To hike or not to hike? That is the question.

Indeed, that has been the question for what seems like an eternity. But the question of whether or not the Federal Reserve is going to raise interest rates in December misses the point. The truth is, the Federal Reserve is damned if it does and damned if it doesn’t.

The “rate hike hype” began nearly three years ago. We’ve experienced almost 36 months of wishy washy, back and forth, pseudo-scientific attempts to decipher increasingly vague and non-conclusive Fed minutes as to when, how much, and what kind of rate hike we can expect.

You don’t have to be a professional economist to recognize the Fed policy as a stall tactic. Peter Schiff has called them out on this point time and again, showing that if they really wanted to raise rates, they would have done so by now.

With gold’s recent volatility and price drop, we’ve heard a lot of noise from pundits and analysts. Consequently, this seems like a great time to ask certain basic questions about this oft misunderstood market. For example, just how big is the gold market? Where does gold fit into the modern financial landscape? Why does gold still matter today?

To start, let’s consider the size of the global market for gold.

The month of July has seen the most intense demand for physical gold and silver since April of 2013, setting numerous records for the year. On the heels of the spectacular drop in spot prices, buyers of physical metal have come out in droves. In fact, available supply is hardly able to keep up with the demand for immediate delivery of metals.

This betrays a fundamental reality about the market for physical gold and silver bullion that many investors – even regular buyers of bullion – are not aware of. There simply is not much supply available at any given time. In other words, gold and silver products spend very little time sitting on the shelf waiting to get bought, making inventory very tight. As such, in times of intense demand, the entire available supply can be bought up in a matter of weeks, or even days. This results in higher product premiums and extended shipping times.

This is exactly where the market is for physical metals is right now. Consider what has happened in just the last couple of weeks.

After Federal Reserve Chairwoman Janet Yellen’s congressional testimony, the markets are still convinced the Fed could begin to raise rates sometime this summer. This is just plain wishful thinking. The Fed can no more raise rates than it can borrow money into oblivion. The reason is simple: the Fed must maintain the pretense of being solvent to maintain its credibility as a financial institution.

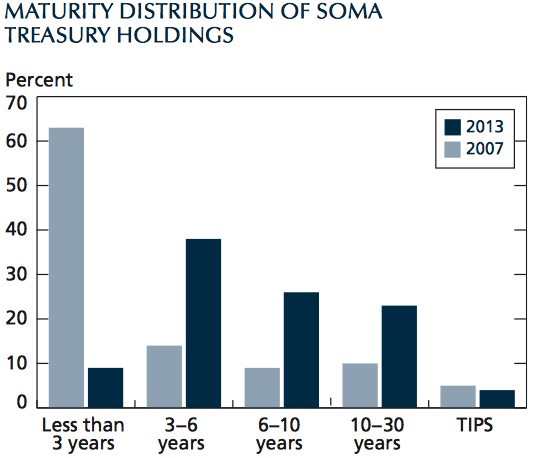

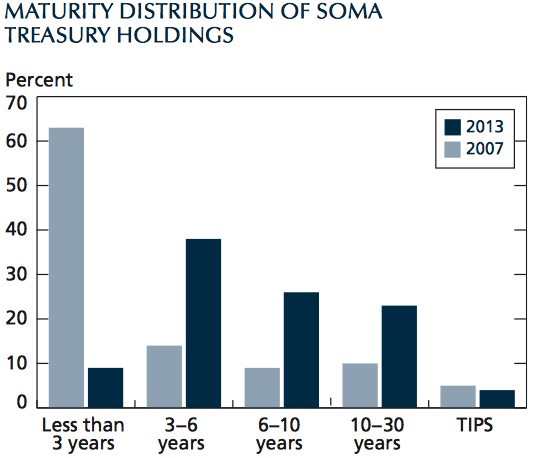

Think about the balance sheet of the Fed. Its assets are a mixture of government bonds, Treasury notes, and mortgage-backed securities. The dollars that the Fed issues to purchase those assets are its corresponding liability. Needless to say, it has purchased a lot of bonds since 2008 (QE1, QE2, QE3). So since 2008, its balance sheet has expanded on both sides.

This isn’t yet a problem, because of the duration of its assets and liabilities. Most of its assets – the bonds and mortgage debt – are long-term, with a rough average duration of over 10 years. Meanwhile, its liabilities are all short-term, current liabilities. These are deposited at the Fed by various banks, and the banks can demand them at any time.

“The greatest problem facing the world today is monetary,” began The Gold Standard Institute’s founder Keith Weiner in his opening remarks at the New York City conference. Having successfully made the transition from technology entrepreneur to world-class monetary economist, Keith walked us through his business plan for the Gold Standard Institute (GSI). An advocate of what he calls the “unadulterated gold standard,” Keith gave a detailed presentation of the reasons why the gold standard is not only superior to the present fiat system but is also urgently necessary for today. Throughout his talk, several thought-provoking issues were raised that differentiated GSI from other sound money advocates.