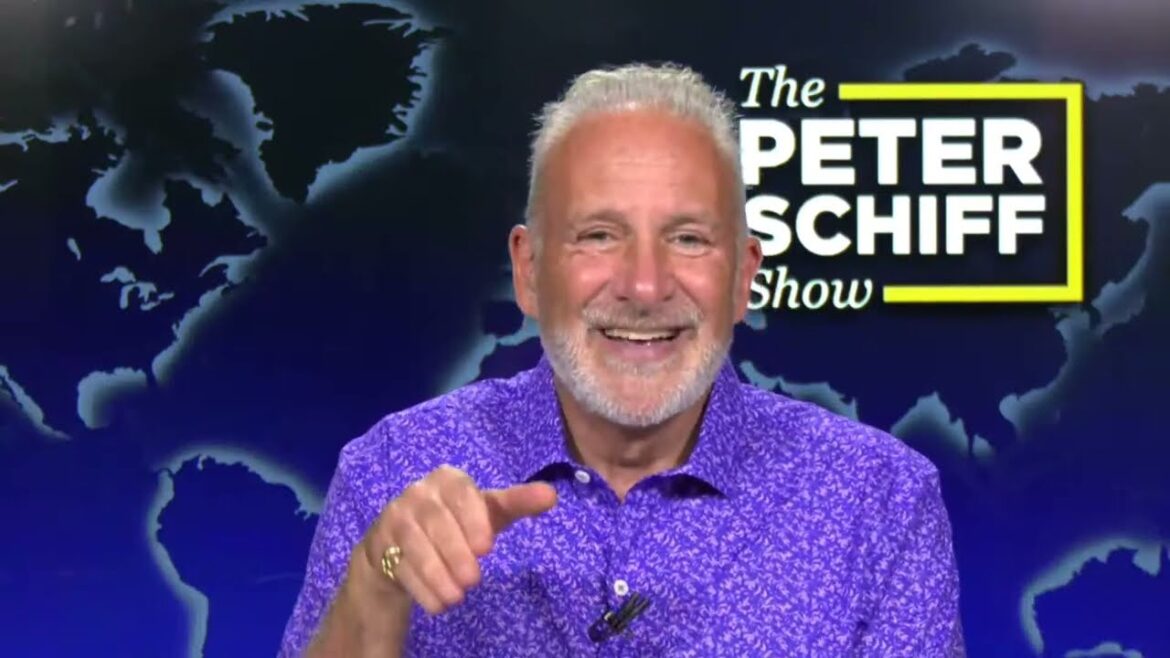

This week Peter recaps another stellar week for precious metal. He also discusses Friday’s jobs report, commodity prices, and Bitcoin.

As the Democratic Party has shifted away from its traditional base of working-class and middle-class Americans, to an increased reliance on college professors, students, and highly educated but low-paid professions, such as social workers, a new policy has risen to prominence: student loan forgiveness.

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy of enduring economic turmoil that still plagues America today.

JD and Joel discuss gold’s new record high and silver’s tear upwards, an earthquake in NYC, headline jobs numbers, and Peter’s most recent podcast.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

This week Peter returned from vacation, and he was just in time for a surge in the price of gold. He discusses the factors contributing to gold’s record prices, the similarities between today and the 1970s, and data pointing to future inflation in America.

Even the mainstream is starting to acknowledge the massive problem of vacant office buildings littering American cities, slowly turning them into post-Covid wastelands. While a few pundits are claiming (in somewhat Orwellian fashion) that the surge in empty commercial real estate is actually a chance for a utopian turnaround in the ashes of Covid weirdness, the potential for an “Urban Doop Loop” triggered by CRE is now being widely acknowledged as a possible trigger for a broader economic meltdown.

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play “an important role in fomenting the popular tendencies toward inflationism.”