Pilgrim Currencies: From Wampum to Gold Eagles

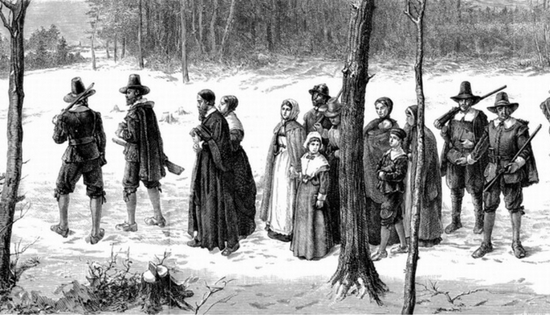

The majority of Americans know the basics behind the story of the pilgrims’ 1620 journey on the Mayflower, their eventual landing at Plymouth Harbor, and the physical and mental hardships they faced helping form the first permanent settlement of Europeans in New England.

Native American tribes like the Pokanoket were instrumental in helping the Pilgrims survive harsh winters, showing them how to plant corn, the best places to fish, and where to catch beaver. Thanksgiving is the day we celebrate the harvest feast the Pilgrims shared with the Pokanokets as an expression of thanks and good will.

Trade with other cultures, like the Pokanokets, was as essential for the Pilgrims’ survival just as it is for Americans today. Unlike our nation’s early European ancestors, however, today we use some pretty sophisticated ways to exchange goods and services. Credit cards, electronic transfers, bank wires, and cryptocurrencies make the Pilgrim’s form of currency seem like an alien technology, but that doesn’t mean it didn’t (and still doesn’t) work just as effectively today.

Spanish Dollar

Early on in the New World, coined money simply wasn’t an option. Little coinage was brought from the Old World, and England strictly prohibited the colonists from producing their own. Early arrivals like the Pilgrims traded through barter or with objects like nails, tobacco, or Indian Wampum, according to the Federal Reserve Bank of Philadelphia. Coins brought with Pilgrims were quickly sent back to Europe to purchase supplies.

Eventually, trade with the West Indies brought coins from a variety of different areas to the burgeoning colonies. One of these currencies was the silver Spanish Dollar, which gained popularity because of its uniformity in weight and size, along with its distinctive notched-edge design.

The Spanish Dollar served as the unofficial national currency of the colonies until the Coinage Act of 1857, which prohibited the use of all foreign coins as legal tender. Also known as the “piece of eight”, the silver coin was typically cut into eight pieces or “bits” for making change, which is where the term “two bits” or a quarter gets its name.

The Pine Tree Shilling

England’s ban on New England establishing its own currency was an impractical prohibition doomed to failure. Geographical distances lead to shortages, and what coins still remained soon were worn so badly they became unrecognizable. Eventually, the commercial success of the Massachusetts Bay Colony would lead to it challenging the law by passing the Mint Act in May of 1652 and secretly minting its own coins.

The first Massachusetts coins were rather crude silver blanks in a variety of sizes and contained the value denomination in Roman numerals on one side and the letters “NE” on the other. One of these new coins was the silver Pine Tree Shilling, named for and featuring one of the colony’s chief exports, the pine tree. The Shilling would eventually become a monetary standard and accepted throughout the Northeast.

The Coinage Act of 1792

After the Revolutionary War, the newly minted country finally began considering the need for its own national currency. The Constitution had given Congress the exclusive power to coin money, and it passed the nation’s first coinage act (Coinage Act of 1792), which established a national mint in Philadelphia.

The nation’s mint adopted a denomination system derived from Alexander Hamilton’s bimetallic standard with Thomas Jefferson’s believe that the dollar should be the standard unit of US currency.

The 1792 Coinage Act created silver coin denominations of half dime, dime, quarter dollar, half dollar, and dollar. Gold coin denominations were to be the quarter eagle ($2.50), half eagle ($5) and eagle ($10). Although copper coins weren’t given the status of legal tender, the Coinage Act did provide for copper cents to be struck by the U.S. Mint.

The road to creating the nation’s first currency began with the humble beginnings of the Pilgrims, a group who dealt not only with hostile environments, disease, and starvation, but with the lack of a proper currency to exchange goods and services. This holiday season, we should be thankful the dollar has continued to maintain value, especially given the decades of monetary policies that continue to challenge its position as a monetary standard for the world.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]