The Wealthy Are Hoarding Physical Gold

The world’s rich are hoarding gold – this according to data buried in a recent Goldman Sachs note to clients.

In the note published over the weekend, Goldman recommended diversifying long-term bond holdings with gold, citing “fear-driven demand” for the yellow metal.

Hedge funds and other large speculators boosted their bullish bets on gold by 8.9% through the week ended Dec. 3, according to government data released last Friday. That represents the biggest gain since the end of September.

The Goldman note cited political uncertainty and recession fears as the catalyst for the move toward gold. It also mentioned worries about a wealth tax, increasing interest in Modern Monetary Theory (essentially money-printing) and the current loose central bank monetary policy.

Data buried in the note also revealed that owning physical gold appears to be the preferred method to “hedge against tail events” by the rich.

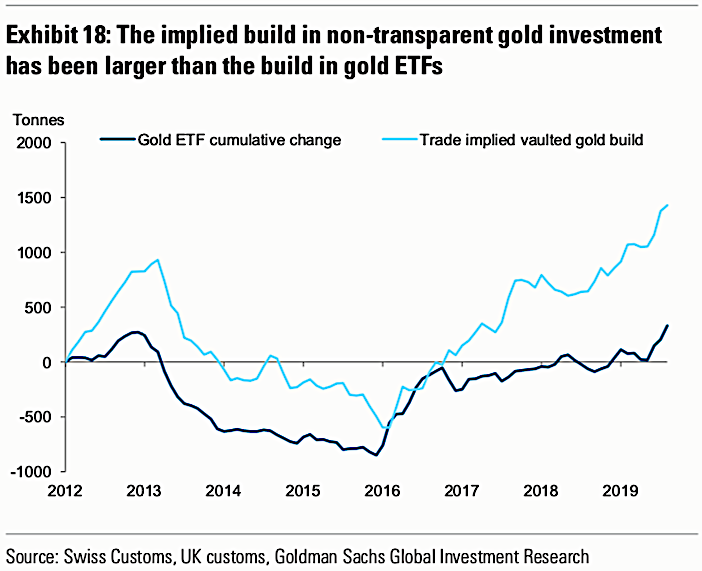

Since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs.”

Goldman said the data is consistent with reports that vault demand is surging globally.

Trade data implies that gold in storage has increased far more rapidly than is reflected by financial market instruments, indicating a widespread preference for physical gold instead of gold-linked financial assets … Political risks, in our view, help explain this because if an individual is trying to minimize the risks of sanctions or wealth taxes, then buying physical gold bars and storing them in a vault, where it is more difficult for governments to reach them, makes sense.

“Finally, this build can also reflect hedges by global high net worth individuals against tail economic and political risk scenarios in which they do not want to have any financial entity intermediating their gold positions due to the counter-party credit risk involved.”

As a writer for Yahoo Finance put it. “This means that for those including gold in their end-of-the-world trade, owning gold bullion is a must.”

You don’t have to be super-rich to invest in gold. And the same reasons the wealthy are hoarding the yellow metal apply to average investors. In a world drowning in government, corporate and consumer debt, and with never-ending loose monetary policy, along with and a political landscape becoming more and more favorable to socialism, it makes sense to own physical gold and store it securely so you have access to your wealth with minimal counterparty risk.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]