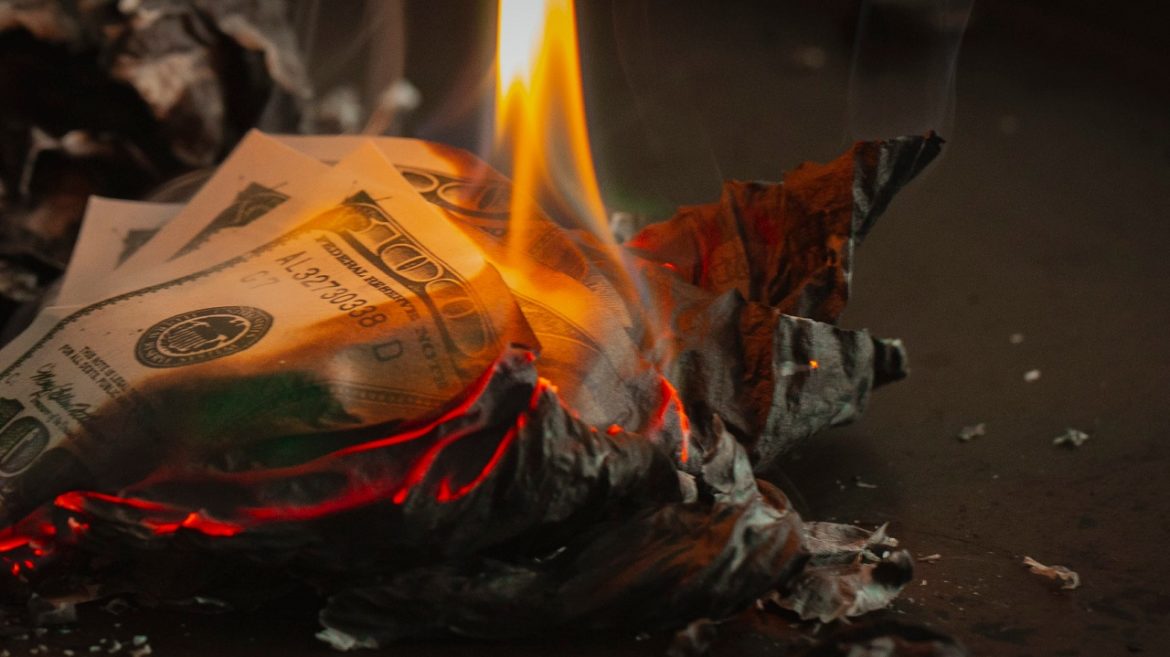

It’s become increasingly hard to hide the inflation problem. Even without the sizzling hot CPI numbers, the average American experiences rising prices every day at the grocery store and the gas station.

With it becoming harder and harder to blow inflation off as transitory, apologists for the central bank and the federal government have shifted to a new strategy — try to convince you that inflation is good for you.

Last Friday was Black Friday and it was a black and blue Friday for investors. Just about everything was down and markets panicked over a new COVID variant. Peter Schiff talked about the market reaction in his podcast. Did the markets overreact? And what would happen if we did go into another global lockdown?

The Dow suffered its worse day since April 2020, the height of COVID lockdowns.

The Fed added $82 billion in Mortgage-Backed Securities (MBS) and $65 billion in Treasuries to its balance sheet while allowing $22 billion in repo agreements to roll off the balance sheet. The net gain was $126 billion in the month that the “taper” was set to begin.

So, did you hit the Black Friday sales Friday morning?

That’s an emphatic “No!” for me. You’d have to just about give away stuff for free to lure me out on Black Friday. No thanks. Too peoplely!

Earlier this week, President Joe Biden announced Jerome Powell will serve a second term as chair of the Federal Reserve. In effect, Biden stuck with the status quo. But the markets reacted as if big changes are afoot. Gold sold off hard, falling back below $1,800 an ounce. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about Powell’s appointment and the market’s reaction to it.

When I was a kid, we used to say some things only “sound good on paper.” In other words, they seem like good plans, but there is no way they’re going to work in the real world.

That’s socialism in a nutshell.

The Pilgrims found this out the hard way during their first couple of years in North America.

With several days to go in the month, the number of silver contracts taken for immediate delivery at the Comex already stands at 741, more than double the total in November 2020. That raises two big questions: who is taking delivery of all this metal mid-month? And more importantly, what are they anticipating?

This analysis focuses on gold and silver physical delivery on the Comex. See the article What is the Comex for more detail.

So much for fighting inflation.

Despite the Fed’s announcement that quantitative easing tapering would begin this month, money supply growth appears to be accelerating.

In the latest period, M2 increased by $193 billion, eclipsing the $21 trillion mark. This represents a 0.91% month-on-month increase. That annualizes to 11.6%. This is above the six-month average indicating money supply growth is accelerating.

I would probably have a hard time convincing you that the higher prices you’re paying at the grocery store and the gas pump are “good for you.” But there are people out there making that claim.

On Monday, President Joe Biden reappointed Jerome Powell to head up the Federal Reserve and nominated Lael Brainard to serve as the vice-chair. In his podcast, Peter Schiff talked about Biden’s decision, the markets’ reaction and what the Fed will (or will not) do moving forward. Ultimately, Peter said the devil you know is still a devil.