Gold Price Plummets After Trump Win, Huge PM Purchase Opportunity

Dan Kurz is a CFA with over two decades experience working in Zurich, Switzerland as a thematic strategist for Credit Suisse CIO Office. Dan’s site, DK Analytics, offers deep and broad analysis at the macro and micro level.

Dan Kurz is a CFA with over two decades experience working in Zurich, Switzerland as a thematic strategist for Credit Suisse CIO Office. Dan’s site, DK Analytics, offers deep and broad analysis at the macro and micro level.

Gold per troy ounce (toz or oz) in $ terms has slumped by a whopping 11% since the November 8, 2016 election. The dollar’s trade-weighted value, meanwhile, has risen by 4% over the same period, while the value of the 10-year Treasury has fallen by a considerable 6% and the S&P 500 has rallied by 6%. What happened? In a nutshell, perception changed. Traders bet on more fiscal stimulus-based growth, lower corporate taxes, higher federal deficits, higher nominal interest rates, and higher inflation, so stocks went up, bonds went down, and the buck went up.

Strangely, and in contrast to the above “playbook,” gold and silver prices, or precious metals (PM) prices, fell and fell. The threat of wider deficits, even bigger debt mountains, more pronounced debt monetization (debt repaid via the printing press or via “quantitative easing” or “QE,” also known as dollar debasement), and higher inflation prospects that have so unnerved the bond market typically “levitate” PM (real money for thousands of years) prices, especially in an environment of negative real interest rates (the ones directly controlled by the Fed) likely to become even more so. We’ll examine the above and the “paper gold disconnect” below, and why we believe current futures market-based PM dollar price weakness is a huge strategic portfolio insurance purchasing opportunity. But before we do, we’d like to frame our gold and silver purchase opportunity theme with the following quote:

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold … The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.” – Author: Alan Greenspan, 1966

(Worthy of mention: physical gold and silver in your possession, unlike electronic “Bitcoin money,” not only constitute absolutely peerless, time-tested stores of wealth, but they a) can’t be ensnared in digital bail-ins or in Internet “lockdowns,” b) aren’t subject to power grid shutdowns, c) aren’t cybercriminals’ allies, and d) are finite/very scarce)

A closer look at the macro picture and valuation dynamics:

On the heels of the election, initially, stunned investors (a Hillary victory was considered a virtual certainty by the “establishment”) became increasingly convinced that even stouter growth in federal spending, and revitalized corporate profits, were in the offing. Specifically, considering that:

• The federal debt has been increasing by over $1trn p.a. on average (true federal deficits have accordingly been of a similar magnitude), or roughly twice nominal GDP growth, since the beginning of the Obama administration

• Much bigger federal gov’t deficits are likely due to a progressively weaker economy (lower tax receipts & higher transfer payments) on the heels of the weakest “recovery” on record featuring plummeting productivity growth

• President-elect Trump’s apparently prodigious fiscal (government spending) appetite and Trump’s avowed steep corporate tax rate reduction plans (from 35% to 15%), if enacted, would expand the federal deficit further still, yet would give, all else being equal, aftertax corporate earnings — whatever their level — a huge 31% boost

• The Fed will have to monetize even more gaping federal deficits, especially given the enormous Treasury bond exposure of its own, highly-leveraged balance sheet — and that of the Fed cabal member banks — which in essence commits the Fed to a low interest rate status quo (“Translation:” look for a record-breaking “QE” ahead)

• Foreigners have become net sellers of Treasuries, which implies even greater Fed purchases of said and, should this continue, dollar weakness, which would further fan domestic monetary inflation risks

• Additional money printing/Fed bond buying only adds to already unparalleled monetary inflation risks that can quickly metastasize if participants begin to experience sustained and rising dollar-based purchasing power erosion

• Total US debt ($18.1trn personal, $5.8trn corporate, $23.1trn government) is $47trn and growing

• A one percentage point higher 10-year Treasury yield will lead to about $470bn higher interest expense in a relatively short period, which would offset fiscal stimulus while reducing consumer demand/hobbling GDP growth thanks to reduced financing access for mortgages, cars, and student loans (a double whammy!), …

… investors sold bonds and, irrationally, in our mind, bought already very overvalued stocks. In the meantime, the Fed’s intention to keep raising the Fed Funds rate incrementally has sent the dollar higher still and gold lower still, however strategically flawed.

Frankly, to some it’s beginning to look like “Reagan, revisited.” But wait; not so fast. We beg to differ, from “A to Z.” Both the rule of law and property right protections are much weaker today than they were in January of 1981; just consider the cumulative corrosive effect of thousands of new, unconstitutional federal regulations spit out by the executive branch, year after year, and piled on top of each other, for decades. Or consider that self-proclaimed king of debt, taxpayer bailout supportive, “eminent domain”–abusing, litigious, crony capitalist extraordinaire Trump revels in trashing/transferring Main Street’s property rights to the “one percent.”

To add insult to injury, instead of Trump “draining the (establishment) swamp,” too many of his cabinet appointments, such as Reince Preibus (chief of staff), Steven Mnuchin (Secretary of the Treasury), Mitch McConnell’s wife Elaine Chao (DOT head), and even Rex Tillerson (Secretary of State), are the very “swamp monster” RINOs, cronies, and statists that have driven policy further away from the constitutional fidelity and private property right/liberty protections — to the delight of Wall Street and K Street, and at the expense of the private sector, free market capitalism, affordable power, coal miners, and the young generation. Did anyone say “hello again, status quo?” (Frankly, the positive implications of this on strategic PM prices could not be more favorable.)

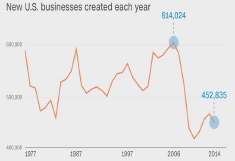

Is it any wonder, then, that vital (small) business formations, the engines of new job creation, inventions, and economic growth, have continued to wilt (related chart below)? This makes it harder to grow our way out of our overindebted state. Moreover, America’s toxic regulatory, tax, and litigation environment has fueled a three-decade-long erosion of its manufacturing prowess, a pivotal sector of high value-added output and high paying jobs, making it harder to “export” our way out of debt, a fact best underscored by multidecade growth in the US’s trade deficit as aggregated in the annual current account balance position:

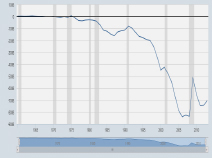

Annual current account balance: total trade of goods for US (bn of $)

Furthermore, constitutionalist Reagan at least attempted to return to federalism and to reduce the growth rate of non-defense-related federal spending (has anybody heard Trump speak about reducing the growing spending/intrusiveness/cronyism of the US government, or that “government IS the problem?”).

Most importantly for investors weighing risks, Reagan began his first term in January 1981 with a 31% federal government debt to GDP and ran it up to 51%; Trump will be starting his first term at 105%. Reagan began with a 10.5% personal savings rate; Trump will be starting at 5.5%. Reagan began with a 12.7% yield on a 10-year Treasury; Trump will be starting with a sub-3% Treasury (based on current yield). Reagan inherited a nearly 12% inflation rate that had a long way to fall; Trump will be starting with “official,” now heavily gimmicked, consumer inflation at 1.7% (current tally) with nearly nowhere to go but up — i.e., if central bankers have their way, and history strongly suggests that it is “only a matter of time.”

Read the rest of Dan’s article here.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.  It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […]

It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […] In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up. When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]