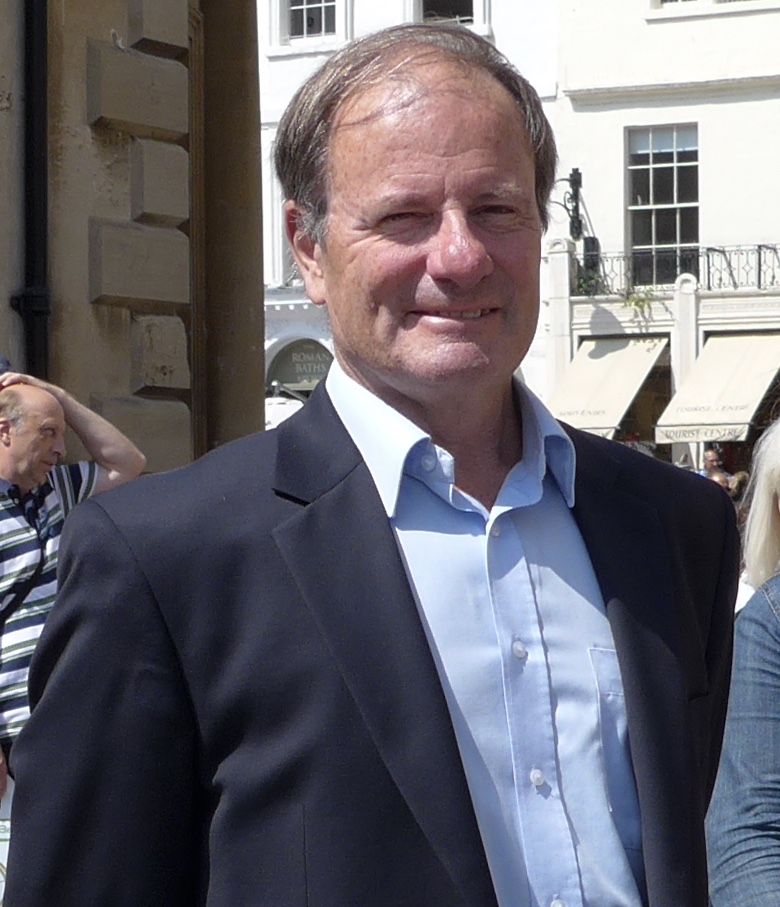

Alasdair Macleod has over 40 years’ experience in fund management, corporate finance and investment strategy. He believes government monetary policies are the biggest threat to our financial savings and independence. As head of Research at Goldmoney, Alasdair helps everyday consumers understand the benefits of using gold as both money and a store of value.

Alasdair Macleod has over 40 years’ experience in fund management, corporate finance and investment strategy. He believes government monetary policies are the biggest threat to our financial savings and independence. As head of Research at Goldmoney, Alasdair helps everyday consumers understand the benefits of using gold as both money and a store of value.

We are all too aware of monetary policy and its objectives of targeting both moderate inflation and full employment at the same time. We are of course talking about price inflation, monetary inflation being the means of achieving the objective.

Central bankers don’t seem to understand that these objectives are incompatible, and here’s why. When you expand the quantity of money or credit, you debase the savings and wages of everyone, with two general exceptions. If the Fed expands the quantity of cash, or narrow money, the banks benefit, and in all likelihood they pass this benefit on to the government by spending it on new government debt. If the banks expand the quantity of bank credit, they benefit their favorite customers, who are usually big business. To believe otherwise is to subscribe to a law of financial perpetual motion, which is simply impossible.

In his latest podcast, Peter reports on the week’s economic numbers and takes the popular media to task for helping Hillary Clinton secure the presidency. Biased reports are showing Obama as a “deficit-reducing miracle worker,” while the debt-to-GDP has never been higher under his presidency.

“The media is constantly going to try to redefine a failed presidency as a success. One of the reasons they want to do that right now is they want that ‘success’ to rub off on Hilary Clinton … The media doesn’t even want to talk about the economy any more. If this election was about the economy, Trump would win. The only chance they have is to make the election about something else.”

That “something else,” of course, is Trump’s salacious comments and the sudden sexual harassment accusations that are coming out of the woodwork.

Despite the recent slump in gold prices, many influential analysts like Raoul Pal and firms like UBS are predicting a strong showing for gold in the next 12 months. Their beliefs are based on strong indicators of a looming recession, negative interest rates, and a downshift in global trade.

Full-time work is being replaced by multiple part-time jobs for Americans, and many indicators are flashing early warning signs for an imminent recession. Learn more in this week’s Fed Up Friday.

Part-Time Jobs Soar, Indicating Most Multiple Jobholders Since 2008

In numbers not seen since the financial crisis of August 2008, the number of multiple jobholders in the U.S. increased to nearly 8 million this past month. Additionally, the number of part-time jobs added was close to 500,000.This data must be taken into account when referencing “job growth” numbers that the Fed highlights as good data to inform their decisions. When someone who used to have a single, stable job is now working two different roles just to make ends meet, that isn’t a healthy economy. Unfortunately, it doubles the amount of “jobs” we added to the workforce, but they aren’t the jobs we want to see.

Late last week the Non-Farm Payroll Report was released. Peter Schiff laid out the details of the official scorecard on U.S. job creation and unemployment in his latest podcast. The big story of the reported “employment gains” is that they lump full- and part-time jobs together. They aren’t taking into account that when someone loses a full-time position in a field like manufacturing, they often have to get two, maybe even three part-time jobs to fill the financial void left over from a layoff.

As Peter Schiff explains, the quality of jobs added is more important than the gross number of jobs added. And by all accounts, the September report is bad news. Peter goes on to discuss a recent CNBC interview with Alan Greenspan, where he talked about the current stagflationary environment of the U.S. with slow economic growth and elevated inflation. That is the best possible environment for investing in gold and silver, and it’s only a matter of time before others wake up to the fact that Greenspan is hitting the nail on the head.

The basic definition of an interest rate is simply the cost of borrowing money. It’s the cost associated with acquiring credit, whether buying a car, getting a mortgage, or taking a vacation. We encounter interest rates every time we make a monthly credit card or student loan payment. Interest and interest rates are a major part of daily life, yet many people don’t have a good understanding of the most critical types of interest or how their rates are set. Broadening our understanding even a little can help empower us to make more informed decisions, whether at the bank or at the ballot box.

In a recent article on the next looming recession, Peter Schiff explains how current monetary policy has come to a crossroads. With respect to interest rates, there now seems to be two entrenched camps: raise or don’t raise. Unfortunately, they’re both wrong, mainly because they’re beginning with the wrong premise: that the economy can somehow avoid the painful process of market correction that raising rates would inevitably bring. Peter explains:

“The real choice is not between recession now or recession later. It’s between a massive recession now, or an even more devastating one later … Now is the time to bite the bullet, endure the pain, and allow the wound to actually heal.”

A wilting, stifled economy is the story this week with the Fed. They’re trapped, unable to bolster the economy and they have no ammo to halt inflation.

Fed President Lacker Urging Preemptive Rate Increases

Regular Fed dissenter Jeffrey Lacker said this week he sees even bigger rate increases coming in if the Fed doesn’t start gradually tightening as soon as possible. His remarks sent precious metals tumbling. In his latest podcast, Peter Schiff discusses why the Fed can’t accomplish Lackers’ plan: “We have so much debt that if we try and fight inflation we’re going to have a worse financial crisis than 2008,” Peter said. “Because it can’t fight inflation, the Fed pretends it can do it.”

In his 200th podcast, Peter Schiff explains the ineffectual outcomes of Richmond Federal Reserve President Jeffrey Lacker’s call for “preemptive” interest rate action. Lacker said he believes the Fed should anticipate a rise in inflation levels by getting ahead of the curve. The suggestion only makes sense to those who can’t see the artificially inflated bubble economy the Fed has been creating for years.

Whether the Fed raises rates in December or not, it won’t solve our economic woes. Only a recession will bring the cure. Tough love, not economic coddling, is what’s needed, but current monetary policy continues to pump the economy full of temporary pain meds instead of helping us through the withdrawals.

There are currently about 54 million millennials entering the workforce in the US, and for many of them, the idea of buying a home isn’t an immediate goal. That’s because the majority (70%) are under an enormous amount of student debt. Large school loans are motivating many millennials to put off their first home purchase until they pay down some or all of their education expenses. The delay is having an immediate impact on the housing markets.