Will You Ever Retire? Many Americans Won’t

Will you ever retire?

More and more Americans will not.

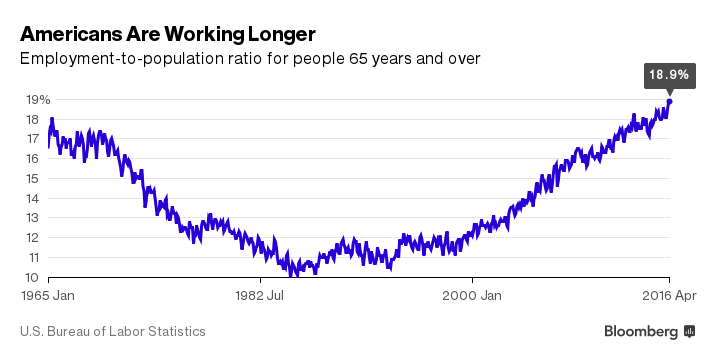

According to the latest data from the US Bureau of Labor Statistics, almost 20% of Americans 65 and older are still working. That’s the largest percentage of older Americans on the job since the early 1960s. With Baby Boomers hitting retirement age, it’s the largest number of Americans over 65 working ever.

Surveys indicate a growing number of people plan to continue working past retirement. The number of Americans who said they intend to continue working “as long as possible” came in at 27%. A full 12% said they don’t plan to retire at all.

There are a number of factors keeping older Americans in the workforce. They are living longer and maintaining their health, giving them the option to continue working if they want to. Some say they simply like their jobs. And a number of people surveyed said retirement just isn’t that much fun.

But according to Bloomberg, the biggest factor keeping retirement-age Americans in the workforce is that they need the money:

Three in five retirees surveyed by the Transamerica Center for Retirement Studies said making money or earning benefits was at least one reason they had retired later than they planned to. Almost half said financial problems were their main reason for working past 65. The financial crisis, and the tech bust before it, devastated many baby boomers’ retirement savings. That’s if they had any to begin with. Today, 60% of US households have no money in a 401(k) or similar retirement account, and the benefits of 401(k)s are skewed toward the wealthiest Americans, a recent report by the Government Accountability Office found.”

Download SchiffGold’s Free Report: The Powerful Case For Silver

Considering the current economic situation, the number of people unable to retire may well swell further in the future. The stock market is a giant bubble right now, just waiting for something to prick it. As we reported earlier this spring, 93% of the stock market gains since the last crash are the result of Federal Reserve monetary policy. As a result, we have a fake wealth effect. Peter Schiff made this point in an interview on CNBC earlier this year:

I think the volatility in the markets has been created by the Fed. The Federal Reserve is the reason the market is so high in the first place. They inflated it. They did it deliberately to engineer a wealth effect. It’s phony wealth, unfortunately.”

What’s going to happen when the bubble eventually pops? All of that make-believe wealth will vanish.

It won’t necessarily take a lot to deflate the bubble. Just look back a few months ago when the Fed ticked interest rates up a mere .25 points. The market tanked. We may well be in for a replay if the Fed hikes rates again this summer. As Jim Rickards put it in a recent interview, “Look out below!”

The bottom line is if you don’t want to work through your retirement years, you need to start planning now. And don’t depend on volatile stock markets alone to fund your retirement dreams. You need to include the wealth preserving characteristics of gold in your portfolio. Historically, gold is one of the most stable assets – it holds its purchasing power with almost no exposure to third-party risks.

Work and plan today. Relax tomorrow.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply