“Good News” in Housing Starts Has a Dark Side

The mainstream media trumpeted the latest data on housing starts as good news for the economy, but there is a dark side they aren’t talking much about.

Reuters reports housing starts rose more than expected in September, driven by high demand for rental units.

Groundbreaking increased 6.5% to a seasonally adjusted annual pace of 1.21 million units, the Commerce Department said on Tuesday. It was the sixth straight month that starts remained above 1 million units, pointing to a sustainable housing recovery. Starts increased to a 1.13 million-unit rate in August. Economists polled by Reuters had forecast groundbreaking on new homes rising to a 1.15 million-unit pace last month.”

Housing starts had slipped the previous two months. The 6.5% increase brought things back to cycle highs, which as Zero Hedge points out, happened right before the last recession.

Reuters called housing “one of the few bright spots in the economy.”

If you dig deeper into the numbers the brightness begins to fade a bit. There are reasons to believe prospects for the housing sector aren’t quite as shiny as the mainstream media makes out.

While housing starts rose, the number of building permits fell 5.0% to a 1.10 million-unit rate in September, the lowest in seven months. A sharp drop off in multi-family permits drove the drop. They hit the lowest level since 2014.

As Zero Hedge points out, the drop in multi-family permits is a bad omen.

This likely means that rents will continue rising to recorder levels for the foreseeable future as the relentless demand for rental housing will not be satisfied for a long time.”

Reuters put a positive spin on the drop in building permits.

The weakness is likely to be temporary amid strong confidence levels among homebuilders. A survey on Monday showed builders’ confidence rose to a near 10-year high in October, with builders upbeat about current sales conditions and expectations over the next six months.”

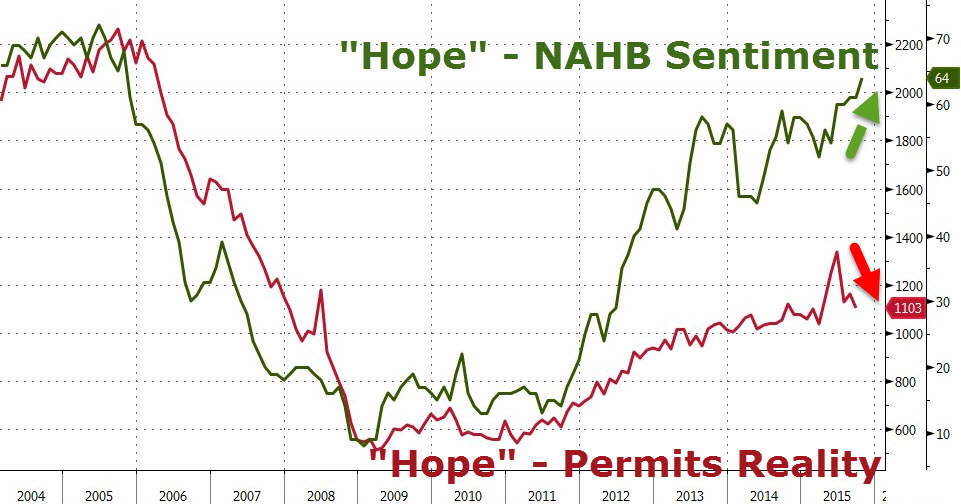

But as the graph above shows, builders’ expectations look more like wishful thinking, as they diverge significantly from reality.

If the housing market is the bright spot, that doesn’t say a whole lot for what Reuters describes as an economy that has “braked sharply,” with third-quarter growth estimates running below a 1.5 percent annualized rate.

Even the economic good news these days sits on a foundation with questionable stability.

This post is part of our ongoing series Data Dependent: Reading Between the Lines, where we examine the real economic data not reported in the financial media. Click here to read all our articles in this series.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

If housing can’t do well in this environment of high immigration and super low interest rates,it never will.Amazing that lenders will lend at interest rates below current inflation and well below future inflation.I guess it’s just this trend of everyone not caring about the future.Politicians figuring they will be out of office,before the country pays the price for huge deficits.Banks’ management just going for the short term fees and profits for making loans now and not caring if the bank gets stuck with a lot of underwater loans,in the future.