Peter Schiff begins hist latest video blog with a review of December’s dismal jobs numbers and the latest data that reveal how poor the supposed US economic recovery really is. He then explains why Janet Yellen will soon be facing a bigger crisis than Ben Bernanke had to deal with when he first took charge of the Fed in 2006.

The monetary policies pursued by Bernanke were far more reckless than the ones pursued by Greenspan. And therefore, the bubble is much bigger. And therefore, the damage to the economy when it pops will be much bigger… We’re going to have another crisis early in the Yellen term that will be bigger than the crisis that we had early in the Bernanke term. Wall Street and government are equally as prepared – they will be equally blindsided.”

[youtube http://www.youtube.com/watch?v=myyRksPJe8I&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

There are two types of gold investors: those trying to make money on short-term market timing and those looking for long-term asset preservation. It was the fear-driven trading of the former that helped gold break $1900 in 2011, and for good reason – stormy markets steer investors to safe havens.

But gold’s fortune has shifted in the past two years, and finishing 2013 down 28% seems to have sealed its fate – at least in the eyes of the short-term speculators. In reality, the same forces that are stabilizing stocks and suppressing gold are also the fundamental reasons long-term investors have been buying gold since the turn of the new millennium. The so-called recovery we’re now experiencing is just a lull in a storm that hasn’t yet abated.

When does a taper really mean more stimulus? When zero percent interest rates are pretty much guaranteed for the foreseeable future. Peter Schiff explains why the “taper lite” is simply an admittance that the economy is addicted to artificial stimulus. Peter also shares his opinion on gold’s sell-off and why investors should be using the opportunity to buy before it’s too late.

“There’s plenty of legitimate support for gold all around the world. Yes, all the speculators who were convinced that everything is great (the same people who thought it was great in 1999)… are convinced that there’s no reason to own gold and so they’re going to sell it and they’re going to short it. But there’s a larger community around the world, particularly emerging markets, central banks – China in particular – that see it differently. And they’re using this opportunity to buy as much gold as they can…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

Having replaced savings with debt on both the national and individual levels, I think it’s well past time for Westerners to take a few lessons from our creditors in the East. Many Americans consider gold a “barbarous relic,” but in Asia, the yellow metal remains the bedrock of individual savings plans. This means that either greater than half of the world’s population are barbarians, or they’ve held onto an important tradition that our culture has forgotten.

Peter Schiff compares the cryptocurrency Bitcoin vs. the precious metal Gold. Which one is the better investment?

For More Information on Investing in Gold

Call 1-888-GOLD-160 (1-888-465-3160)

Talk now to a Precious Metals Specialist who will be happy to answer your questions.

Request a Callback

Click Here and a Specialist will call you back at your convenience.

Chat Online

Click Here to chat with a Specialist right from your web browser.

Summary: In his latest video, Peter Schiff shares his thoughts on the bitcoin mania that is sweeping the world. After rising from less than $20 to more than $600 in one year, many investors are wondering if bitcoin might be worth the risk. Early adopters pitch bitcoin as “gold 2.0” – a digital currency that cannot be manipulated like fiat money. Bitcoins are even “mined,” similar to physical gold and silver. However, Peter explains why bitcoins still fail as a substitute for gold and strongly urges investors to avoid this risky new currency. Bitcoin could very well have already hit its top, but Peter is confident gold is still well below its future record highs.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

It’s starting to feel like we are part of a giant poker game against the US government, whose hand is the true condition of the American economy. The government has become so good at bluffing that most people feel compelled to watch how the biggest players in the game react to determine their own investment strategy.

Unfortunately, this past month revealed that even pros like Goldman Sachs have no idea what sort of hand Washington is really hiding.

This week, Peter Schiff spoke with Gold Silver Worlds about why the collapse of the US dollar is unavoidable and what you can do to protect yourself from it.

What would the dollar be replaced with once it falls? Schiff believes the world cannot use the euro or the yen as the world reserve currency because they are nearly as bad as the dollar. At the end of the day, those are all fiat currencies backed by nothing but promises.

In an interview with The Daily Caller, Peter Schiff shares his views on the debt ceiling agreement, the future of gold and silver, and how indebted individuals can best prepare for the coming economic crisis.

In a new video blog post, Peter Schiff expands at length upon Janet Yellen’s lousy record as an economist. While the media claims that Yellen warned of the housing bubble as early as 2005, Peter reveals that this is a complete whitewash of the truth. Looking directly at Yellen’s own words, he demonstrates that Obama’s nominee for Fed Chairman is likely to bring only more stimulus and inflation while doing nothing to prepare for the real crash.

Janet Yellen is just as clueless as everybody else. In fact, she admitted as much herself. In 2010, when she was testifying before the financial crisis enquiry commission… [Quoting Yellen] ‘I did not see and did not appreciate what the risks were with securitization, the credit ratings agencies, the shadow banking system, the SIV’s – I didn’t see any of that coming until it happened.'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Peter Schiff recently gave an exclusive interview to Commodity HQ, focusing on the great potential silver has in the coming years. Rather than worry about investment products that are backed by physical gold or silver, Peter recommends buying the actual precious metals and storing them in a safe place.

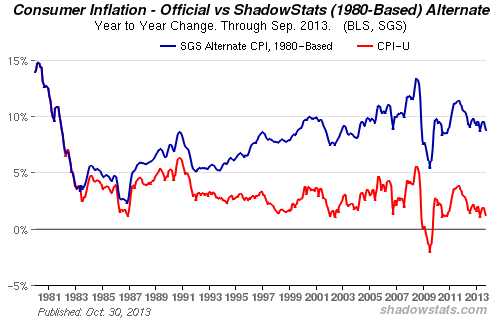

[Investors] should be paying attention to both gold and silver. They are both precious metals and I think they are both going to benefit from the continuous inflation that is being created. This comes primarily from the Federal Reserve, but also from central banks around the world that kind of battle each other in a currency war that is really a race to the bottom to see which country can depreciate their currency the fastest. That is a great environment for alternatives to fiat currencies. Gold and silver have been real money for thousands of years and I think they will be primary beneficiaries of the current round of quantitative easing.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!