As we head into the month of October, it’s interesting to note that two of the worst stock market crashes in history during this month. Of course, we had the 1929 Wall Street crash that kicked off the Great Depression, and there was also the Black Monday stock market crash in 1987.

As Peter Schiff noted in his latest podcast, given that stock market valuations are higher today then they were at those prior peaks, you would think there would be more concern about the possibility of another October surprise. But there seems to be very little worry out there. Nevertheless, Peter raised an interesting question, could the twin deficits in trade and the federal budget portend another October crash?

In an article we published last week, Peter Schmidt highlighted what he called the “fatal conceit” of modern Keynesian economics. These economists, central bankers and politicians think they can plan, direct and guide the economy through their great wisdom and application of their economic models. But as economist Friedrich Hayek explained, the central planners’ arrogance ignores the knowledge problem. No individuals or groups of individuals, no matter how many PhDs they have among them, possesses the knowledge necessary to foresee all of the consequences of a given policy.

As financial guru Jim Grant once put it, “We are the prisoners of the very dubious set of pseudo-scientific pretentions that are part of the people who manage our monetary affairs.”

In a follow up to his last article, Schmidt puts an exclamation point on this idea of fatal conceit, recounting the maneuverings of Benjamin Strong, New York Federal Reserve governor from 1914-1928.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

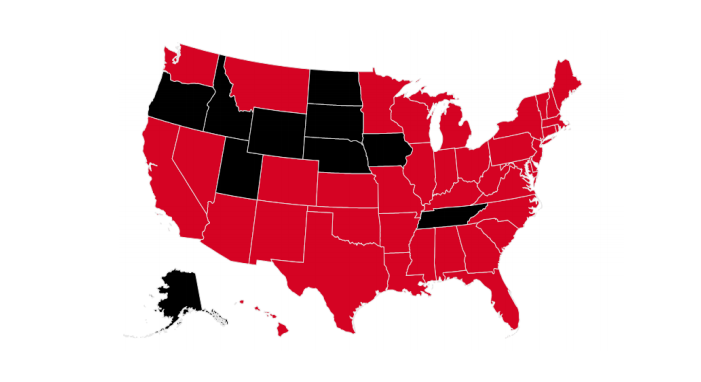

The federal government isn’t alone drowning in debt. Most US states don’t have enough money to pay their bills either.

That was the conclusion of the Truth in Accounting annual State of the States 2018 report. According to the report, American states have racked up $1.5 trillion dollars in unfunded state debt. Much of the red ink is related to pension plans and retiree benefits

As expected, the Federal Reserve nudged interest rates up another 25 basis points Wednesday. The federal funds rate now stands at 2.25%.

The Fed offered up a rosy outlook for the US economy, projecting growth will continue for the next three years. The central bank also dropped the phrase, “the stance of monetary policy remains accommodative” from its statement. As an analyst told Reuters, “It does seem to potentially indicate they believe monetary policy is becoming less accommodative and getting more toward that neutral rate.”

The Indonesian stock market has plunged nearly 7% this year. The country’s currency, the rupiah, has fallen 9%, and is at its weakest level since the 1998 Asian financial crisis. Bond yield have soared. To weather the storm, Indonesians are buying gold.

In a recent podcast, Peter Schiff talked about the “Trump tariff put” – this idea that the president will be able to call off the trade war to rescue the market should it start to fall. Peter called that idea nonsense.

It is the type of wishful thinking, the type of just ignoring all of the bad news, whistling past the graveyard, the type of mentality that you have in a bull market where everything is good news and there is nothing to worry about.”

In his most recent podcast, Peter tackled another similar myth – that a divided government will be bullish for the market.

Apparently, the American consumer has bought into the notion that everything is great in the economy. Consumer confidence surged to an 18-year high this month and is close to the all-time record.

The Conference Board Consumer Confidence Index jumped to 138.4, up from 134.7. Analysts expected a dip.

A recent Paul Krugman New York Times column praised the success of the Keynesian macro model in the wake of the 2008 financial crisis. In his view, the Federal Reserve did exactly what was necessary – pushed interest rates to zero and launched rounds of quantitative easing to jumpstart demand. As Tom Woods and Bob Murphy put it in a recent episode of the Contra Krugman podcast, “we agree that Krugman’s model did great…if we overlook all the times it blew up in his face.”

As is typical of Keynesians, Krugman ignores the side-effects of Federal Reserve policy. It works for a while, but it perpetuates the boom-bust business cycle. Sure, the economy today seems to be booming, but there is a rotten underbelly that most everybody in the mainstream seems to be ignoring. Peter Schmidt offers a succinct breakdown of Keynesian-based Fed policy and reveals why its doomed to failure.

The EU has announced it will create a special payment channel to circumvent US economic sanctions and facilitate trade with Iran.

Last month, German foreign minister Heiko Maas called for the creation of a new payments system independent of the United States. The announcement Monday sets that plan in motion.