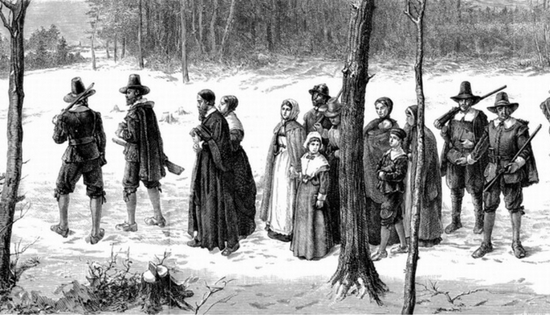

The majority of Americans know the basics behind the story of the pilgrims’ 1620 journey on the Mayflower, their eventual landing at Plymouth Harbor, and the physical and mental hardships they faced helping form the first permanent settlement of Europeans in New England.

Native American tribes like the Pokanoket were instrumental in helping the Pilgrims survive harsh winters, showing them how to plant corn, the best places to fish, and where to catch beaver. Thanksgiving is the day we celebrate the harvest feast the Pilgrims shared with the Pokanokets as an expression of thanks and good will.

Trade with other cultures, like the Pokanokets, was as essential for the Pilgrims’ survival just as it is for Americans today. Unlike our nation’s early European ancestors, however, today we use some pretty sophisticated ways to exchange goods and services. Credit cards, electronic transfers, bank wires, and cryptocurrencies make the Pilgrim’s form of currency seem like an alien technology, but that doesn’t mean it didn’t (and still doesn’t) work just as effectively today.

Last week, St. Louis Federal Reserve economist William Emmons presented a study showing American home ownership declining at a rate that’s projected to return levels to the 1950s. In a presentation entitled “Is Home Ownership Still the American Dream?” Emmons explains how the increase in home ownership of post-WWII was fueled by many factors, including New Deal government housing policies, which “laid the foundation for this huge increase in home ownership rates.”

Although the 2008 Housing Crisis was a strong factor, Emmons suggests the downward trend in home ownership began as early as 2005. The Fed economist also suggested the move on balance appeared secular and long-lasting, despite the fact that 90% of Americans younger than 45 have bought or expect to buy a home in the future. Aspirations to own homes are even higher among African-Americans and Hispanics than whites and Asians, yet rates for these groups are 20 – 30% lower.

Next to Donald Trump’s economic policies, one of the most spirited economic debates at the moment involves which direction the dollar will move in the coming months. While Goldman Sachs is predicting the dollar and euro will reach a value equivalency by Q4 of 2017, other analysts see the greenback trending downward next year.

The dollar has risen 4.4% against the euro and 2% against a basket of world currencies since Trump’s win on November 8, according to Fortune. Big moves within securities and bonds markets since Trump’s victory are creating a general sense of uncertainty, making predicting anything a difficult task.

But for market veterans like Jim Paulsen of Wells Capital Management and Peter Schiff of Euro Pacific Capital, the dollar’s demise is clear given inflationary anticipations mixed with short and long-term interest rate increases.

Peter Schiff recently appeared on Alternative Media Television (AMTV) to discuss the so-called “Trump effect” on the US economy. So far, the stock market has gone through some downs after the president-elect’s surprise win and now back up with the Dow Jones average nearing record highs.

There’s also been last week’s bond rout, which sent long-term yields soaring as bond prices dropped. The yield on the 10-Year Treasury saw its largest two-week increase since 2001, up 5.9 basis points to 2.337%. The selloff was driven by “rising inflation expectations and the market’s near-certainty that the Federal Reserve will raise interest rates in December,” according to MarketWatch.

As markets settle down following the week after the election, inflation continues to rise. Many continue to expect a December rate hike despite the potential volatility caused from state officials calling for Fed reform as early as Q1 2017.

The domestic gold market in India is facing an upheaval as traders place an increasing number of bulk, short-term orders on fears Prime Minister Narendra Modi could seriously throttle overseas imports of gold. The traders’ fears stem from Modi’s plan to eliminate so-called black money from India’s monetary system by demonetizing the 500 and 1,000 rupee notes. The bills were previously the country’s largest currency denomination.

Analysts are locating the cause for the recent rise in the dollar on investors now pricing in President-Elect Trump’s fiscal stimulus plans. Investors are betting Trump’s plans to cut taxes, expand infrastructure, immigration reform, and deficit spending as being pro-inflation. “If you block immigrants, or even illegal immigrants working in the states, wages will rise … if you block Chinese exports to the US prices will rise,” Tai Hui, chief Asia market strategist at JPMorgan Asset Management told CNBC.

The president of the United Auto Workers said he will sit down and talk with President-Elect Trump to try and crush the North American Free Trade Agreement, describing NAFTA was “a problem.” The union of auto workers is an early advocate for working with Trump to change trade agreements seen as being detrimental to American workers. Other industry organizations are likely to ally themselves with the future president, who made trade a cornerstone of his campaign promise to “Make America Great Again.”

The results of Tuesday’s election stunned the world much like Brexit did this summer. Markets dipped, and then recovered quickly to close at record highs following election night. The Fed however, could see big changes coming their way.

As Trump Becomes President-Elect, Here Come Fed Reforms

As we revealed in our infographic on Trump’s Fed views on Monday, his campaign wasn’t shy about their concern with the current Fed structure. Now that the election is complete, and Trump’s stunning victory rattled many in the nation, we can look back on what he’s said about monetary reform as a guideline for the next several months.

Among his most drastic proposed changes were possibly repealing Dodd-Frank, auditing the Fed, and more.

Tuesday night’s election coverage had both sides fidgeting for a while, but Donald Trump staged an almost miraculous comeback, winning in state and counties where Democrats thought they had an edge. While liberals were taken by surprise, they weren’t the only ones. Polling experts, who were generally confident in the data showing Clinton with a four-point lead, were stumped at exit polls and data showing the Democratic candidate performing better with minorities and white educated women than anticipated.