By Peter Schiff

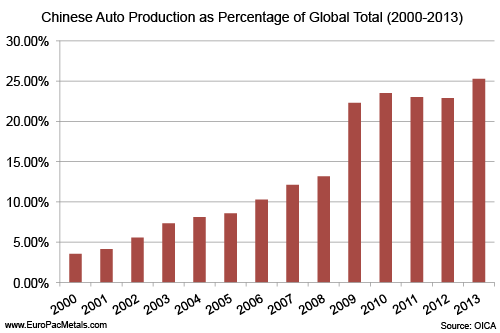

Even investors who typically eschew precious metals have been hard-pressed to ignore the platinum industry this year. The longest strike in South African history paired with surging Asian demand is set to push the metal back into a physical deficit in 2014 – and could have repercussions for years to come. While gold remains the most conservative choice for saving, the “industrial precious metal” platinum is a compelling investment for those, like me, who are bullish on global net economic growth.

By Peter Schiff

We can’t ignore it anymore – the markets are rigged. The LIBOR scandal broke almost two years ago, and the banks found responsible for manipulating that key index are still dealing with lawsuits. Meanwhile, allegations of gold market manipulation have been simmering for over a decade and grew into an inferno after the spot price dropped dramatically last spring.

Yet I’m left wondering what the conspiracy theorists hope to accomplish. Yes, I believe in exposing truth for its own sake and that the individual investor should have the same opportunities in the marketplace as the big institutions. But with these conspiracists, there is often a subtext of, “Because the price is suppressed, buying gold is for suckers.” I think this conclusion is precisely wrong.

By Peter Schiff

So far, 2014 has been a paradoxical year for gold. Many investors aren’t even aware that it has rallied more than 7%. On the rare occasion that the financial media mentions the yellow metal, it is only in the context of comparing the recent rise to last year’s decline.

In spite of this overwhelming negative sentiment, gold is experiencing a stealth rally as one of the best performing assets of the year. Let’s look at some important metrics of the most under-valued sector in this market.

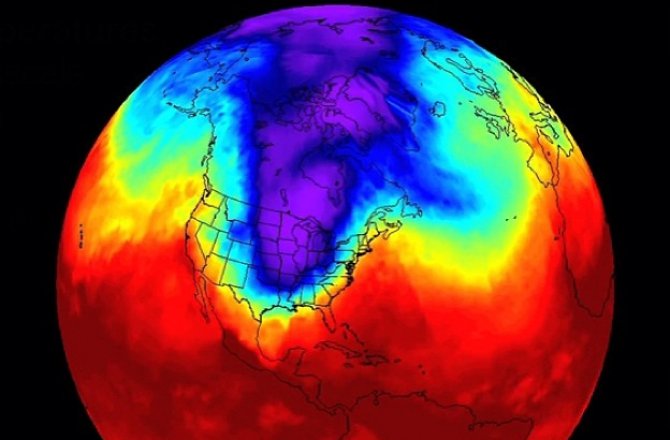

In his latest commentary, Peter Schiff pokes holes in the theory that the polar vortex and exceptionally cold winter is solely responsible for the poor economic data of the past several months. Peter argues that economists and the media are blowing a lot of hot… er, cold air to convince the public that the economy is doing better than it really is.

By Peter Schiff

Before Bear Stearns and Lehman collapsed, the market for physical gold was limited to a relatively small group of investors who understood the havoc inflation was wreaking on our savings and the US markets. As the financial crisis took hold, a flood of new and inexperienced buyers entered the market, creating an opportunity for unscrupulous metals dealers to swindle their way to massive profits. This is what drove me to launch my very own gold dealer, Euro Pacific Precious Metals, to provide a safe alternative for those who were taking my advice to diversify into sound money. In our first year of business, I released Classic Gold Scams and How to Avoid Getting Ripped Off, a free report that has saved countless investors from losing their shirts.

By Peter Schiff

The most puzzling part of the investment business is seeing how the vast and largely economically illiterate masses interpret any given piece of news. Take the recent gold selloff: many large players were motivated to sell by news that Cyprus will have to liquidate its gold stockpiles to pay off acute debt obligations. But just a moment’s reflection shows this reaction to be knee-jerk.

