Survey Shows Economists Lack Confidence in 2017 Rate Hikes

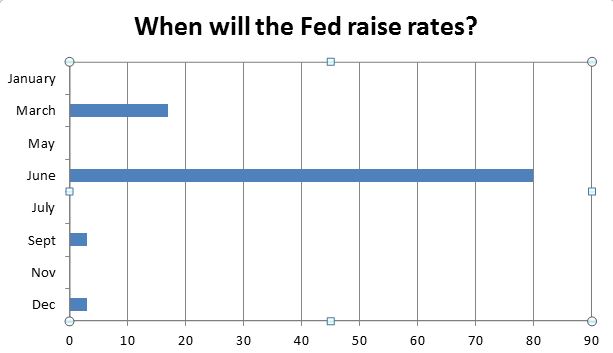

According to a recent Financial Times survey, a majority of top economists predict the Fed won’t be as aggressive on raising interest rates as it suggests. After last week’s rate hike announcement, the Fed’s own dot plot showed it had planned for three federal funds increases for 2017, according to MarketWatch. However, the majority of economists in the Financial Times survey were confident with only one hike in June.

The disconnect between what economists are predicting and what the Fed is pushing highlights the different levels of confidence in the US economy. The Fed seems to be overplaying its hand — a strategy that makes its actual lack of confidence that much more evident. Peter Schiff explains:

“The only reason the Fed raised rates this December is the same reason they did so last December: they did it despite having no confidence in the economy, but they didn’t want to send a message that they were that worried. They raised interest rates by the smallest possible amount. They also did it to try and preserve their credibility when it comes to talking about future interest rates.”

Recently, Peter made similar observations about the Fed’s over-estimate on GDP growth. The Fed is now posturing the same way it did last year. They had forecast GDP growth for 2016 to be 2.4%, but the economy is going to end up growing below 2% per official numbers.

“I don’t think the economy is growing at all because I don’t believe the official GDP numbers,” Peter said. “They understate inflation, and therefore overstate growth. Even with that built in, we are not going to achieve the 2% the Fed anticipated. It’ll be south of 2%.”

The probability of a US recession was another item on the Financial Times survey, which showed a vast majority of economists giving a 10% to 30% chance for a recession over the next 12 months. The outlook for a recession no doubt informed the respondent’s estimates of fewer rate increases.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]