Gold: Not Just Another Commodity, A Safe-Haven in Times of Uncertainty

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Mainstream media pundits, economists, and journalists alike love to lump gold in with other commodities. They put it in the same category as oil, copper, wheat, natural gas, and other things that come out of the ground. But while gold is in fact a metal you must dig up, it is a mistake to call it “just another commodity.” Gold’s recent price performance shows that it is anything but. Gold is a superior safe-haven asset to own in times of financial duress and uncertainty.

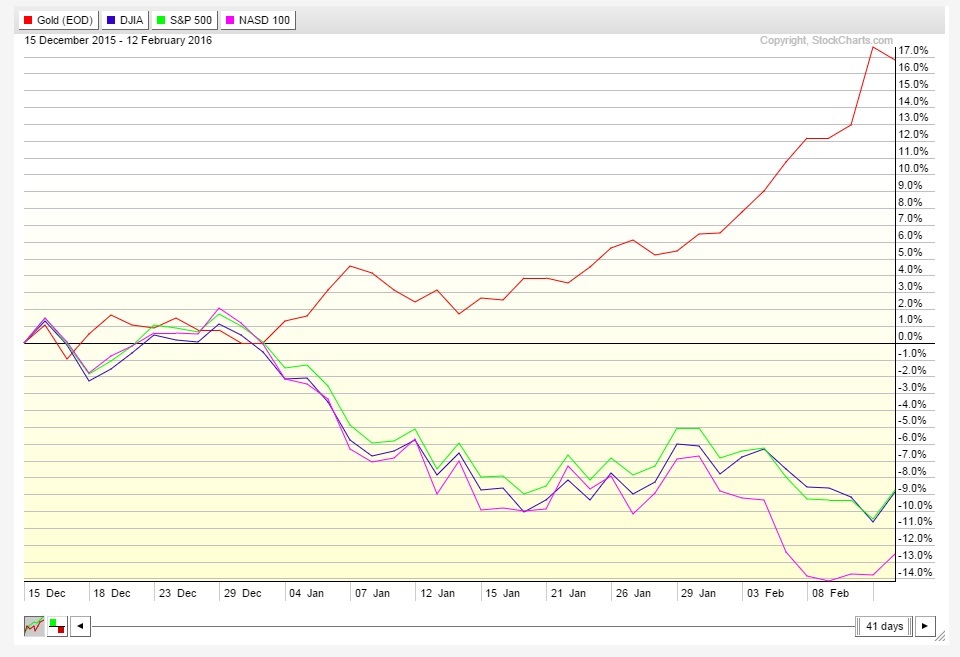

Since the beginning of 2016, the market has demonstrated that gold is a unique asset we should approach differently than other commodities. Here is a chart comparing the price of gold against major US domestic indices since the beginning of the year.

Regardless of what you may think is behind the downward pressure on stock prices, be it woes in the European banking system, China’s capitulating stock market and massive capital outflows, or the creeping realization that Janet Yellen and other central bankers cannot effectively manage the economy, the big picture is clear. In times of financial duress, capital flows into gold.

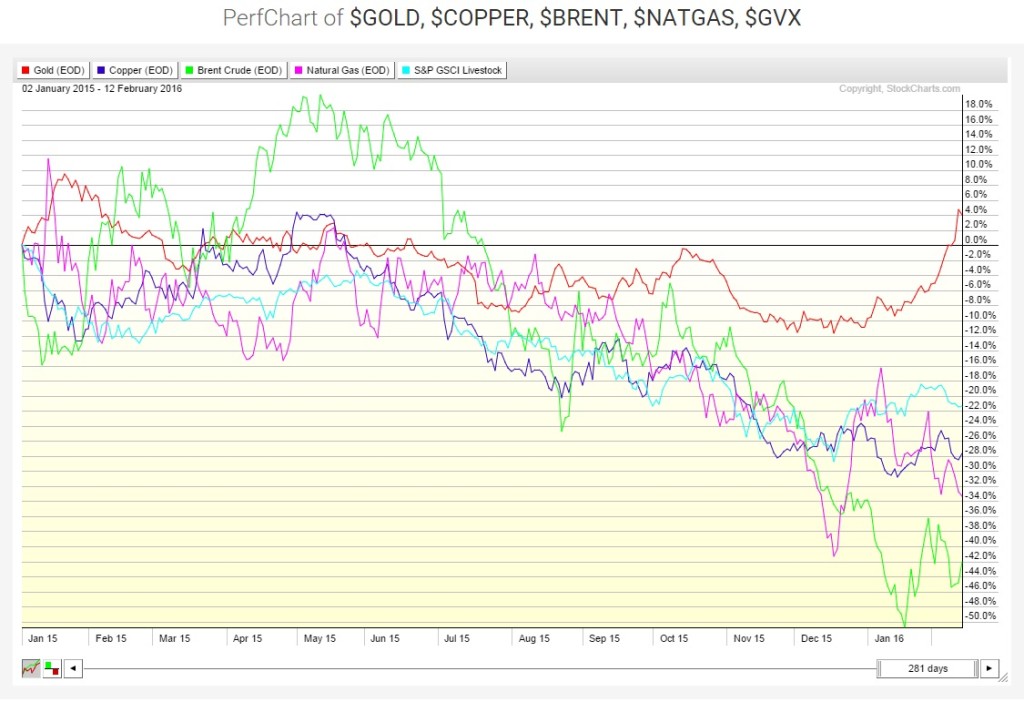

What about other commodities? Does capital flow into oil or livestock during times of financial uncertainty and risk? They are, after all, “hard assets” and not paper claims to an asset. Shouldn’t they behave in the same way as gold? Here is a chart comparing gold to some popular commodities over the same time period.