The real story behind Cyprus’ deal has much more profound ramifications – and they are positive for gold.

In his latest video blog post, Peter Schiff analyzes the latest economic data and the overwhelming negative sentiment against gold. Picking apart some anti-gold headlines from Forbes and The Wall Street Journal, Peter counters the gold naysayers and explains why they’re completely misinterpreting the fundamental condition of the US economy.

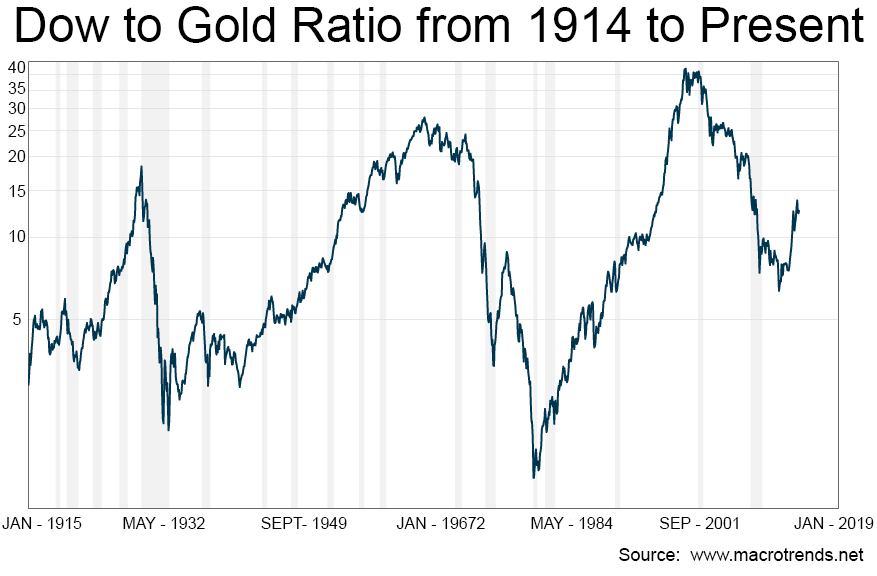

But rather than the price of gold collapsing to meet the expectations of the price of gold stocks, I think the reverse is going to happen… I think the price of gold stocks will soar to catch up to the price of gold… If you look at the price of stocks relative to gold this year, we have resumed our down trend. And so even though the stock market is now heading higher in terms of dollars, it is now headed lower in terms of gold. And that is a trend that I am convinced will continue.”

In his latest video blog post, Peter Schiff looks at last week’s jobs numbers and gold’s rally thus far in 2014. He also comments on Janet Yellen’s press conference and her obvious lies about the effects that Fed policy is having on the economy.

Wall Street is still extremely skeptical of gold’s rally. Everybody expects that this rally is a head fake, that it’s going to reverse, and that gold is still headed much lower in 2014. I think that a lot of people that are anticipating lower gold prices are going to be surprised.”

For More Information on Investing in Gold

Call 1-888-GOLD-160 (1-888-465-3160)

Talk now to a Precious Metals Specialist who will be happy to answer your questions.

Request a Callback

Click Here and a Specialist will call you back at your convenience.

Chat Online

Click Here to chat with a Specialist right from your web browser.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

Gold is the simplest of financial assets – you either own it or you don’t. Yet, at the same time, gold is also among the most private of assets. Once an individual locks his or her safe, that gold effectively disappears from the market at large. Unlike bank deposits or stocks, there is no way to tally the total amount of gold held by individual investors.

I like to call this concept “dark gold.” This is the real, broader gold market that exists below the surface-level transactions on the major exchanges. It’s impossible to know precisely how much dark gold exists around the world, but we do know that it is enough to render “official” gold holdings insignificant. That’s why I don’t buy and sell gold based on the decisions of John Paulson, or even J.P. Morgan Chase. It is a long-term investment that requires a deep understanding of the nature of money – and how little Wall Street’s media circus really matters.

In late December of last year, Peter Schiff and his brother Andrew released a new and expanded version of their illustrated economic fable How an Economy Grows and Why it Crashes. Since the debut of the original version of the book in 2010, people across the world have told them that the book’s simplicity, humor, and straightforward story-telling have given them a better understanding of real economics.