This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Today marks silver’s ninth consecutive week of higher nominal prices. Short coverings from yesterday’s rally is the reason behind silver’s higher price today. Commodity traders have been looking at the chart below and deeming silver as overbought. This is seen in the large short interest for silver, meaning traders are betting against silver’s price by shorting the market. Across silver futures, ETF’s, and OTC markets, there has been an increase in short positions.

This article is a comprehensive breakdown on SchiffGold’s most bought/sold silver products. I give my personal comments on each product and I give a brief final analysis to help buyers pinpoint the exact product that meets their goals and objectives.

Additionally, I wrote this for buyers seeking to take delivery or possession within the United States. International markets value some products differently. For clients seeking international silver holdings I recommend talking to your precious metals specialist.

One of the wisest questions any potential buyer can ask before they purchase an asset is, “How much would I receive if I sold this asset or product today?” In other words, “What is the bid on this asset?” Answering this one question alone can save an individual from making a foolish purchase.

Wise buyers understand the fundamental dynamics of the market. They are aware there is no single price for any product or asset. Instead, there is an “ask” price and a “bid” price.

The “ask price” (aka the “offer”) is the lowest price a prospective seller is willing to accept. The bid price is less intuitive. The bid is the highest price a prospective buyer is willing to pay for a product or asset.

Dealers create a market by simultaneously acting as sellers and buyers. Dealers earn a profit via buying an asset at the bid price and selling at the ask price.

Here is an example of a dealer quoting the bid and ask price for a contract of the Dow Jones Industrial Average also called “the Dow”:

From the gold and silver in Solomon’s temple to heaven’s streets of pure gold, there are more than 700 references to these two precious metals in the Bible. As relevant and desired as gold and silver are today throughout most cultures, they have a much older and timeless context within the Bible. When examining scripture, a reader can draw three critical characteristics about gold and silver: their divine origin, intrinsic value, and monetary quality.

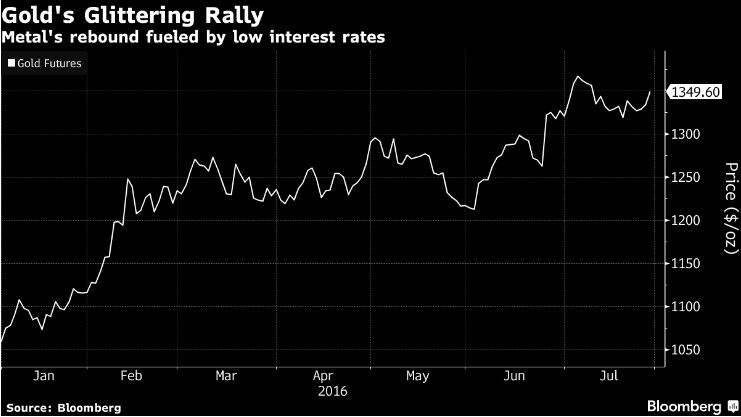

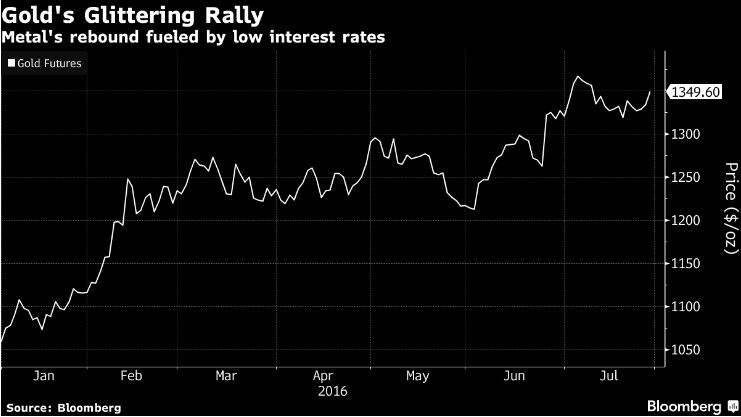

It seems at least once a week, a Fed official is coming out of the woodwork to suggest the “possibility” of a September rate hike. Right now, investors are nearly split over whether or not that is likely to happen. What’s really prompting this more aggressive posture by the Fed? In his latest podcast, Peter Schiff looks at the real motives behind the faux-hawkish statements from the Federal Reserve.