This chart shows the relative price performance of gold against copper, oil, natural gas, and livestock. The middle of last year serves as the midpoint on the chart. At that time, all of these commodities began to trend decisively lower – except for gold. Oil led the charge with a breathtaking 60%-plus decline in price. Only recently has it shown signs of cooling off. But the damage has already been done for companies that were banking on a higher price. (Banking used in a literal sense here in that capital is tied up in these enterprises for the long-term, and if they are marginally unprofitable, they must be chopped up and sold off in bankruptcies.)

Though more gradual, copper’s performance looks just as painful.

Gold however, represented by the red line, proved resilient, and just recently started its double digit price ascension from $1060 per ounce all the way up to as high as $1250 per ounce. That represents a 17% move in less than two months.

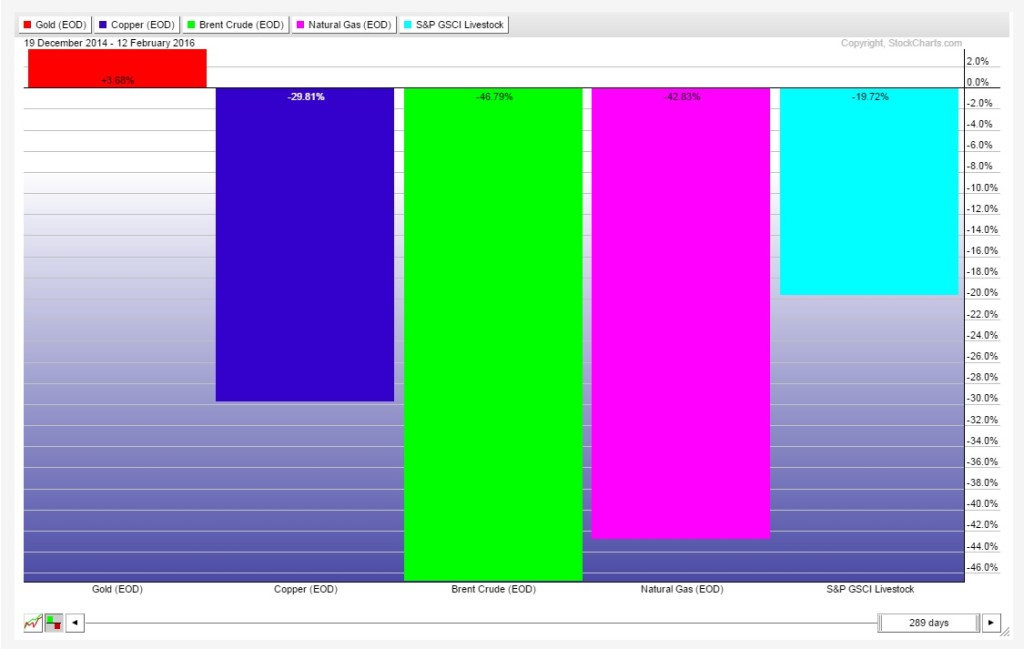

There is an obvious difference between gold and other commodities, and the magnitude of difference is noteworthy. The following chart puts this into perspective.

There is not a single commodity listed above that falls within a 20% range of gold’s price performance over the past year.

The difference between gold and these other commodities should be obvious. Gold historically attracts capital flows in ways that these other commodities do not. This is especially true during times of financial uncertainty, increased perceived risk, and global fears of entering a prolonged period of economic recession or depression. Gold’s recent price performance in the midst of a lot of economic uncertainty and talk of recession supports this thesis.

Many investors like to group all “hard assets,” or commodities, together, thinking they must all perform the same way in most scenarios. This often means that gold and oil are put in the same category.

They shouldn’t be, for several reasons.

First, oil presents some serious storage issues compared to gold.

Secondly, the price of oil is very sensitive to potential changes in the above ground supply, which is pretty limited. That is not the case with gold. A stable supply of gold exists above ground flowing to whomever wants it most.

Finally, oil’s dramatic price decline against the resilience and strength of gold should show once and for all that gold has unique properties which make it superior to oil and other hard assets in some economic scenarios.

In times of financial uncertainty, people don’t buy a broad basket of commodities. They buy gold. Gold is not just another hard asset. It is the superior safe haven financial asset in a world where financial assets are becoming increasingly risky.

We discuss several of the properties that make gold so unique and different from other commodities and why it is the most important asset to own in our free Why Buy Gold Now special report. Download your copy here.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Leave a Reply