In an interview with HedgeyeTV, David Stockman explains why he believes we’re on the verge of popping another major financial bubble for the third time in this century. He and Keith McCullough also discuss the potential political fallout from this bubble – who will be the politician to fire Janet Yellen and refute Keynesian policies? They wrap up by talking about Stockman’s recent book The Great Deformation and how the financial media is caught up in a “recency bias” that allows them to ignore the monetary fraud being perpetrated by the Federal Reserve and the government.

While parts of this conversation are a bit technical, Stockman does a great job explaining the fundamental economic and political realities of the United States.

James E. Miller, editor-in-chief of Mises Canada, published a defense of Peter Schiff’s forecasting record last week. Miller calls out mainstream financial media as biased Keynesian propagandists, while praising Peter’s willingness to stand by Austrian Economics in the face of public ridicule.

Still, Schiff has a point. He went on national television and endured a deluge of mockery for challenging established opinion. His forecasts, while not always correct, were far more accurate than those of his contemporaries. No one likes an ideologue wedded to a philosophy to the point of redundancy; yet there comes a point when facts are facts. When it mattered, Schiff had both an accurate assessment of the economy and a solid explanation to justify his findings. His advice might have saved the livelihood of millions, had it been taken. To this day, his call was seen as heroically prophetic, even while his philosophical underpinnings are still held in suspicion. He hasn’t earned the benefit of the doubt in the eyes of his Keynesian-minded contemporaries.”

Renowned author and investor Jim Rogers appeared on RT yesterday to share his thoughts about the end of the US dollar as the world’s reserve currency. In this short interview, he suggests that the Chinese renminbi might fill the void left by the dollar. This prediction shouldn’t be much of a surprise to our readers, as we’ve been following the ever-growing gap between the East and West. The big takeaway is this: Rogers is certain that by the end of this decade, the world will be well on its way to completely abandoning the dollar as a reserve currency.

The US thinks that they’re in charge and they don’t have to worry about anything. No, I hate to say it – I’m an American citizen – but you know, there’s a lot of arrogance still in the United States. Especially about the dollar.”

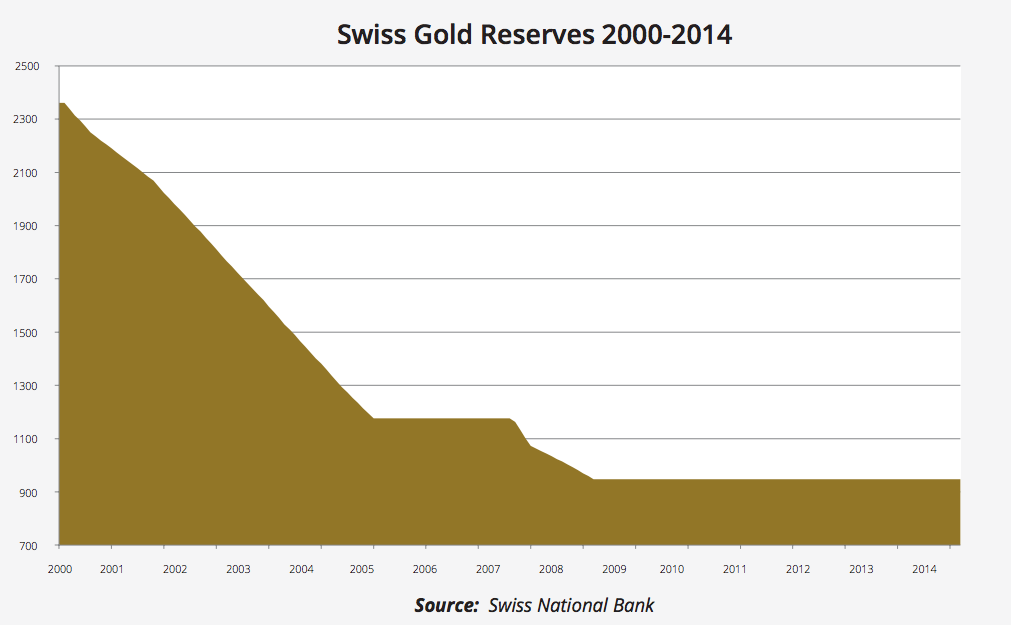

Last week, an analyst for Bank of America predicted that gold could rise to $1,350 if Switzerland passed the “Save Our Swiss Gold” initiative at the end of November. That’s almost 17% higher than today’s gold price. The media is not just watching the price of gold in the weeks leading up to the Swiss Gold Initiative – the value of the Swiss franc in relation to the euro has also been closely eyed. Unfortunately, as you can see in this article from Bloomberg, the financial media generally makes it sound like the Swiss Gold Initiative would be terrible for the franc.

However, the Swiss Gold Initiative is more than just a referendum on returning to sound money policies in Switzerland.

A couple weeks ago, we reported on Alan Greenspan’s prediction that the price of gold would rise. He said this at the New Orleans Investment Conference. In an interview at the Council on Foreign Relations (CFR) the next week, Greenspan commented even more on gold, though the CFR did not publish his thoughts in the official transcript. Most notably, Greenspan explains what so-called “gold bugs” have been telling the skeptical financial media for years:

Gold is a currency. It is still by all evidences the premier currency, where no fiat currency, including the dollar, can match it… Intrinsic currencies, like gold and silver for example, are acceptable without a third party guarantee…”

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold. Check out Peter Schiff’s Gold News every Friday, when Erik will recommend a new entertaining and educational video – the Friday Feature.

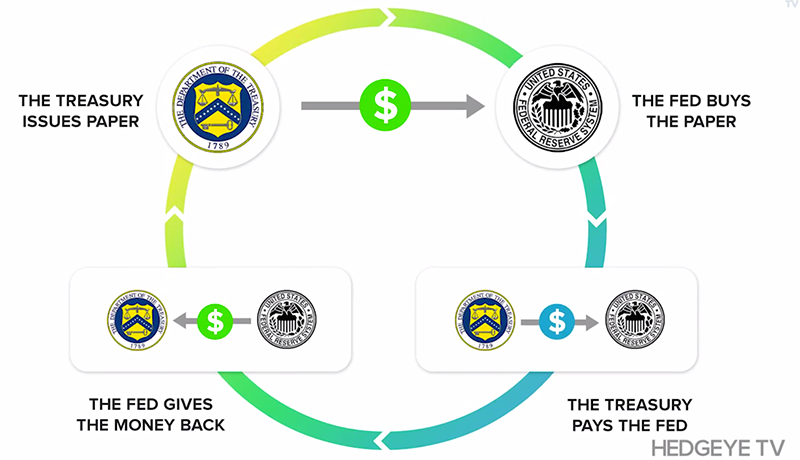

For this week’s Friday Feature, I’d like to present “The American Dream”. This animated short takes an elementary look at how the American people have had the monetary rug pulled out from under them. The film investigates the causes of the financial crisis, the origins of money and examines those responsible for creating the Federal Reserve System. While much of the information in this film will be common knowledge to most contrarians, I believe this film is a great tool for educating younger generations about the Federal Reserve and the history of money. Enjoy!

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

In this lecture, Dr. Andrew Bernstein discusses why capitalism is the best system for men to live under, from both socio-economic and moral standpoints. Free markets are ideal for society:

- They make available an abundance of inexpensive and effective consumer products.

- They give the poorest among us the opportunity to rise into the middle and upper classes of society.

- They create an environment where man’s mind is able to function to the best of its ability.

The Mises Institute has released the second part of an exclusive interview between its President Jeff Deist and Patrick Barron, a private banking industry consultant. Find the first part of this engrossing interview here. In this second half, Deist and Barron discuss:

- How US dollar supremacy might come to an end with a whimper, instead of a bang.

- How the Bundesbank is a potential savior for the world monetary order, while the IMF is a paper tiger.

- How elites will have an increasingly hard time denying gold its role in the global monetary system.

- How America’s fiat dollar corrupts cultures, as well as economies.

Last week, gold and silver analyst Dan Popescu interviewed Egon von Greyerz, Founder and Managing Partner of Matterhorn Asset Management. They spoke at length about the upcoming Swiss Gold Referendum, which we’ve previously reported on here and here. Von Greyerz provides great insight into the Swiss mindset and the importance of gold for central banks around the world. At the end of the interview, he even weighed in on the massive flow of physical gold from the West to China.

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist.

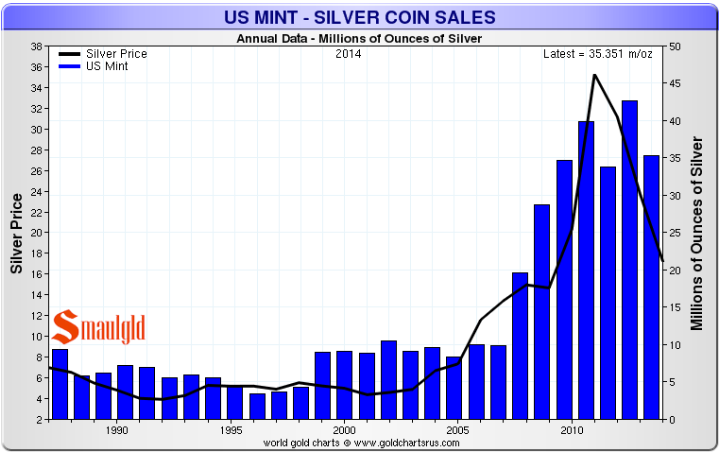

Sales of the US Silver Eagle are often looked to as the leading indicator of demand for silver bullion coins. It remains the most popular bullion coin among investors both domestically and internationally.

While the Eagle has been in the limelight for nearly a decade among investors, bullion coins from smaller national mints have also seen a dramatic uptick in demand. There has also been a massive increase in ETF purchases of physical silver and substantial industrial demands from the growing solar industry.

Louis Cammarosano from Smaulgld guides us through the growing demand for silver on the industrial and investment fronts.