Basically, it comes down to a bait-and-switch move by the Fed to create some wiggle room for actually doing nothing. Here’s an analogy: a fish monger tells his customers, “It’s possible I will raise the price of fish.” Since he’s created the idea that a price increase is possible, he can now tell my customers, “I’ve decided NOT to raise prices.” The fish seller wants his customers to appreciate how “inexpensive” the current price is. They will now feel as if they’ve gotten something (“inexpensive” fish) when in reality nothing has changed.

Unlike re-printable fiat currency, gold is money because there is a finite amount of it. The Fed can’t produce more gold whenever it wants. For this reason, gold has functioned as a barter and wealth preservation system for thousands of years. But how much gold is left in the earth? What will happen to the price when exploration stops or is limited?

The Bureau of Economic Analysis (BEA) released its estimate for the second quarter of 2016. After a weak showing in the first quarter, many pundits predicted strong economic growth for April, May, and June. However, the reality was a modest 1.2% growth to GDP. In this month’s Schiff Report, Peter explains how these numbers could affect gold stocks and precious metals.

Toronto-Dominion Bank’s chief investment officer, Bruce Cooper, is changing the firm’s outlook to conserve capital by moving funds heavily into gold. According to Bloomberg, TD Bank oversees more than $230 billion in assets, and has “shifted to a ‘maximum overweight’ in gold for its portfolios.” Cooper oversees TD Asset Management, the investment arm of Canada’s second-largest lender.

So, what’s caused Cooper’s course change? The usual suspects: a sluggish global economy, the Brexit vote, central banking policies, and the upcoming US presidential election. All have contributed to TD’s overall feeling of uncertainty.

Within TD’s portfolio, gold promotes “diversification, stability and protecting against deflation more than returns,” Cooper said. “Job one today is about capital preservation. It’s not about shooting the lights out.”

For Cooper, gold investment is about playing it smart, not about being a doom and gloomer. “We’re cautious but not negative. This is not about canned goods and getting in the bunker,” he said.

The former Fed Chairman Alan Greenspan appeared on Bloomberg last week to discuss the state of the US economy. He noted some economic indicators like bond yield spreads, rising entitlement costs, and stagflation, which are sending the US economy over the tipping point. What worries Greenspan the most is an environment of uncertainty that’s taken hold.

For example, Greenspan noted the spread between the 5 and 30-year treasury bonds is at its “widest level in American history.”

When central bankers talk about gold, it’s usually with an attitude of disdain. So, why do they hate gold so much?

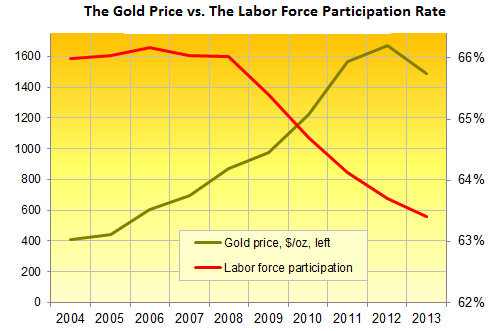

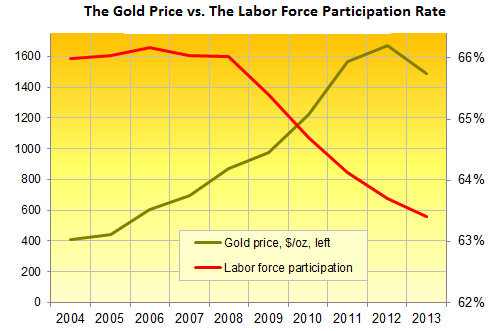

The Federal Reserve operates under a dual mandate. It must maintain price stability while also simultaneously promoting maximum employment.

The Fed hates it when the price of gold rises because it correlates with a rising unemployment rate.

Gold also reveals the weakness in the US dollar and the Fed’s failure to stabilize prices. For this reason a rising gold price is an embarrassment to the Federal Reserve as it undermines its purposes.