New Gold Study Shows Emerging Markets Bringing More Demand

The World Gold Council, a leading market development organization, released a study on global gold markets showing the retail investment market is “well positioned” for future growth. The study looked into four major markets: China, India, Germany, and the US and found healthy latent demand within every market. It also identified some interesting purchasing distinctions between developed and emerging economies.

Despite all the recent news concerning falling gold prices, world demand for gold bars and coins is still booming. Since 2006, global demand has gone from 430 tons to 1,051 tons in 2015, which is a monetary move from $10 billion to almost $40 billion, according to the study.

A major cause that’s underpinned the exponential growth in the demand and price of gold has been growing anxiety and distrust in governmental and financial institutions. Mistrust of central banking policies and weak fiat currencies around the world also contributed to the growth in demand. The faith of gold investors seems to be tested on a regular basis, from the financial collapse of 2008 to the current fallout from the US presidential election. In contrast, the world’s faith in gold is still strong, with two-thirds of individuals believing gold will never lose its value in the long-term.

Another factor in rising gold demand has been the opening of new markets like China, where before 2004 it was illegal for individuals to own gold bullion. The recent policy change in Sharia finance standards allowing investment in gold bullion is another significant opening in world markets that will bring in billions of new customers and drive demand higher.

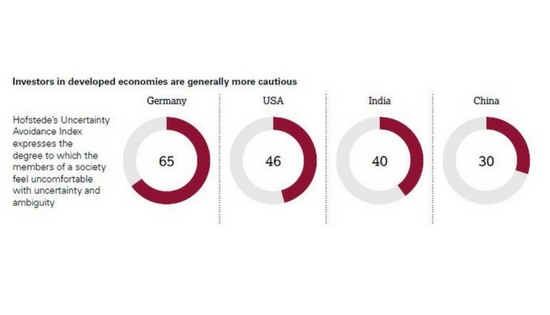

Emerging markets like China and India show investors are less cautious than in developed countries. In general, China and India have a “higher proportion of speculative and short-term investors than Germany and the US.” Emerging market investors are also more willing to invest a great portion of their income. For example, Chinese investors move more than double the share (37%) of their income compared to Americans (17%) into gold.

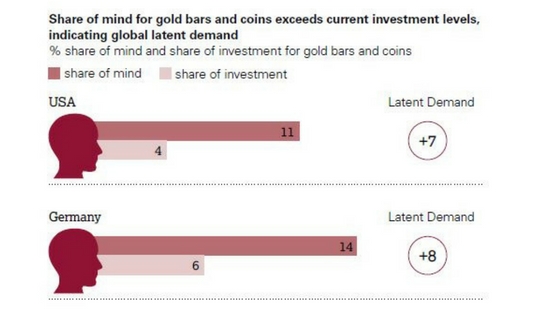

In all four countries, the study found high levels of latent demand, which is the difference between what individuals would ideally invest versus what they actually invest. The US and Germany had the highest levels of latent demand.

It’s clear from the World Gold Council’s extensive study that new, aggressive emerging markets will keep demand for gold high for the future. As faith in institutions wanes, buying gold and silver for assurance and wealth protection make precious metals the best alternatives to shifting fiat currencies and rising inflation.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]