Jim Grant agrees with Peter Schiff that the Federal Reserve cannot continue to raise interest rates in 2016. On CNBC today, Grant explained his reasoning for why the Fed will regret raising rates in December and reverse its course of action:

It seems to me that the Fed is more likely to go to zero than to go to one-half of one percent from here. [I think that as the Fed] read the data, it felt it had to move. It had been saying for so long it would, [therefore] it had to, [and] it did. That doesn’t mean it was right to do so in the Fed’s own scheme of things. I think the Fed will regret the move it did in December. I think it will backtrack.”

A recent New York Times feature went to great lengths to promote the idea of a cashless society, focusing on the war on cash in Sweden.

The Nordic country sits on the cutting edge of the movement away from cash. As the Times put it, cash is so “last century”:

Few places are tilting toward a cashless future as quickly as Sweden, which has become hooked on the convenience of paying by app and plastic. This tech-forward country, home to the music streaming service Spotify and the maker of the Candy Crush mobile games, has been lured by the innovations that make digital payments easier. It is also a practical matter, as many of the country’s banks no longer accept or dispense cash.”

Wall Street ended the year on a sour note and wrapped up 2015 down on the year for the first time since 2008.

Peter Schiff believes this is just a sign of things to come. He’s been saying consistently that the December Federal Reserve rate hike was likely a one-time deal with another round of quantitative easing and possibly negative interest rates in the future. Why? Because the data simply doesn’t support the economic optimism the rate hike was supposed to represent.

In episode 127 of his podcast, Peter looks closely at the numbers, and makes the case that despite the Fed’s desperate attempt to tell us otherwise, we are heading toward recession and bursting bubbles.

This following interview with Peter Schiff was originally published at Gold Eagle. Find it here.

Gold-Eagle: Fed Chair Janet Yellen recently hiked interest rates by 0.25%. What impact do you believe this will have upon US stocks and the national economy?

Peter Schiff: The air was already coming out of the bubble prior to this tiny rate hike. But now that the hole has been made larger by the hike, the air will rush out that much faster. The key is how much longer the Fed will wait before admitting that the economy is much weaker than they believed and reverse course.

Gold-Eagle: The last time the Fed increased the Federal Funds Rate was nine years ago in June 2006. In your view, do you believe the Fed will continue raising rates in 2016 with the objective of increasing inflation to stimulate economic growth?

Hindsight is supposed to be 20-20, but for some people it seems like it’s blind.

We’re approaching a decade since the housing bubble burst, plunging the US economy into the worst crisis since the great depression. Still, defenders of big government and central planning continue efforts to sell the myth that the meltdown was caused by “deregulation” and insufficient government oversight of greedy Wall Street types. This includes a lot of people who should know better, including New York Times columnist Paul Krugman.

In a recent column, Krugman once again dragged out the deregulation myth, claiming “the bubble whose existence they denied really was inflated largely via opaque financial schemes that in many cases amounted to outright fraud — and it is an outrage that basically nobody ended up being punished for those sins aside from innocent bystanders, namely the millions of workers who lost their jobs and the millions of families that lost their homes.”

Peter Schiff has been saying that the December Federal Reserve interest rate hike is likely a one-and-done deal, with rates going back to zero or lower, and another round of quantitative easing in the cards for 2016. Peter insists that the US economy isn’t in good shape, and it can’t even sustain the recent small rate hike, much less the series of increases promised by the Fed.

Another bit of news came out this week that seems to further reinforce Peter’s position.

This article was written by Stefan Gleason and originally published at the Tenth Amendment Center. Find it here.

Is America on the cusp of a revolution that will usher in a new monetary order? The lessons of history tell us that no fiat currency retains its value for long or lasts forever. And as Shakespeare noted, “what’s past is prologue.”

Major episodes in monetary history often stem from political revolutions. Just as there are boom-bust economic cycles, there are cycles of optimism pessimism that drive cultural, geopolitical, and war cycles. American history reflects the ebbs and flows in social sentiment.

The Founders wrote gold and silver into the Constitution as legal tender. They did so not because the American Revolution was financed with sound money – quite the opposite. The Founders were keenly aware of the dangers of unbacked paper money because the Continental Congress printed huge volumes of it to pay for the Revolutionary war.

If you want to see the value of gold in a currency crisis, just look north.

When people tell you “gold is down,” you should always ask an important question: compared to what? If you bought gold in Canadian dollars (CAD) last year, you’re probably pretty happy. Gold is up 7.9% in the Great White North, and 17% over two years. Even if you bought gold in Canadian dollars five years ago, things still look pretty good. The price is up a healthy 5.8%.

We tend to talk about everything in terms of dollars, but the USD is not the only game in town. And the bullish market for gold when looking at it in Canadian dollars reveals the yellow metals intrinsic value. It historically protects wealth during a currency crisis.

The recent Federal Reserve rate hike was supposed to assure us that the US economy is improving. But as we’ve shown, the actual economic data just doesn’t back up the optimism. At best, the economy remains tepid, and Peter Schiff has argued that it is likely heading toward another recession. As a result, Peter doesn’t believe the rate hike will stick, and a lot of mainstream economists agree.

Now we have fresh evidence of another millstone hanging around the economy’s neck that doesn’t bode well for Fed policymakers – Obamacare.

According to a new study, the national health insurance program is taking a big bite out of customers’ wallets. It appears the so-called Affordable Care Act is anything but affordable. CNBC summarized the study’s findings this way:

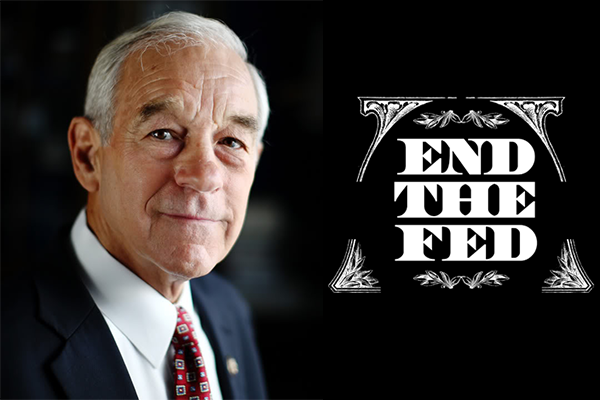

This article was written by Ron Paul and originally published at the Ron Paul Institute for Peace and Prosperity. Find it here.

Stocks rose [last] Wednesday following the Federal Reserve’s announcement of the first interest rate increase since 2006. However, stocks fell just two days later. One reason the positive reaction to the Fed’s announcement did not last long is that the Fed seems to lack confidence in the economy and is unsure what policies it should adopt in the future.