The World Is Awash in Record Levels of Quantitative Easing

The Federal Reserve stayed pat on interest rates in its most recent meeting, but speculation continues to percolate that the central bank will possibly raise rates in September.

Peter Schiff has been saying for months that the Fed won’t raise rates. He reiterated this on his most recent podcast. (Scroll down to listen to the full podcast.)

The Fed continued to say that they believe the economy is evolving in a way that will warrant gradual rate hikes. And of course, by gradual they mean no more rate hikes…So they raised rates once in December and they haven’t raised rates since. That’s about as gradual as you can possibly get. I mean, if a snail was raising rates they would have blown past Janet Yellen…I think, again, the rate-hiking cycle ended when they raised rates. It began when they started talking about tapering. That was the whole rate cycle, and whether people want to admit it or not, we are now in the easing cycle.”

In fact, Peter has said on numerous occasions the next move for the Fed will be lowering rates back to zero and launching another round of quantitative easing.

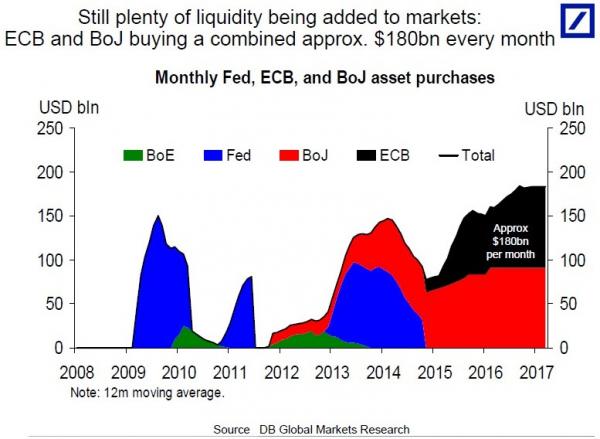

If the actions of central banks in the rest of the world serve as any example, Peter will certainly be proven right because the world is awash in QE. In fact, Reuters reported that the amount of quantitative easing is at record levels:

Eight years after the global financial crisis and years after the US and British central banks stopped their quantitative easing bond-buying programs; the amount of QE stimulus being pumped into the world financial system has never been higher. The European Central Bank and Bank of Japan are buying around $180 billion of assets a month, according to Deutsche Bank, a larger global total than at any point since 2009, even when the Federal Reserve’s QE program was in full flow.”

And amount of QE is expected to increase even further.

All of this extreme central bank monetary policy is one of many reasons to buy gold. Download SchiffGold’s Free White Paper: Why Buy Gold Now?

ABN Amro analysts expect the European Central Bank to increase quantitative easing to 100 billion euros per month and extend the program by nine months to the end of 2017. JP Morgan predicts the BOJ will up its QE by 25% to $960 billion annually. Just yesterday, Japanese Prime Minister Shinzo Abe announced a $265 billion economic stimulus package. The plan will reportedly include 13 trillion yen in “fiscal measures.

The ECB and BOJ aren’t the only central banks jumping the QE train. With Brexit a reality, many analysts also expect the Bank of England to resume its bond-buying program. Barclays projects up to $197 billion in extra easing. As Reuters pointed out, the global economic outlook doesn’t show any signs of improving and that means QE will likely continue indefinitely:

These are among the most aggressive forecasts. But with world growth struggling to avoid an effective recession and inflation still below official target rates in many countries, central bank balance sheets are about to get bigger.”

ZeroHedge put it more bluntly:

The monetary policy beatings will continue until morale improves.”

It seems highly unlikely the Fed will swim against the swift-running QE river and actually raise rates. Peter’s projections appear a whole lot more realistic.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply