In his latest video, Peter Schiff appeals directly to Swiss voters – send a message to your government and the entire world by passing the “Save Our Swiss Gold” referendum on November 30th. This historic vote would force the Swiss National Bank to:

- Keep 20% of its assets in physical gold bullion (currently less than 8% of its reserves).

- Repatriate all Swiss gold holdings to Switzerland.

- Not sell any more Swiss gold.

Find more information about the initiative here, here, and here. Full transcript below.

On Friday, Peter Schiff reviewed the Halloween stock rally as an effect of the end of the Federal Reserve’s quantitative easing program. He focused on comparing the irrational euphoria of Wall Street to the dismal performance of gold stocks. Gold investors need to remain patient, because eventually the markets will realize that the United States is headed to another recession.

In the latest episode of his podcast, Peter Schiff gives his take on the end of quantitative easing. Peter reviews CNBC’s reaction to the news and Alan Greenspan’s opinion of QE. He also shares his own predictions for the future of the American economy and the price of gold.

In his latest podcast, Peter Schiff takes a look at the most recent earnings reports from Wall Street. Why are McDonald’s, Coca-Cola, and Amazon’s earnings so far off from expectations? If the economy is getting better, surely these companies – companies that are dependent on the prosperity of everyday Americans – would also be experiencing decent profits. Right? Think again. Peter Schiff explains what corporate America can tell us about the real condition of the United States economy.

Peter Schiff has been one of the few voices of reason warning that the Federal Reserve is going to re-start its quantitative easing by mid-2015, as well as keep interest rates at zero until there is a currency crisis. With the recent market turmoil, economists around the world are beginning to realize that Peter is right – more QE is needed. Even St. Louis Federal Reserve Bank President James Bullard says that another round of quantitative easing might be in order. In an interview on Bloomberg, Bullard said:

Is the world waking up to the economic reality Peter Schiff has been warning about all year long? With the current chaos in the stock market and rise in the price of gold, mainstream commentators and economists around the world are starting to wonder if stocks really are in bubble territory. All sorts of technical indicators are driving speculative investors to seek the safe-haven of gold. Take a look at some of these ominous indicators highlighted by the Economic Collapse Blog:

- The S&P 500 and Nasdaq Composite experienced the worst three-day decline since 2011.

- The price of oil is plummeting, which happened just before the 2008 financial crisis. Oil hasn’t been this cheap for two years.

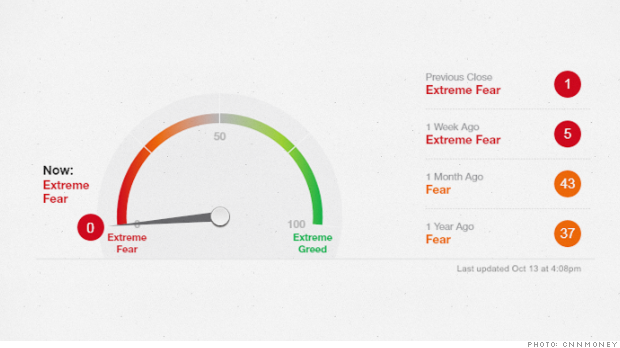

- The Volatility Index (VIX) is at its highest since the European debt crisis, indicating a lots and lots of fear on Wall Street.

Peter Schiff highlights the differences between the Chinese and American economies. More importantly, he explains why China doesn’t want the rest of the world to know how much gold it owns or intends to buy.

Back in September, Peter Schiff was interviewed by Anthony Wile of The Daily Bell. We posted a segment of the interview last week. In this second part, Peter elaborates on the true drivers of the American economy, his strategy for physical precious metals investment, the war on drugs, and the economic troubles of Europe.

Daily Bell: What’s driving the market – fundamentals? We think it’s almost purely monetary policy these days.

Peter Schiff: It’s just cheap money. That’s all that’s driving it. It’s inflation. You can say to some degree it’s about earnings, but earnings are a function of share buybacks. Companies are buying back stock and they only can afford to do that because they can borrow so cheaply, so it’s stock buybacks that are driving earnings from share growth, not topline revenue growth. And of course, the other thing that’s sustaining earnings is that corporate debt service is so low. Despite a record amount of debt on corporate balance sheets, their debt service costs are so low that’s adding to their earnings. That’s the same thing that’s happening with the federal government. Despite the fact that we have a record national debt, the interest payments that we make per year are lower than we made in Ronald Reagan’s presidency, even though the debt was a fraction of its current size and that’s because the carrying costs are so low. I recently completed a 30-page report on this topic called “Taxed By Debt”, with a lot more information than we have time to go into here.

Chris Waltzek invited Peter Schiff onto GoldSeek.com Radio this last week to talk about the rebranding of Euro Pacific Precious Metals to SchiffGold. Peter explains the reasoning behind the brand change and why investors should avoid buying numismatic and collectible precious metals products. He then goes on to discuss his expectations for the US economy for the rest of 2014. He shares his 2014 predictions for the Federal Reserve’s monetary policy, as well as the price of physical gold. Enjoy the audio and full transcript below.

Peter Schiff appeared on Yahoo! Finance yesterday to speak with Jeff Macke about the latest meeting minutes released by the Federal Open Market Committee (FOMC). The Fed has admitted that it does not plan on raising rates soon, officially throwing the United States and the dollar into the arena of the international “currency war.” Read some highlights from the interview below.