Gold as Safe Haven for TD Bank’s $230 Billion in Assets

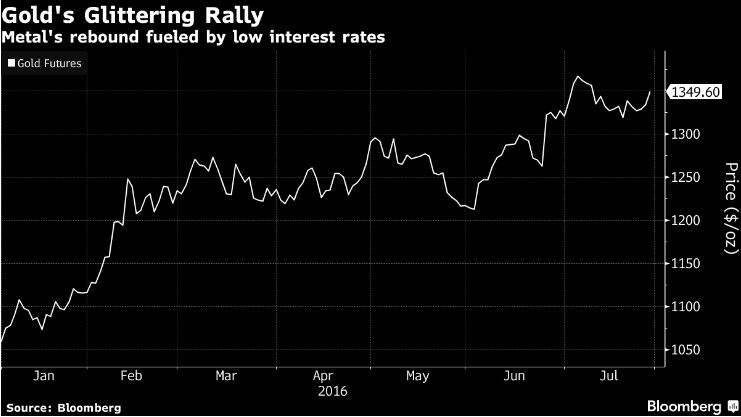

Toronto-Dominion Bank’s chief investment officer, Bruce Cooper, is changing the firm’s outlook to conserve capital by moving funds heavily into gold. According to Bloomberg, TD Bank oversees more than $230 billion in assets, and has “shifted to a ‘maximum overweight’ in gold for its portfolios.” Cooper oversees TD Asset Management, the investment arm of Canada’s second-largest lender.

So, what’s caused Cooper’s course change? The usual suspects: a sluggish global economy, the Brexit vote, central banking policies, and the upcoming US presidential election. All have contributed to TD’s overall feeling of uncertainty.

Within TD’s portfolio, gold promotes “diversification, stability and protecting against deflation more than returns,” Cooper said. “Job one today is about capital preservation. It’s not about shooting the lights out.”

For Cooper, gold investment is about playing it smart, not about being a doom and gloomer. “We’re cautious but not negative. This is not about canned goods and getting in the bunker,” he said.

2016’s political outcomes are also something to consider, Cooper believes:

If Germany moves away from its traditional austerity approach or Hillary Clinton and the Democrats take power in the US and unveil fiscal stimulus, that could shift the global economy into a more inflationary state.”

A Clinton presidency would almost certainly ensure fiscal stimulus alongside monetary easing in the form of low or potentially negative interest rates and quantitative easing. The combination of poor fiscal and monetary policy will further weaken the US dollar.

The morale of the story is if you do not own gold or silver it’s wise to take action before the 2016 elections. Physical coin supply is limited, we may experience another shortage, comparable or worse to the industry shortage we experienced last fall.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply