While the government and mainstream media keep telling us, “The economy is improving, the economy is improving!” we keep getting news like this from the New York Times:

With a hint at what may be in store for shoppers this holiday season, Macy’s cut its profit outlook and CEO Terry Lundgren said markdowns are likely as a convergence of factors lead to a high inventory of goods for retailers. Macy’s third-quarter sales fell 3.6% at established locations.”

Macy’s Q3 revenue dropped to $5.87 billion, falling short of the $6.15 billion forecast by Wall Street analysts. The company dropped its full-year earnings forecast a full 50 cents, from $4.70 to $4.80 per share down to $4.20 to $4.30 per share.

The mainstream media trumpeted the latest data on housing starts as good news for the economy, but there is a dark side they aren’t talking much about.

Reuters reports housing starts rose more than expected in September, driven by high demand for rental units.

Groundbreaking increased 6.5% to a seasonally adjusted annual pace of 1.21 million units, the Commerce Department said on Tuesday. It was the sixth straight month that starts remained above 1 million units, pointing to a sustainable housing recovery. Starts increased to a 1.13 million-unit rate in August. Economists polled by Reuters had forecast groundbreaking on new homes rising to a 1.15 million-unit pace last month.”

Wal-Mart’s problems may well reflect deeper issues in the US economy.

The giant retailer announced Wednesday that profits could drop as much a 12% in the next year. It’s stock plummeted 10% on the news. Company officials also warned they now expect sales growth for the current fiscal year to be flat. In February, the company predicted 1 to 2% growth.

According to the Wall Street Journal, the cost of recent wage increases is weighting heavily on the company’s profit margin:

If the Federal Reserve is truly “data dependent,” then the data just keeps undermining its case for an interest rate hike this year. Wholesale inventories rose in August, and sales fell, flashing a recessionary warning sign.

According to the Associated Press, the Commerce Department reported wholesale inventories rose 0.1% in August, while sales fell a full 1%.

The dip in sales follows a general year-long trend, with the number dropping 4.7% over the past 12 months.

Goldman Sachs officials are ready to push back their rate hike forecast to late 2016. As Bloomberg reported, they are hedging their bets on a December rate hike (probably to save face):

Goldman Sachs Group Inc. said there’s a chance U.S. policy makers will delay raising interest rates well into next year. While Goldman Sachs’s central forecast is still for a December liftoff, a slowdown in output and employment may justify the Fed keeping rates near zero for ‘much longer,’ the bank said in a report.”

Peter has been saying the Federal Reserve won’t raise rates all year. Now, as the year winds down and bad economic data continue to leak out, the mainstream appears to be catching up. Peter said it will eventually wake up completely.

The pretense that the Fed is about to raise rates, that a rate hike is just around the corner is going to end. It cannot withstand all of this negative economic news.”

Every week, various government agencies trot out economic facts and figures, and every week, the media breathlessly reports the “good news.” Here is some of the news beyond the news reported by the mainstream media over the last week.

As USA Today reported, consumer spending and personal income rose last month. But while Commerce Department numbers show healthy gains in consumer spending (0.4% in August), a Gallup poll asking actual people about their spending indicates a continual decline. According to the poll, daily spending averaged just $89 in August, down from the same time period in both 2014 and 2013. It was the fourth month in a row the poll indicated a year-on-year decline. Spending was at its lowest since March, based on the poll.

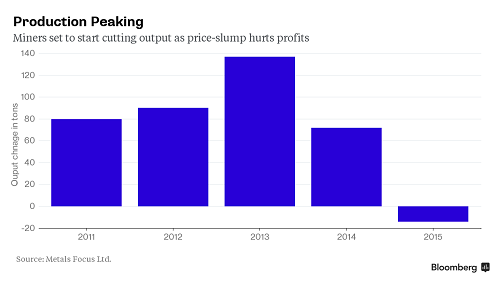

With many mining companies in the red, analysts expect gold production to drop for the first time since 2008.

According to a Bloomberg report, the anticipated drop in production follows a global surge. Gold output jumped 24% in a decade to a record 3,114 metric tons in 2014, according to data from industry researcher GFMS.

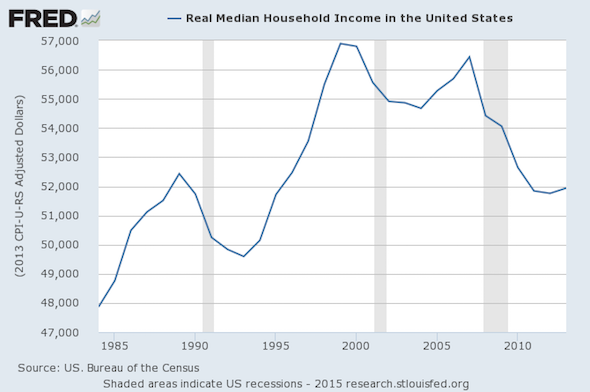

Thus far, the so-called economic recovery has done little to improve the lives of everyday Americans.

In yet another sign that the recovery is an illusion, figures released last week and reported by Reuters show American’s household income lost ground last year.

The data released by the U.S. Census Bureau on Wednesday, which showed the inflation-adjusted median income slipping to $53,657 last year from $54,462 in 2013, offered a reminder of the tepid nature of the economy’s recovery.”

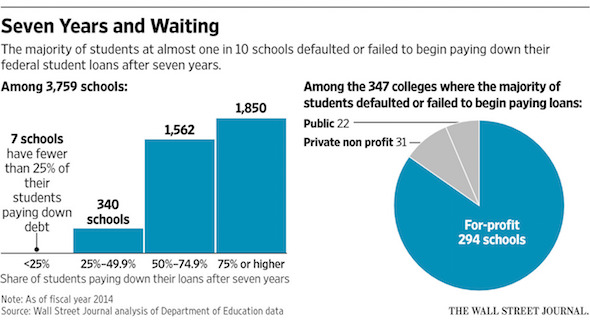

At the end of 2014, the New York Fed reported a surprisingly high delinquency rate for student loans – 11.3%. Now the latest data released by the White House reveals that number may in fact be dramatically higher. As the Wall Street Journal reports:

New figures covering more than 3,700 schools were released as part of the White House’s College Scorecard, which allows consumers to explore data about debt and degrees. The average repayment rate among almost 1,200 for-profit schools—meaning these students were actively paying off loans—was 61%, the lowest of any sector. The average repayment rate among all colleges was 73%.”

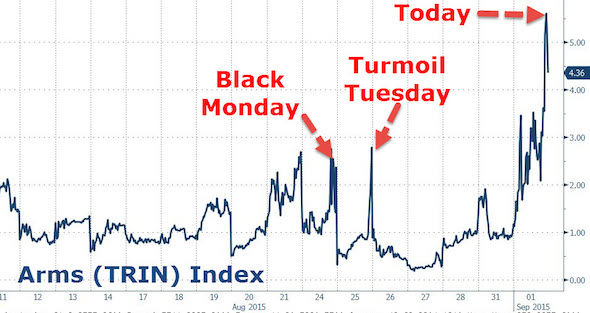

Yesterday, the Arms Index (TRIN) spiked dramatically to levels not seen since 2011 and nearly twice as high as last week’s “Black Monday.” The Arms Index is a way of measuring how balanced the stock market is, with higher values suggesting the market might head in a bearish direction sooner than later. As ZeroHedge describes it:

A sudden surge in the TRIN indicates a jump in trader lack of confidence, as everyone scrambles to either go long the 2-3 rising stocks, or to sell or short the biggest decliners, ignoring the bulk of the market.

Of course, the Arms Index is a purely technical indicator that stock speculators watch closely, but it coincides with a growing mountain of data pointing to frightening volatility in American stocks and major cracks in the rosy mainstream narrative of an economic recovery in the United States. International banks, investment firms, big-name fund managers, and everyday technical analysts have all been sharing insights into terrible data and trends the financial media has largely ignored.