Two persistent myths convince gold bears that the price of gold will remain low – a looming series of interest rate hikes from the Federal Reserve and the fact that gold did not rally during the last round of quantitative easing. Peter Schiff explains why both of these myths are ready to die following Friday’s terrible job report. The silver price surged significantly higher on Friday’s news, and Peter thinks it won’t be long before gold also breaks out of its trading range. Investors are quickly running out of time to take advantage of these low prices.

A terrible jobs report was released on Friday, triggering a dramatic day on Wall Street. Peter Schiff reviews the numbers and analyzes the market’s reaction. He also shared some insight into why financial reporters are no longer reporting on the poor manufacturing numbers.

Following up on his recent arguments with Scott Nations on CNBC (watch them here and here), Peter Schiff compiled a new collection of his 2006 warnings of a housing crash. The parallels between then and now are striking. Just as financial news anchors laughed at Peter in 2006 when he predicted what would become the Great Recession, they are now chiding him for suggesting the Federal Reserve is pushing the United States into a new recession.

We argued about interest rates and whether or not the Fed was about to raise them. Scott’s position was that it was a virtual lock that the Federal Reserve was going to raise interest rates before the end of the year. They’d probably go in September, but certainly by December. My position was that the Fed was not going to raise interest rates at all in 2015, and in fact they may actually do quantitative easing 4 in 2016…”

Physical silver and gold isn’t just for preserving your savings. It’s also the world’s oldest form of money.

You can bypass the Federal Reserve’s worthless paper dollars by spending precious metals with friends, neighbors, and businesses which accept sound money. We’ve created a brand new Barter Metals page with all of the information you need to get started conducting business using physical gold and silver – and links to our most popular barterable products.

Barter may seem outdated, but as Peter Schiff points out, it has a long history in the US:

In August, Peter Schiff was a guest speaker at The Jackson Hole Summit, a gathering of free-market activists warning of the dangers of overreaching central banks and irresponsible monetary policies. The Summit coincided with the official central bank conference held every year in Wyoming.

Peter’s speech was titled “Monetary Roach Motel: There Is No Exit from the Fed’s Stimulus”, and he reprised his consistent message of how the Federal Reserve created the economic problems it is pretending to solve. Peter also spent some time exposing Janet Yellen’s terrible track record as an economic forecaster.

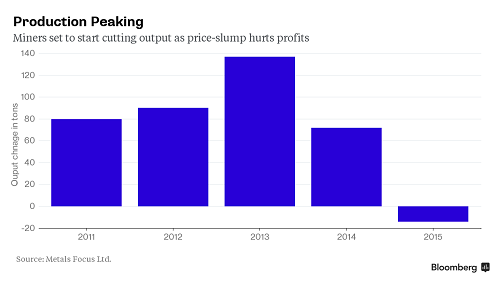

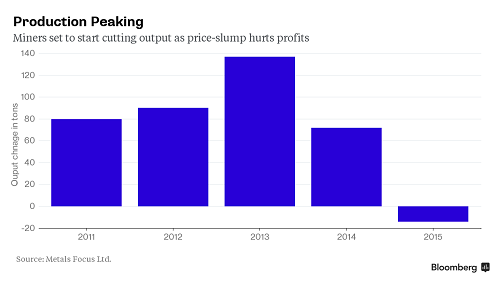

With many mining companies in the red, analysts expect gold production to drop for the first time since 2008.

According to a Bloomberg report, the anticipated drop in production follows a global surge. Gold output jumped 24% in a decade to a record 3,114 metric tons in 2014, according to data from industry researcher GFMS.

Just as Peter Schiff predicted, the Federal Reserve did not raise interest rates yesterday. In fact, in the press conference following the Federal Open Market Committee meeting, Janet Yellen admitted to a reported that it is not impossible that the Fed might hold rates at zero forever.

Peter discusses this news, the movement of the gold price, and the latest economic data in his podcast published yesterday.

Janet Yellen actually believes that if the Fed wanted to keep interest rates at zero forever that they actually could. I’m willing to rule out that possibility. There is no way that interest rates are going to be at zero forever. Not even close. They’re not even going to stay at zero until the end of this decade. There is going to be a currency crisis that forces the Fed to raise rates…”

Peter Schiff reviews the latest economic data ignored by the mainstream media and maintains his forecast that the Federal Reserve will not raise interest rates this week. Peter also explains why mainstream analysts are all wrong, whether they argue for or against a rate hike.

What does the Fed have to hang their hat on? All the economic data is pointing towards a decelerating economy, towards recession. All they can do it point to the jobs numbers and say, ‘Well, but we have a low unemployment rate.’ So what? First of all, employment has already been a lagging, rather than a leading, indicator. Companies don’t lay people off, and then we have a recession. That’s not how it works…”

Here’s another story for the “Peter Schiff was right” archive and another testament to just how clueless mainstream economists can be.

Three years ago, it was already becoming clear that ballooning student debt defaults were becoming a major problem. CNBC reported that the loan “industry underestimated defaults by a whopping $225 billion.” We wrote earlier this week about the latest White House data revealing just how much worse the defaults have become.

In the summer of 2012, Peter appeared on CNBC to debate why the federal government should get out of the student loan business. Diana Carew, an economist with the Progressive Policy Institute (PPI), appeared alongside Peter to defend the need for federal college funding.

You can watch the video below, in which Carew counters Peter’s economic arguments with straw men, suggesting that Peter wants to “get to decide who goes to college.” Carew used the same emotional rhetoric employed by politicians:

In his latest Schiff Report, Peter Schiff tears into the latest non-farm payroll jobs report, which everyone claimed could be the deciding factor for the Federal Reserve to raise interest rates. Peter also discusses the new phenomenon of quantitative tightening, which is the process of foreign central banks selling the US Treasuries they’ve accumulated.

[These countries have already started selling their US Treasuries.] Now you’ve got people in the media who have labeled this ‘quantitative tightening.’ Quantitative easing was when the Fed was reducing the supply of Treasuries by printing money. If foreign central banks are going to be increasing the supply of Treasuries by dumping theirs, how is the US economy going to deal with quantitative tightening? In fact, it can’t.”