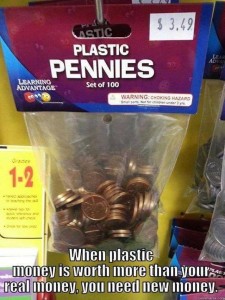

Time to Invest in Plastic Pennies?

If I want 100 pennies, all I have to do is go to my local bank and plop down a $1 bill.

But if I want plastic pennies, now that will cost me some real dough – $3.49 to be exact.

Who would have thought there was money to be made in toy pennies?

A company called Learning Advantage is cashing in on the plastic penny market, selling bags of the fake currency for more than three times the value of the real thing.

Nice work if you can get it, right?

Of course, we all get a little chuckle out of the absurdity. But the fact that plastic money is worth more than real money indicates a deep problem with the United States monetary system.

As we reported last fall, with a production cost of 1.6 cents each, it actually costs more to produce a penny than its worth. Currency debasement has eroded the value of the dollar to the extent that the penny has become less than worthless.

US monetary policy debases currency when it relies heavily on “printing” money through quantitative easing. Simply put, that means your money has less purchasing power. Currency debasement explains why the US ditched the copper penny in 1982, as well as silver half-dollars, quarters, and dimes in 1964. Today, we call old silver coins “junk silver.” However, they’re anything but junk – they actually contain a useful commodity that has held its value for centuries. It’s not that zinc or copper or silver have become “too expensive” – it’s that those coins have lost some of their purchasing power.

We see the impact of currency debasement in terms of wages. As we reported last month, in 1964 a minimum wage worker earned $1.25 per hour. That’s five silver quarters for every hour worked. Today, you can’t even buy a cup of coffee with those five quarters. But the melt-value of those silver quarters today stands close to $15 – the number minimum wage advocates throw around as the ideal.

So, what can you do?

Well, you could invest in plastic quarters. But you might be better off putting some of your money into physical gold or silver. Precious metals have historically held their value, even as government and central bank policies debase the currency.

Three-cent plastic pennies are pretty funny, but they reveal a very important truth – we need to fix our money!

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.  It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […]

It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […] In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up. When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

Its worth pointing out that gold and precious metals are not so much an ‘investment’ but more an ‘insurance policy’ against periods of stagnant economic growth coupled with high inflation (as seen in the 1970’s). They do not necessarily protect against inflation during periods of economic growth/ bull markets (as seen in the 1980’s when gold declined while inflation ran amok, culminating in 20% interest rates). This is because precious metals are not a productive asset-they ‘do nothing’, i.e. don’t pay a dividend like shares, you can only profit from them via capital gains. Given this, my personal preference is to invest in companies that mine precious metals, as opposed to investing directly in the metals themselves. This has the added advantage that a share certificate is easier to insure and harder for the Government to confiscate than a gold bar. However while gold is not a ‘generator’ it is a very useful ‘battery’ that can be converted into money when ‘generators’ (i.e. productive assets) fail.