Physical Silver Demand Exploding: US Mint Sales Hit New Record

The demand for physical silver is absolutely through the roof.

The mainstream media has finally caught up with a story we began reporting on back in July. Yesterday, Reuters reported booming worldwide demand for silver coins:

The global silver-coin market is in the grips of an unprecedented supply squeeze, forcing some mints to ration sales and step up overtime while sending U.S. buyers racing abroad to fulfill a sudden surge in demand. The U.S. Mint began setting weekly sales quotas for its flagship American Eagle silver coins in July because it can’t meet demand, and the Canadian mint followed suit after record monthly sales in July. In Australia, the Perth Mint sold a record of more than 2.5 million ounces of silver this month, nearly four times more than in August, and has begun rationing supply of a new line of coins this month, a mint official said.”

The US Mint in West Point, New York, produces the popular American Eagle coins. A spokesperson for the mint said it is currently operating three shifts and paying overtime in an attempt to keep up with demand. Officials with Australia’s Perth Mint also report increased production of silver blanks after higher-than-expected demand in July and August.

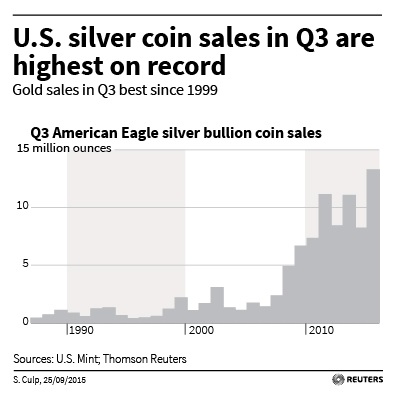

The US Mint sold 14.26 million ounces of American Eagle silver coins in the third quarter. That represents the highest sales volume on record, dating back to 1986.

The Royal Canadian Mint began limiting sales of its silver Maple Leaf coins in July. Reports throughout the industry are that this level of demand is practically unprecedented:

In his 35 years of dealing precious metals, Roy Friedman, vice president of sales and trading at Manfra, Tordella & Brookes, one of the biggest U.S. wholesale coin dealers, said he could not recall seeing a squeeze in supplies of North American silver coins spilling over to coins made in Austria and the U.K. to the degree seen this year.”

Analysts say “mom-and-pop investors” are driving the market.

The difficulty in getting coins from US mints has led many investors and collectors to look overseas, and that triggered a domino effect in Europe and Asia. We are now seeing a truly world-wide supply shortage of silver coins.

While there have been squeezes in the past, according to Reuters, “This episode has lasted far longer, and its effect more pronounced, than in the past, dealers say.”

Click here to listen to an industry insider talk about this ongoing silver shortage.

While the mainstream media spends most of its time focusing on paper and technical metrics, we’ve been dealing with the physical realities of the market here at SchiffGold for months. We’ve been accommodating customers as efficiently as possible, but some have faced long wait times.

The supply issues and high demand show no sign of abating, so shortages and waits will likely continue. SchiffGold may have access to alternatives to nationally minted North American bullion for silver investors that are deliverable sooner. However, these opportunities are limited. Call us today to see how we can work with you to meet your silver investing needs.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

How about a little NIRP to go with your QE4? Won’t this be just peachy keen!

http://www.financeandeconomics.org/

Isn’t investor demand but a tiny part of the overall silver market?

Here is the big problem for some of us and I am in the latter category.

Young people, I know not the number of you but; have lost your family (for whatever reason)and are not old enough or educated to get a decent job even if there was some decent factory jobs (as in my day)out there as they use to be. What in hell are you gonna do when this country falls apart and it will soon?

Elderly people, I also do not know the number but; you have been retired for years and your retirement money will be gone long before your body fails you but, has failed you enough that you cannot go back to work. What will these people do???

The young people have not been able to save anything for retirement and the old will probably lose their SS that they paid into for years while working. This is but one of the problems when you rely on government to take care of you.

We are in trouble folks. I don’t have a clue of the exact date all this will fall apart but fall apart it will. I am not lecturing anyone about anything. I expect big time rioting due to food prices and shortages like none of us have ever seen. Our country is on it’s way down and we as a people have let it happen right before our eyes. The average time our elected officials have been in office is about 20 years. Why do they want to keep being elected? To take everything we have and more and we keep electing them term after term. Both sides of the isle are so damn corrupt and we keep them in there for years so they can do nothing but steal us blind.

I’m outa here, I need to do something constructive.

Good luck to all. Sorry about my bad grammar and punctuation.