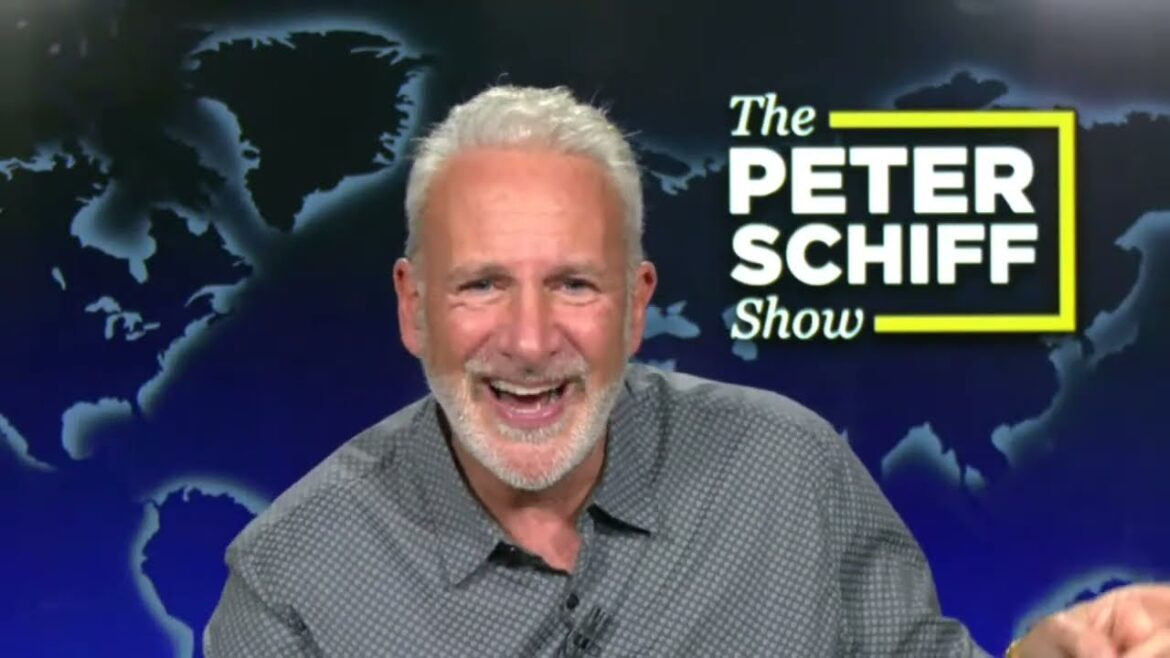

On this year’s Leap Day, Peter analyzed another round of inflation data and the economic factors at play in the quickly approaching 2024 general election. Bitcoin also surged back above $60,000 after the SEC approved bitcoin ETFs. Inflation came in worse than expected for personal consumption, and gold finished the week at nearly $2090/oz.

This week Peter covers the highlights of a volatile trading week, paying special attention to Nvidia, Wall Street’s favorite AI stock, and Newmont Corporation, a heavy hitter in the gold mining industry. Both companies’ shares experienced dramatic price action this week, with NVDA gaining $260 billion in market cap and pulling the market up after an excellent earnings report. Newmont, on the other hand, saw shares fall 7% after a disappointing last quarter.

Peter released a brief video addressing the looming resurgence of inflation.

Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data.

During this week’s Super Bowl ads, Biden slammed greedy corporations for inflation. In his most recent podcast, Peter explains exactly what’s happening with inflation, and why Biden’s blame game has it backward.

Jerome Powell’s 60 Minutes portrayal of the national debt crisis as a distant concern starkly contrasts with the urgent reality we face. Peter Schiff doesn’t mince words in his most recent podcast when he highlights the immediate threat:

The story of America’s job growth is more complex and nuanced than the government wants us to believe. In a world where job numbers wield significant influence over perceptions of economic health, it’s crucial to scrutinize the data—and the methods behind their presentation—closely.

In his latest podcast, Peter Schiff delves into the murky waters of government economic reporting.

Recent data have many cheerful about the economy. But according to Peter in his latest podcast, the economy may already be in recession. Here are some of Peter’s biggest causes for concern:

The president touted a manufacturing renaissance. However, economic indices show US manufacturing entering a Dark Age. Home sales are not looking bright, either.

In his latest podcast episode, Peter uncovered the unsettling realities of recent job market trends, focusing primarily on the December jobs report. He casts a light on the sickly nature of recent job creation:

The Federal Reserve will play a pivotal role in the upcoming election and aim to boost President Biden or another Democratic candidate.