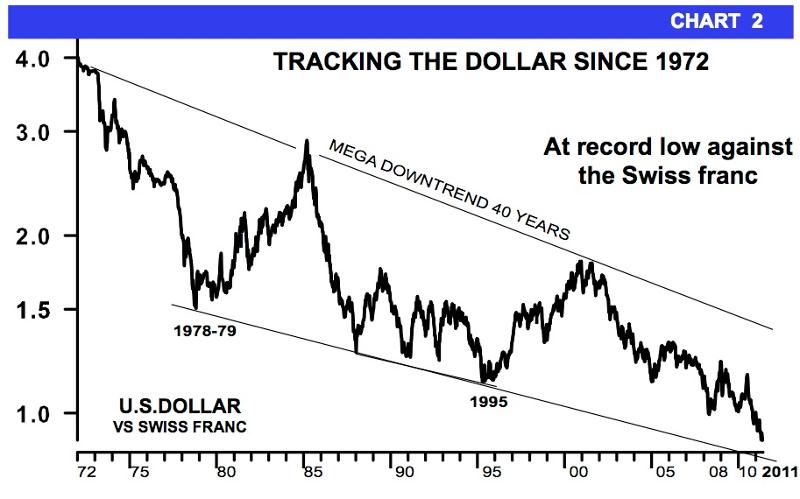

Dollar Worth Less

We all know the US has been spending money on a massive, unprecedented scale. This is something we’ve often discussed, as well as the fact that the Fed has been financing the spending by buying US bonds, which fuels inflation.

This procedure has gone unnoticed by large segments within the US, but not by the rest of the world. Increasingly, global investors and central banks are shunning the dollar:

For a while now, China has been taking action to diversify its huge reserves, which are now $3 trillion – with about half of that in US dollars. They’ve been buying gold, resources, and equities in other countries and currencies.

This month, however, a Chinese monetary official stated that China doesn’t need so much held in reserve. It wants to lower its reserves to $1 trillion, which essentially means they’ll have $2 trillion to diversify out of fiat currencies. If this proves to be the case, it’ll keep downward pressure on the US dollar.

That said, an upward rebound rise in the dollar would not be unusual in months ahead and it’ll likely coincide with a downward correction in the metals markets. For now, we’re still watching the 71.50 level on the Dollar Index. It’s the last support and it may hold near that level. However, we think that once this barrier is broken, the descent will likely intensify.

Fed Easing: Not Easy

We know US debt is out of sight. It’s at unprecedented levels and it’s growing by leaps and bounds. To finance this, the government sells Treasuries, and the Fed has been buying 70% of these bonds with money it creates out of thin air.

The Fed has become the biggest buyer of Treasuries in the world, even passing up China and Japan, which have been in the #1 and #2 positions for a long time. But as we’ve previously discussed, China is now diversifying its massive wealth and Japan has problems at home that have its attention.

This raises the big question… Who will fill the debt financing void if the Fed really ends QE2 on June 30 and stops buying bonds?

It’s going to be interesting to see what happens in the months ahead. But our guess is, if push comes to shove, the Fed will again step in with a new QE program – probably sooner rather than later to keep the stock market and the economy going.

The outlook remains very bullish for precious metals and emerging market currencies, and very bearish for the US dollar and US equities. Stay focused.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its thirtieth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Leave a Reply